Narendra Modi completed a year in power on May 26. And while countless observers have analysed his first year as prime minister, the Indian stock markets gave their own verdict: The benchmark Sensex index gained 11.4% in the 12 months from May 26, 2014 to May 26, 2015.

During the year, the Sensex also touched its all-time high of 30,000 points in intra-day trading on March 4, when Reserve Bank of India governor Raghuram Rajan cut the repo rate.

Here are the biggest gainers and losers among 66 large-cap stocks comprising the S&P BSE LargeCap index. Large-cap firms are generally those with a market capitalisation of more than Rs10,000 crore. The index represents 70% of the market capitalisation of the 733 stocks in the S&P BSE AllCap index.

Biggest gainers

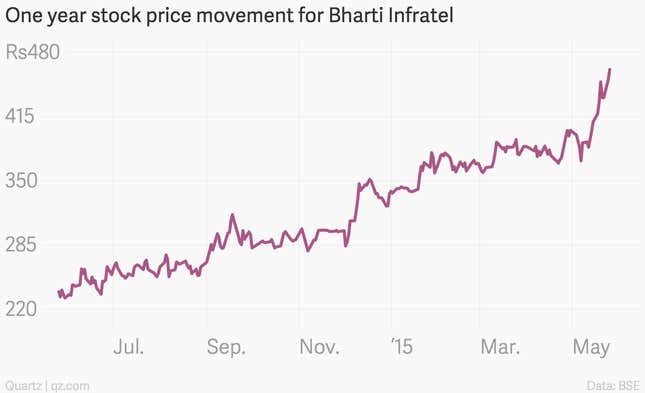

Bharti Infratel, the listed telecom infrastructure unit of Bharti Airtel, saw its shares rise 99% during the year. The firm has major clients including telecom services providers Airtel, Idea and Vodafone. Data and voice usage in the country is increasing, and with 4G telecom spectrum auctions, the demand for tower infrastructure will likely increase.

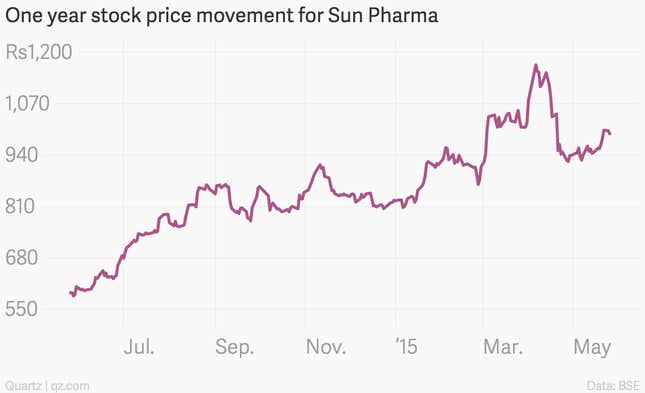

Stocks of pharmaceutical companies were some of the top gainers, including Lupin, Cipla and Sun Pharma—with a rise of 92.6%, 72.2% and 68%, respectively. The industry also saw a flurry of merger and acquisition activity during the year. Sun Pharma, for instance, announced its merger with Ranbaxy in April 2014—and has seen a steady rise in its stock price during the year. Lupin has also been making small acquisitions, helping its stock price surge.

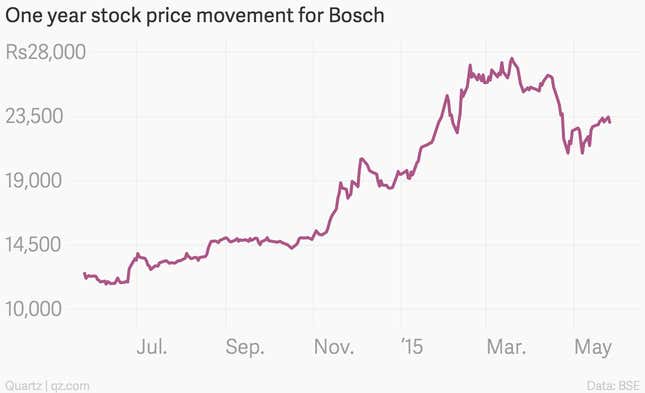

Bosch, the German engineering firm, saw its share price rise around 84% during the 12 months. The company is one of the major technology and automation suppliers in the country. To be sure, the firm’s stock has been steadily rising over the past few years, on the back of an expanding auto industry and growing demand for diesel systems.

Biggest losers

Meanwhile, some of the biggest losers were power and oil and gas firms.

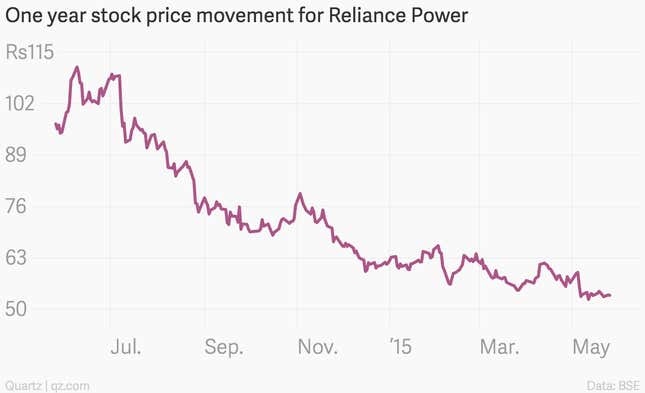

Already under pressure with limited fuel supplies and financing constraints, the Supreme Court’s cancellation of 218 coal blocks in September last year added to the power sector’s troubles. The biggest firm to be hit was Jindal Steel and Power, which had the largest number of operative coal mines. A sharp drop in global oil prices also impacted oil and gas exploration firms like Cairn India during the year. Jindal Steel and Power’s stock tanked 55%, while that of Reliance Power and Cairn India fell 45% each.

DLF, a real estate firm, had its stock plunge 43% during the year. The company in October last year received a major setback, when India’s market regulator, the Securities and Exchange Board of India, banned the company from tapping the capital markets for three years. This was in response to a case involving some irregularities during the firm’s initial public offering in 2007.

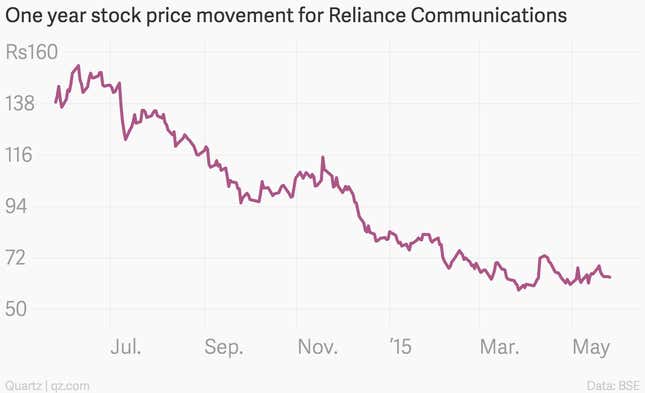

Telecom services provider, Reliance Communications, owned by Anil Ambani, has also seen a drop of 54% in its stock price in the last 12 months.