Intel stock surges 10% because TSMC and Broadcom both might buy a piece of it

Other companies could also get in on the action, including Qualcomm

Intel (INTC) stock was rising sharply on Tuesday morning as investors weighed the benefits of reported plans that could see rivals acquire parts of its business.

Suggested Reading

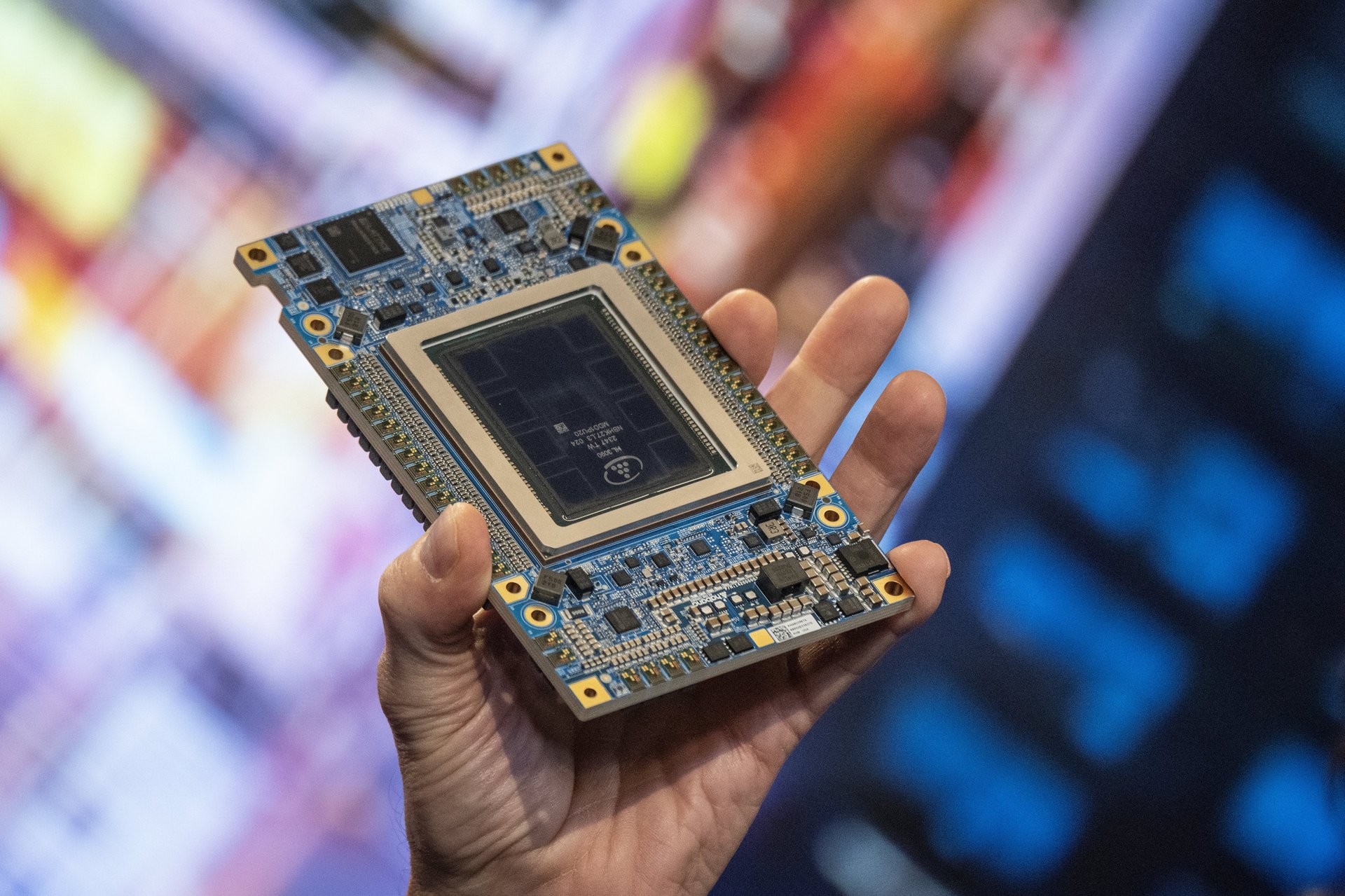

One plan could see Taiwan Semiconductor Manufacturing Company, which is already responsible for about 90% of the world’s advanced semiconductors, acquire Intel’s manufacturing business, The New York Times reported. It could also take a majority stake in the business alongside a group of private equity and tech companies.

Related Content

That idea has been pushed by President Donald Trump’s administration and Howard Lutnick, his nominee to be Commerce Secretary. Frank Yeary, Intel’s interim executive chair, has met with both TSMC (TSM) and Trump administration officials about the deal, The Times reported.

While the Trump administration asked TSMC to explore the idea, the White House is unlikely to support a deal that would let a foreign entity operate Intel’s factories, the Wall Street Journal reported.

Broadcom (AVGO) has also been examining Intel’s chip design and manufacturing business, The Journal reported, citing unnamed sources familiar with the matter. The deal, which Broadcom executives have only informally discussed, would hinge on finding a partner to take over Intel’s manufacturing business, The Journal reported. Nothing has been submitted to Intel yet.

Qualcomm (QCOM) has also been interested in buying some of Intel’s chip design units. Yeary has left the door open for other companies interested in buying Intel’s product business, including Qualcomm, The Times reported.

Intel stock surged 10% in Tuesday morning trading. The stock has rallied to start the year.

The potential deals come a few months after Intel ousted its former CEO, who failed to help modernize and stabilize the tech giant, which has struggled to compete with rivals such as Nvidia (NVDA) and TSMC. The company has also hired help to fend off potential activist investors.

In August, Intel announced a plan to save $10 billion in 2025 through measures including a 15% reduction of its workforce. The following month, the company said it would further separate its chip-manufacturing and design operations, and pause factory projects in Germany, Poland, and Malaysia.

Despite its issues, Intel said last month that it expects to report break-even profit for the first quarter of 2025, after reporting declining revenue for three periods in a row. In November, the company was awarded a $7.86 billion grant by then-President Joe Biden’s administration to build semiconductors in the U.S. The Trump administration is expected to rely on Intel to make domestic chips, at least as long as TSMC declines to move operations to the U.S.