This post has been corrected. YourStory had provided incorrect data in their previous report. They sent Quartz a revised report later, and the figures have been changed accordingly.

Last week, India did not succeed in making the cut to a list of the world’s 30 best countries for e-commerce. The US, followed by China, were top two rank holders, while India lagged due to its poor infrastructure, low incidence of credit card use, and complicated tax laws, according to a report by global management consulting firm A.T. Kearney.

Despite this unexciting global news for the Indian e-commerce sector, investor sentiment around Indian startups is upbeat.

A report by YourStory, a website that tracks startups, has found that investments in Indian startups jumped 300% in the first quarter of 2015 from the same period last year. That is, startups raised $1.7 billion (Rs10,200 crore) in the first three months of 2015 (excluding 30 other deals made for undisclosed amounts) as compared to $450 million (Rs2,700 crore) in the first quarter of 2014.

And the numbers backing this spike in investments are stark: In 2014, a total of 300 deals were made; in comparison, nearly 150 deals have already been made in the first three months of 2015. So much so that, according to YourStory, in the first two months of January and February, two startups were funded per day on an average.

India’s entrepreneur hub

In the first three months of 2015, $859.5 million of the total startup funding took place in the National Capital Region (NCR). That was bigger than India’s startup capital Bangalore‘s $346 million. The NCR consists of Noida and Gurgaon. Mumbai stood third with $295 million funding, followed by Delhi at $84 million.

Where’s e-commerce?

As compared to last year, e-commerce lost the top spot—making way for payment and consumer internet companies.

This was probably because “investor money is chasing established e-commerce players, newer e-commerce entrants aren’t getting funded as much,” according to YourStory.

Payment companies led with a combined funding of $720 million, followed by consumer web companies’ $343 million and e-commerce’s $286 million.

Online payment company Paytm, which is now valued at over $1 billion, raised the highest round of funding among all Indian startups. In January, China’s Alibaba put $575 million into the company.

Some consumer web startups that were funded in this quarter in India are fashion social network VioletStreet, food order and delivery apps TapCibo and FoodPanda, auto classifieds website CarDekho, and online dating destination TrulyMadly.

Money flow

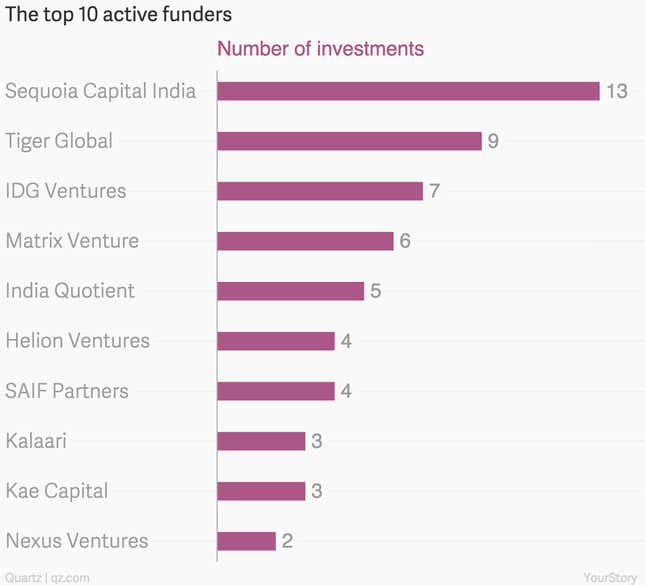

Among the investors who put in money into Indian startups in 2015 so far, Sequoia Capital lead the way, followed by Tiger Global and IDG Ventures India.

And the deals are as diverse as they can get. For instance, last week, Sequoia invested $50 million in Urban Ladder, the online furniture marketplace, along with SAIF Partners and Kalaari Capital.

In March, Bangalore-based Moonfrog Labs raised $15 million from Tiger Global and Sequoia Capital to create mobile games. This year, Sequoia has also pumped money into Teewee, which is dubbed as a homegrown version of Google Chromecast, food-ordering service TinyOwl and renting service Grabhouse.