Singapore is one of the few bright spots for India’s Look East Policy, New Delhi’s vaunted push to engage with Southeast Asia.

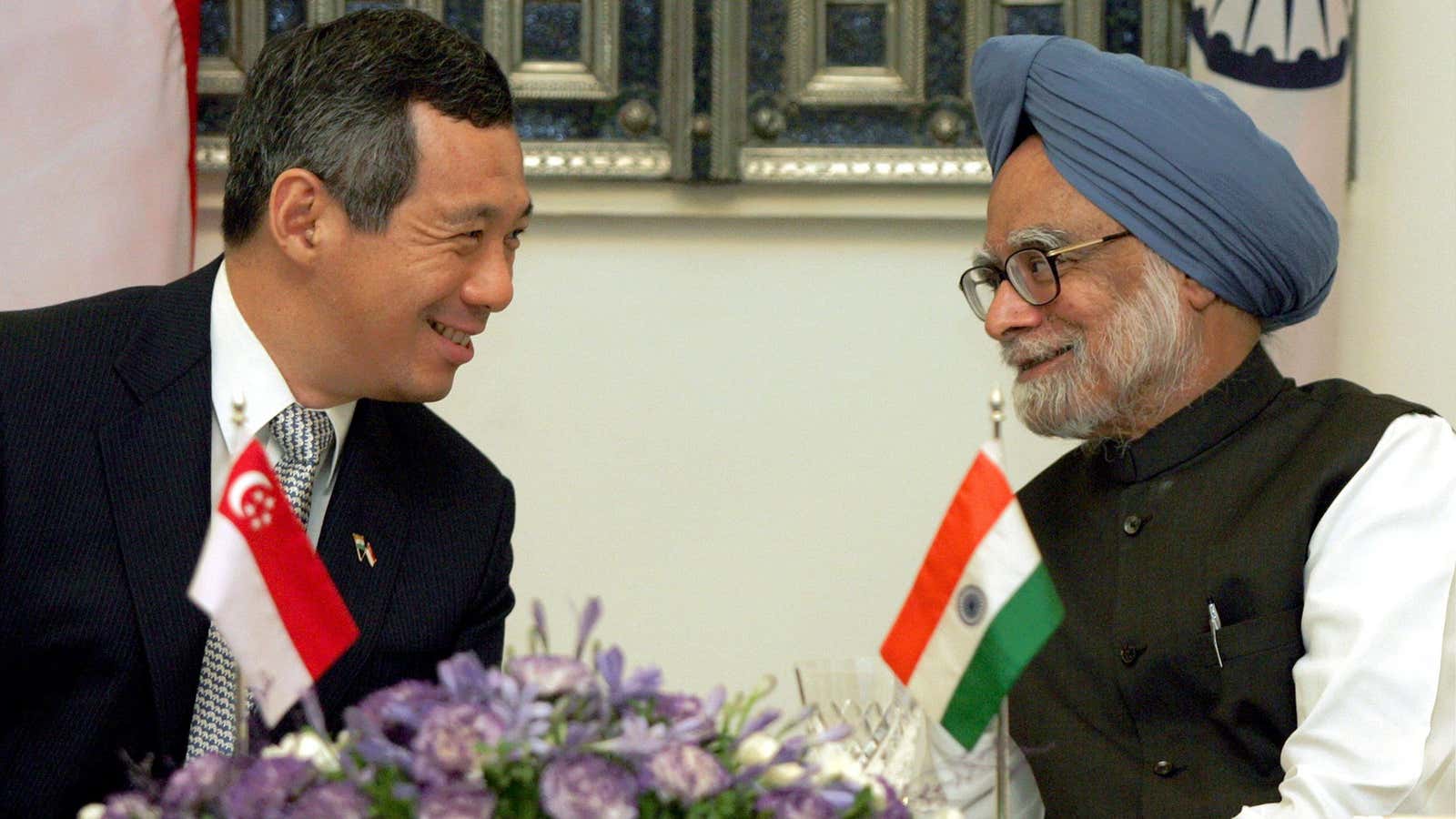

Successive governments have remained close, economic ties have deepened on the back of a successful free trade agreement—and yesterday, Singapore’s foreign minister K. Shanmugam met Indian prime minister Narendra Modi as the two countries mark fifty years of diplomatic relations.

The tiny city-state, of course, has been a major source of foreign direct investment (FDI) into India. In May this year, Singapore beat Mauritius to become the top FDI source for the subcontinent, with about $6 billion (over Rs35,800 crore) flowing in last year.

But this isn’t a one-way street. Singapore is one of the largest destinations of Indian FDI—including emerging as a preferred destination for Indian entrepreneurs.

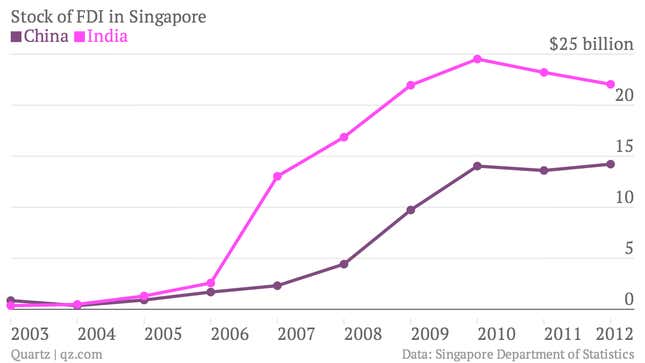

And within Singapore, India has among the biggest stocks of FDI, essentially the total accumulated value of foreign-owned assets, of any Asian country.

The growth has been so prolific since 2005, when the free trade agreement came into force, that it has far outstripped China’s investments in Singapore.