India looks likely to increase the foreign investment limit in domestic insurance firms to 49%, as the government readies a bill allowing for long-pending changes in the country’s investment sector.

On Wednesday, the government approved a standing committee report by the Parliament suggesting amendments to the Insurance Laws (Amendment) Bill 2008.

“The Bill is aimed at removing archaic and redundant provisions in the relevant legislations and to enable the insurance sector to work for the betterment of the insured with greater efficacy,” the government said in a press release.

The sector, long dominated by nationalized insurance companies, was opened up in 2000 (pdf) with a 26% limit on foreign investment in domestic insurance firms.

But after a period of robust growth, the industry is struggling with slower market expansion, rising cost and a dire need for capital.

With the foreign insurance limit almost doubling to 49%, an additional Rs20,000 crore could be pumped into the cash-starved sector.

“Additional capital will provide insurers the opportunity to grow the business, while improving penetration across the India,” Steve Hollow, Deputy CEO of SBI General Insurance told Quartz.

These seven charts capture the state of India’s insurance sector—and why increasing the foreign investment cap is so crucial.

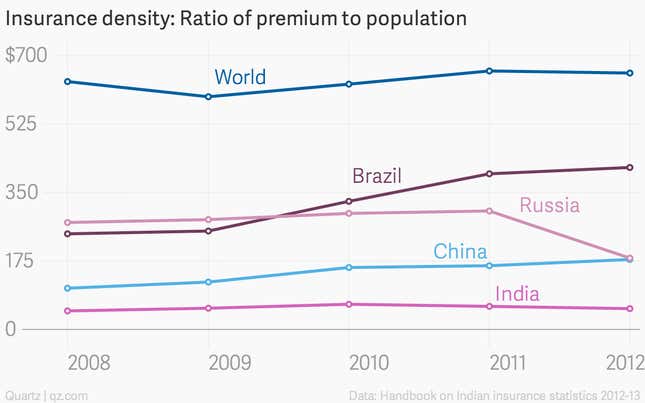

India’s insurance density—the ratio of premium underwritten in a year to the total population—is far below the global average and the lowest among the BRIC nations…

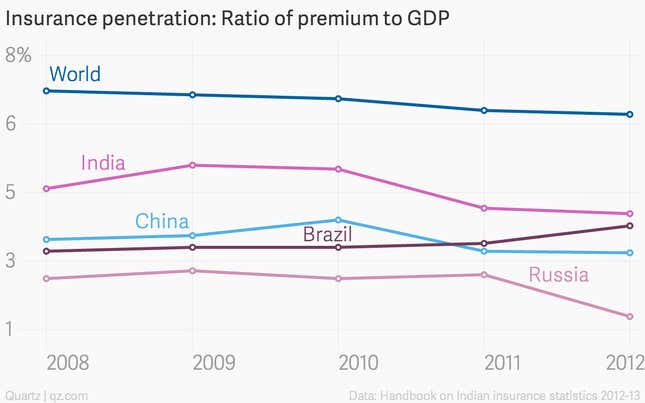

…and although insurance penetration—the ratio of insurance premium underwritten in a year to GDP—is better than BRIC peers, it’s still far below the global average.

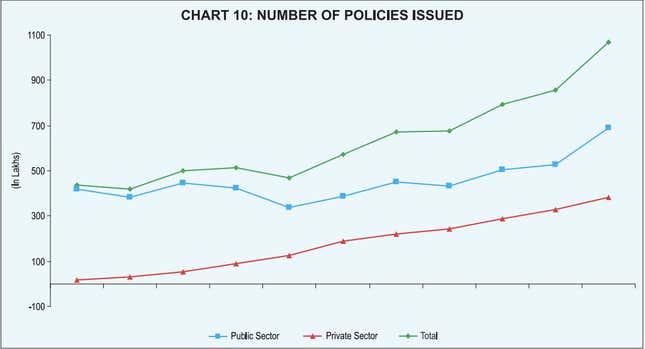

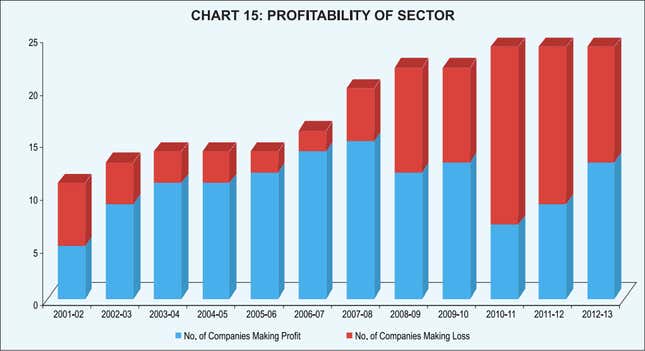

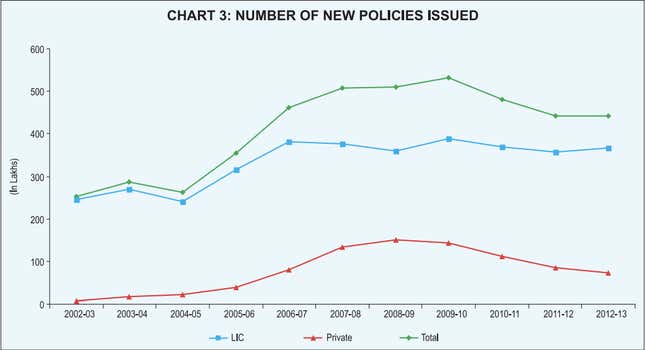

In the life insurance sector, business has slowed down, though profitability has improved…

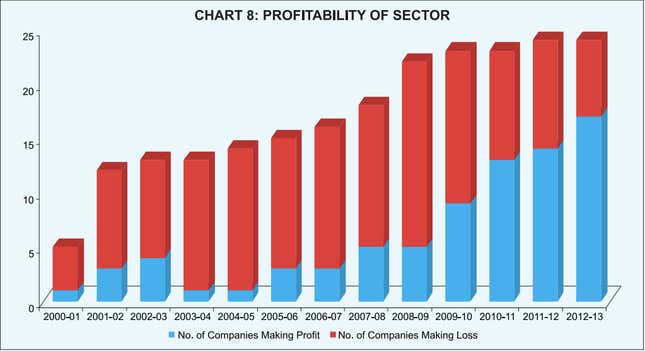

…and while the non-life insurance business is growing, profitability has been a problem.