Just about two months after its managing director Christine Lagarde called India a “bright spot,” the International Monetary Fund (IMF) in its April 15 regional economic survey (pdf) again described Asia’s third largest economy by the same terms.

“Domestic and external vulnerabilities have moderated on the sharp decline in the current account deficit and inflation, the fiscal position has begun to improve, and a resumption of capital inflows allowed a significant buildup in foreign reserves,” the report said. “This confluence of achievements has made India one of the bright spots in the global economy.”

But all those kind words come with one big caveat: India needs to sort out its toxic banking assets.

In its policy requirements for the country, the IMF said that enhancing financial sector supervision and monitoring is warranted given the rise in corporate and financial sectors strains.

“Further progress is needed to strengthen prudential regulation for banks’ asset quality classification, augment capital buffers and improve corporate governance at public sector banks, and strengthen the insolvency framework,” it said.

To do this, the IMF said continued efforts are needed to gather information on and analyse the interlinkages between corporate vulnerabilities and the banking system’s health, particularly on the extent of unhedged foreign exchange exposures of large firms with international operations.

Indian banks have been struggling to keep toxic or non-performing assets (NPA) in check. An NPA, according to the Reserve Bank of India (RBI), is a loan for which interest and/or installment of principal remains overdue for a period of more than 90 days.

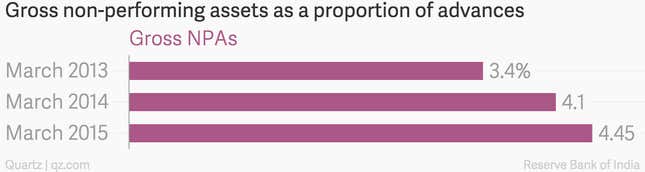

According to latest data from the RBI, gross non-performing assets (GNPA) as a percentage of the gross advances inched up to 4.45% as of March 15, compared to 4.1% a year ago.

“Asset quality has seen sustained pressure due to continued economic slowdown,” S S Mundhra, a deputy governor of the RBI, said in a speech (pdf). The level of distress is not uniform across the bank groups and is more pronounced in respect of public sector banks, he added. GNPA for public sector banks for March was at 5.17%.

Of course, this is something that India’s banking sector has been grappling for some time now.

“I think, the most immediate problem we have to confront is that of rising level of stressed assets in the banking system. Fortunately in the last quarter those levels of stressed assets tapered off or flattened out,” RBI governor Raghuram Rajan said last July. “But, it is too early to declare victory.”