Few bright spots, several dark ones.

That’s the assessment by India’s central bank of corporate performance in the last financial year. As part of an annual exercise, the Reserve Bank of India (RBI) has released a report analysing the performance of 2,854 private companies in 2013-14. These companies reported combined revenues of Rs29,496 billion ($484.75 billion or 48% of gross domestic output). The report captures how different parts of the economy performed. These are four takeaways from it.

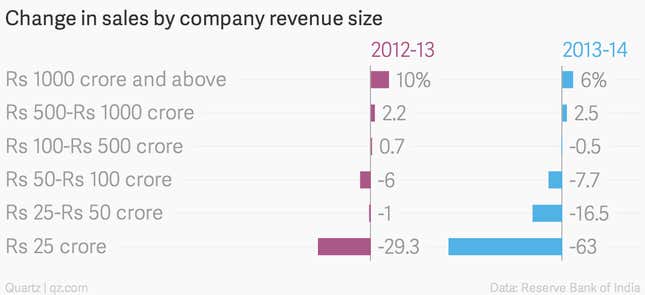

Size matters

When the economy slows down, the worst affected are the small and medium enterprises. In 2013-14, when India’s gross domestic product (GDP) grew at 4.7%, marginally higher from 4.5% a year ago, only two sets of companies in RBI’s size classification, with revenues above Rs500 crore ($82.18 million), reported growth. The other four sets, whose revenues ranged till Rs500 crore ($82.17 million), felt the squeeze being tightened. The worst among the lot were the smallest: revenues of below Rs25 crore ($4.10 million).

Growth has to go wide

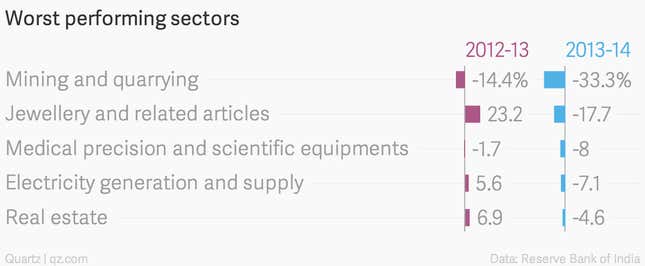

Even during the slowdown, there were sectors that grew well. Information technology grew the fastest, followed by paints, pharma, paper and tea plantation. However, these five sectors accounted for only 12.6% of the total revenues of the companies analysed by the RBI. In other words, for India’s GDP to rebound sharply, the spread of growth has to be wider in the economy.

Mining was the worst-performing sector, contracting by nearly one-third. Jewellery was another sector that shrunk brutally, from 23% growth in 2012-13 to an 18% negative growth in 2013-14.

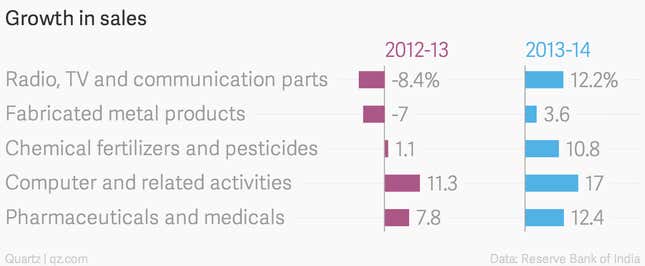

Turnarounds are few and far in between

While several sectors went from bad to worse, there were only a handful that went from bad to good. Television and communication equipment saw a reversal due to demand from telecom companies that are investing more to set up next-generation networks.

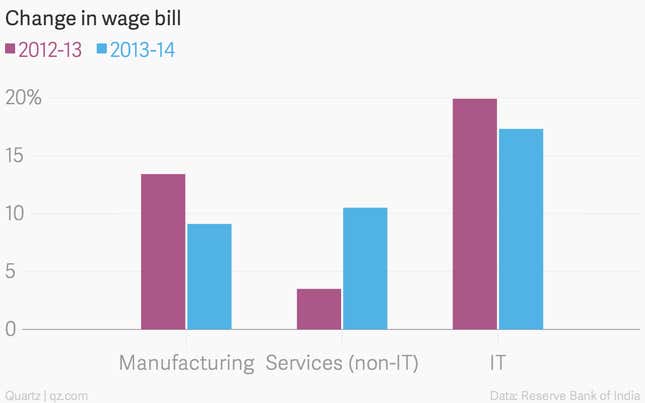

It pays to work for software firms

RBI classified companies in this study into three categories: manufacturing, information technology (IT) and services other than IT. IT employees received the highest increase in salaries in 2013-14, though it was marginally lower than in the previous fiscal. This data captures total expenditure on wages, and new hires might partly account for the changes.

The sector breakup of wages also shows how much the Indian economy has tilted away from manufacturing to services. In the RBI study, 209 IT firms spent Rs86,700 crore on salaries. By comparison, 1,966 manufacturing firms spent Rs102,300 crore ($16.82 billion) on wages, only 18% higher than what IT firms spent.