Is SpaceX’s Starlink ready to launch an IPO?

A billionaire investor in SpaceX predicts its satellite business will go public in or around 2027

Billionaire SpaceX investor Ron Baron recently told CNBC that he expects the company’s satellite business, Starlink, to spin off and go public “in 2027 or so.”

Suggested Reading

Baron reckons that in four years, SpaceX will be worth $250 billion to $300 billion—up to double its current valuation of $150 billion. Earlier this month, he told MarketWatch that his fund owns about $1.7 billion worth of SpaceX stock and he’s bullish on the company’s prospects.

Related Content

Elon Musk, the founder of SpaceX, told employees last year that he didn’t think Starlink would go public until 2025 or later.

Starlink, which has a big lead over its rivals by owning more than half of the satellites now in space, is racing toward Musk’s ambitious goal of launching a “megaconstellation” of 42,000 satellites by next year.

With products launching at market-dominating speed and investors getting giddy over SpaceX’s valuation, it could be high time for Starlink to go public. So what would it take for that to happen?

When will Starlink IPO?

It’s all about predicting cash flow.

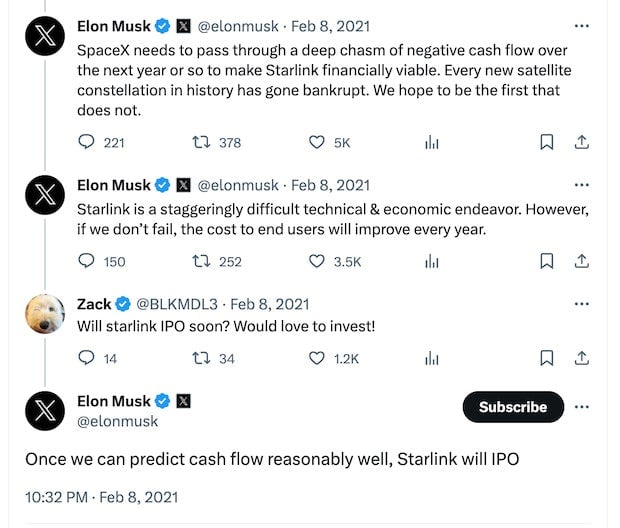

In 2021, Musk posted on X (formerly Twitter) about taking Starlink public, but not before SpaceX passed “through a deep chasm of negative cash flow over the next year or so” for Starlink to become “financially viable.” Starlink will IPO when it can predict cash flow “reasonably well,” he added.

Is SpaceX profitable or just breaking even?

Musk posted in early November that Starlink has “achieved breakeven cashflow.” Near the start of the year, Gwynne Shotwell, president and COO of SpaceX, said the satellite business had “a cash flow positive quarter last year” and that “[t]his year, Starlink will make money.”

The Wall Street Journal reported that SpaceX made $55 million in profit on $1.5 billion in revenue for the first quarter of 2023. The private company also reportedly took in about $2 billion from issuing stock last year, up from $1.5 billion in 2021, keeping it flush with cash.

Still, SpaceX reportedly aimed to attract investors in a 2015 presentation with projections of Starlink reaching 20 million subscribers by 2022. It’s currently well short of that total, with just 1.5 million subscribers.

With Musk keeping financials and other information under wraps and dripping details to the public via X, it’s hard to know if SpaceX can“predict” cash flow and profitability well enough to take Starlink public.

But that doesn’t matter, because money and hype keep finding their way to the space company.

The US Space Force recently awarded SpaceX its first first Starshield contract, to establish a secure satellite network for government entities. That deal is worth anywhere from $15 million to $70 million over the course of a year.

Even Italy’s biggest bank, Intesa Sanpaolo, wants in, having staked an undisclosed sum in SpaceX last month. That investment could be worth $151.6 million (141.7 million euros) according to BeBeez, an Italian private equity news service.

As for the rest of us, investing in Starlink’s partners and competitors, including Musk’s own Tesla, payments firm Shift4, and satellite outfit Iridium Communications, is one way to gain exposure to the expanding industry. Another option: buying into space exchange-traded funds such as Cathie Wood’s Ark Space Exploration ETF.