Internet advertising in India will grow the fastest among all media segments in the next five years, but in 2018 it will still be less than half the size of television and print, in a markedly different trajectory from global trends, a new report by consultant PwC says.

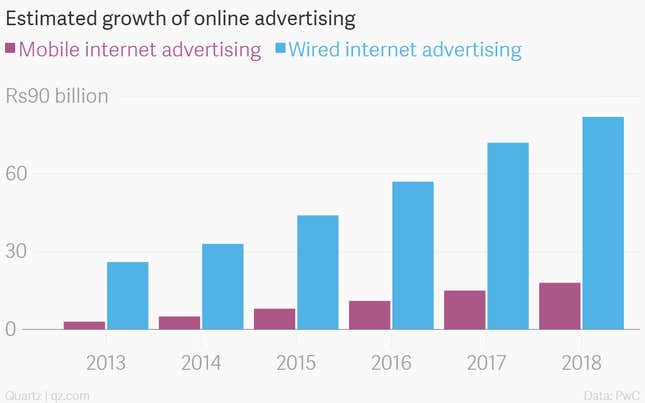

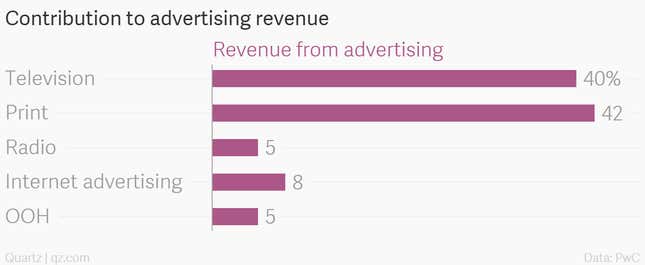

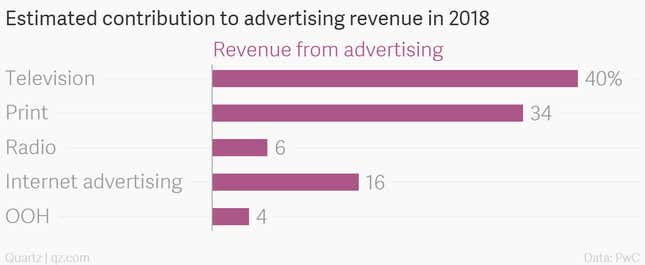

While internet advertising will nearly dethrone television as the largest segment globally by 2018, in India it will still account for just 16% of the overall ad pie. It is expected to be worth Rs100 billion by that time, up from 8% now. This is despite growing at a compounded annual rate of 28%, which is the fastest for any segment. Print, at seven percent, will grow at the slowest clip, while television will grow at the industry average of 15%, the report said.

“In the global context, internet advertising is going to be big. In India it will take longer than five years for that,” said Smita Jha, leader of the entertainment and media practice at PwC India.

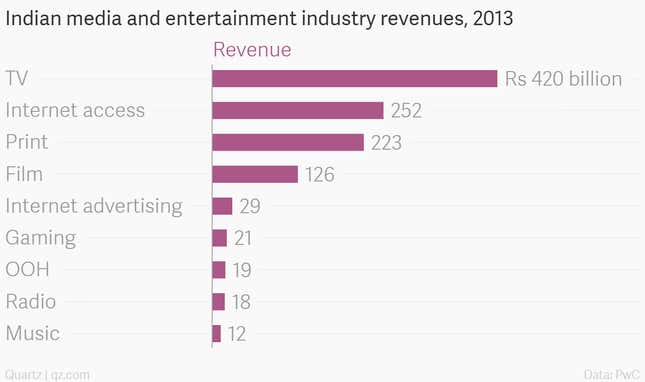

TV will, however, continue to be the biggest revenue generator in the Indian entertainment and media industry.

The report estimates that while TV will have 37% share of revenues in 2018, internet access will retain its second spot, with 29% share in revenues. The print medium will be at the third spot with 14% share of the total revenue. Currently, TV has 38% of the industry’s revenues, while internet access and print have 22% and 20% respectively.

Internet access should count towards telecom revenues but as many cable TV providers have started bundling broadband access with their services, the industry seems to be facing a classification conundrum.

In a sign of a rapidly digitising economy, internet access and internet advertising grew at the fastest pace in 2013, growing at 47% and 26%, respectively. Internet advertising, which was estimated to be about Rs30 billion in 2013, constituted 8% of the overall advertising revenues in the industry.

The revenue growth for the digital medium will come primarily from advertising rather than consumers paying for content, PwC says.”Monetising content is a challenge. Customers’ perception is that the content is free. Unless users can get access to content quicker online, they won’t be willing to pay,” Jha said. In the US, 25% of advertising revenues went towards internet advertising in 2013. In China, this number stood at 40%.

Overall the internet advertising market in India is expected to generate revenues worth $1.8 billion in 2018. One of the biggest challenges to the growth of internet advertising, the report found, is a lack of content in local languages.

What could upset PwC’s calculations is a combination of low-cost smartphones, cheap data connections and a proliferation of local content online. If that digital tango takes off perfectly in India, the growth of internet and the value of advertising in the medium could grow more rapidly than what linear models can predict.