Bengaluru-based payments company Freecharge wants to win the mobile wallet war in India—where banks have not managed to innovate for the smartphone generation.

The five-year-old startup was acquired by e-commerce major Snapdeal in April 2015, but the company operates at an arm’s length from the parent as it does not want to become “anybody’s in-house currency.”

In September 2015, Freecharge launched its mobile wallet—to take on competitor Paytm, which already has over 50 million users. The company says it now has approximately 14 million users for the service.

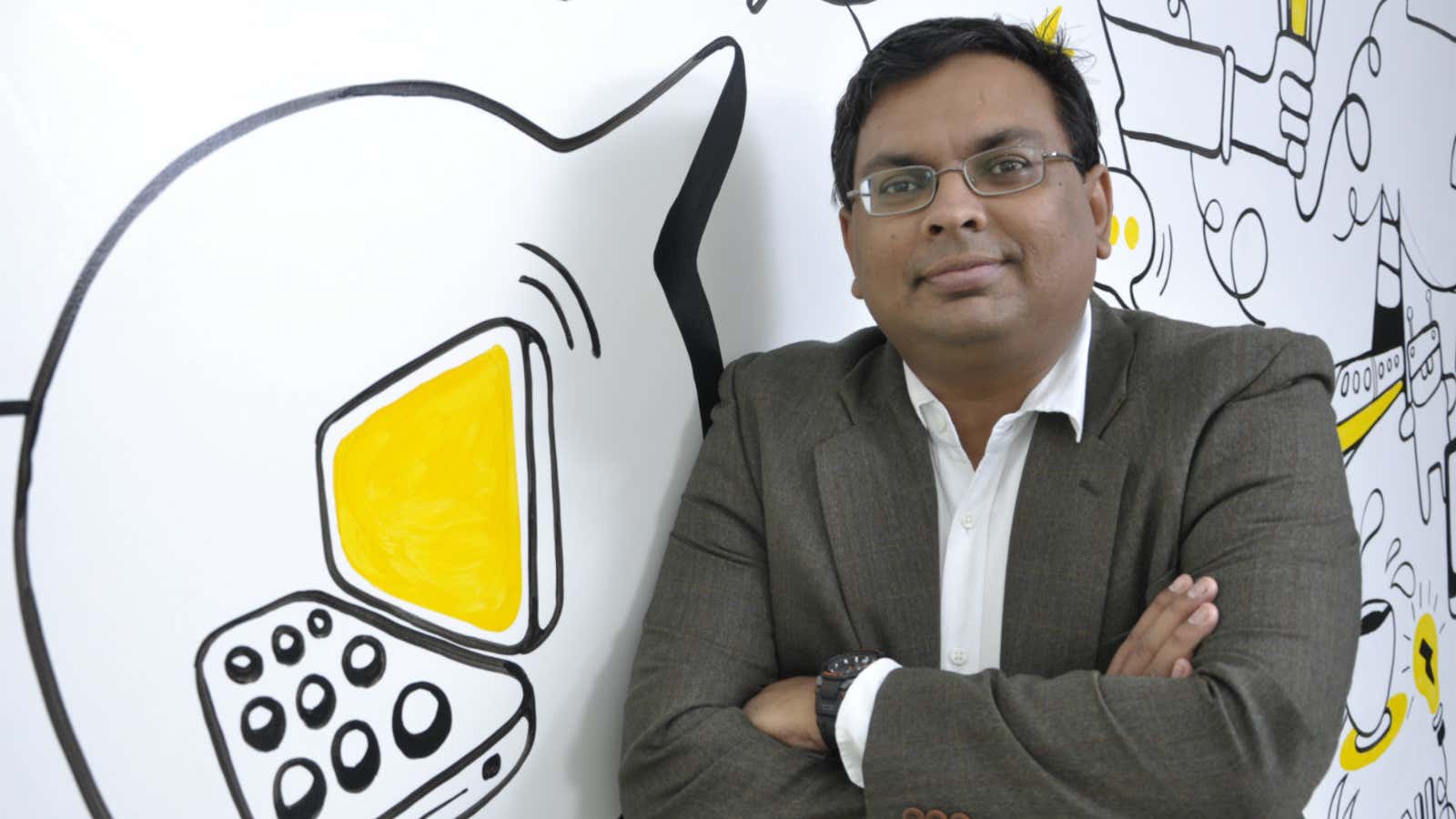

Freecharge is adding around a million new wallets per week, says the company’s chief operating officer Govind Rajan—earlier the chief strategy officer at Snapdeal and chief executive of Airtel Money.

Rajan spoke to Quartz about what is fueling this growth and the Snapdeal-Freecharge dynamics.

Here are the edited excerpts:

What are your near-term goals?

At this point, we are focused on March 2016. We want to have 35 million wallets by March 2016. Quite frankly, I want consumers to use Freecharge as many times as possible. That is my only goal today.

In terms of the number of retailers who accept us, we don’t have any fixed target as we are not even sure how many there are in the country. While our conservative estimate is 12 million, our realistic estimate is 40 million, because the guy who sells you a newspaper is also a retailer.

In the next two years, our target is that every Indian should accept e-payments.

What segment of people is fueling the growth in wallets for Freecharge?

Digital natives—people brought up during the age of digital technology. For the millennials, internet is not an acquired habit. They do all their transactions online and they live their social life online.

Besides them, people who use us once understand how easy it is. My mother used Freecharge once and now she recharges her phone by herself.

Are most of your users coming from Snapdeal?

Our user base is roughly 50-50, meaning half are from Snapdeal; the others are using Freecharge directly.

Many online commerce platforms, like Ola, have their own wallets. How do you fit into the market?

In the US or in China, guys who have won the battle—PayPal and Alipay—had three things that worked for them: an anchor merchant, a user interface (UI) that is undisputable in class, and ubiquity.

We think these three are important and we are working on them. We have brought in an anchor merchant—Snapdeal. This helps users develop trust and familiarity with Freecharge. Snapdeal also helps us understand merchants’ perspective.

Secondly, we have developed a best-in-class UI.

Now we are building ubiquity by forming direct linkages with merchants and working with others who can create inter-operability. Consumers are not going to use one wallet for one transaction and a second for another.

Why would a retailer who already offers cash and card payment options use your product?

Retailers have seen what’s happened in the US and China. The fact that mobile wallet is the future is clear to everybody. The question for a retailer is not whether I want to offer or not. It is about “do consumers want to pay for it?”As long as integration is smooth and fast, and doesn’t involve extra investment, retailers will use us.

Having said that, we have to work with retailers to see how we can drive more revenue for them. We are in the business of lubricating commerce.

Is there a disadvantage in having Snapdeal as your parent company? Aren’t the other e-commerce players averse to you?

Not really. What did PayPal and eBay do? For many years, they operated in the same place and after that, they moved away and became two companies. Snapdeal is headquartered in Delhi, and Freecharge is in Bengaluru. We have physically separated ourselves. Why do we call ourselves Freecharge and not something like SnapPay?

If we get accepted on Amazon and Flipkart tomorrow, we will treat Amazon and Flipkart the same way as Snapdeal. We are a payments company and our real battle is not against anything other than cash.