Jamie Dimon, from Sandy Weill's assistant to savior of First Republic

The JPMorgan Chase CEO adds another big moment to an eventful tenure as banking's elder statesman

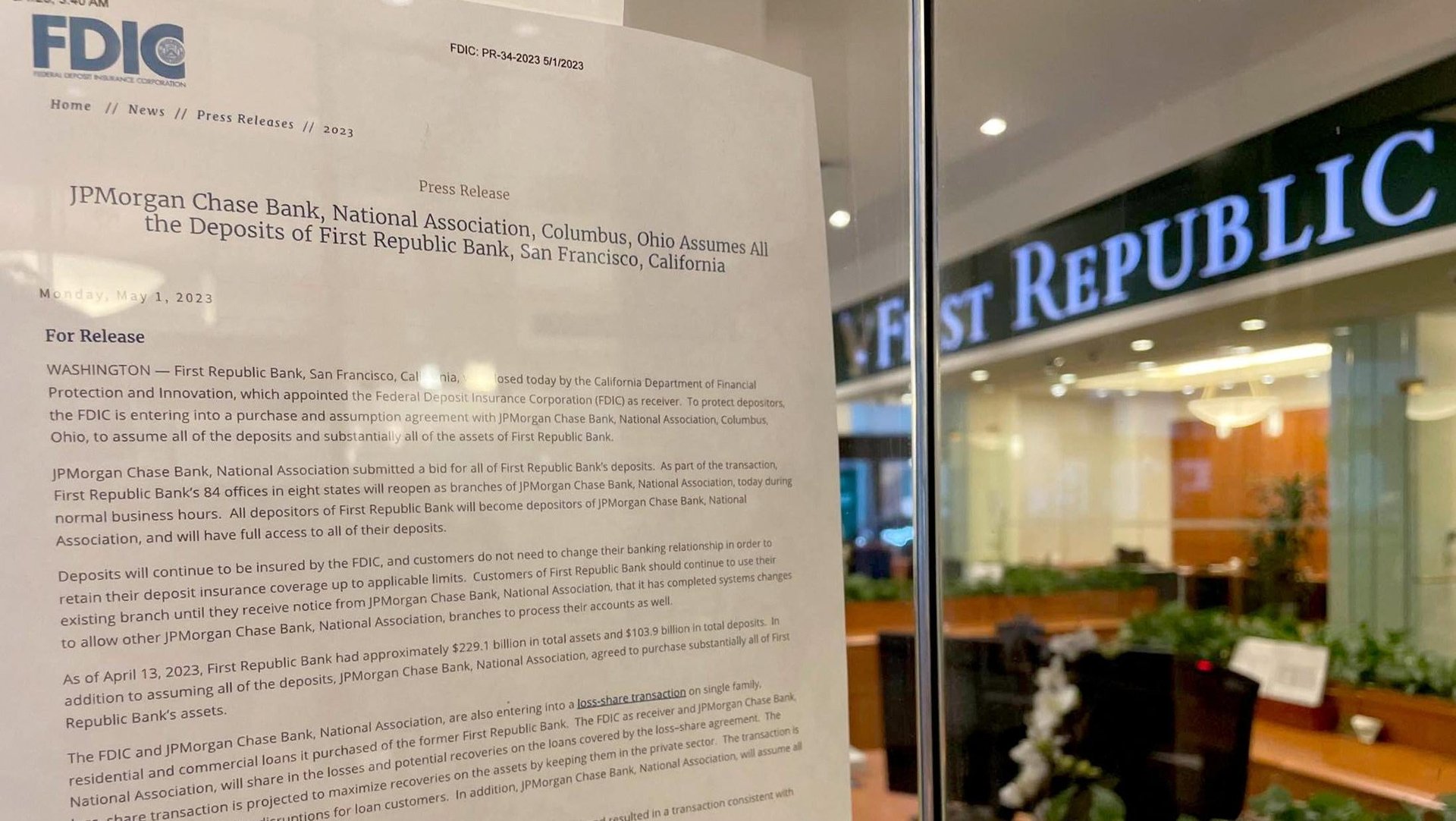

With his May 1 rescue of First Republic Bank from regulatory receivership, JPMorgan Chase CEO Jamie Dimon has further burnished his image as the finance sector’s white knight and the keeper of his company’s mythical fortress balance sheet.

Here’s a look back at the career of the most tenured leader among the CEOs of America’s largest banks.

2 / 15

1982: Dimon graduates from Harvard Business School

Following his stockbroker father and grandfather into finance, Dimon gets a job as an assistant to future deal-making legend Sandy Weill at American Express.

3 / 15

1986: Dimon goes with Weill to Commercial Credit

With his protégé Dimon at his side, Weill turns Commercial Credit into a voracious combiner of insurance and brokerage businesses. The merger-happy company will eventually be renamed Travelers Group.

4 / 15

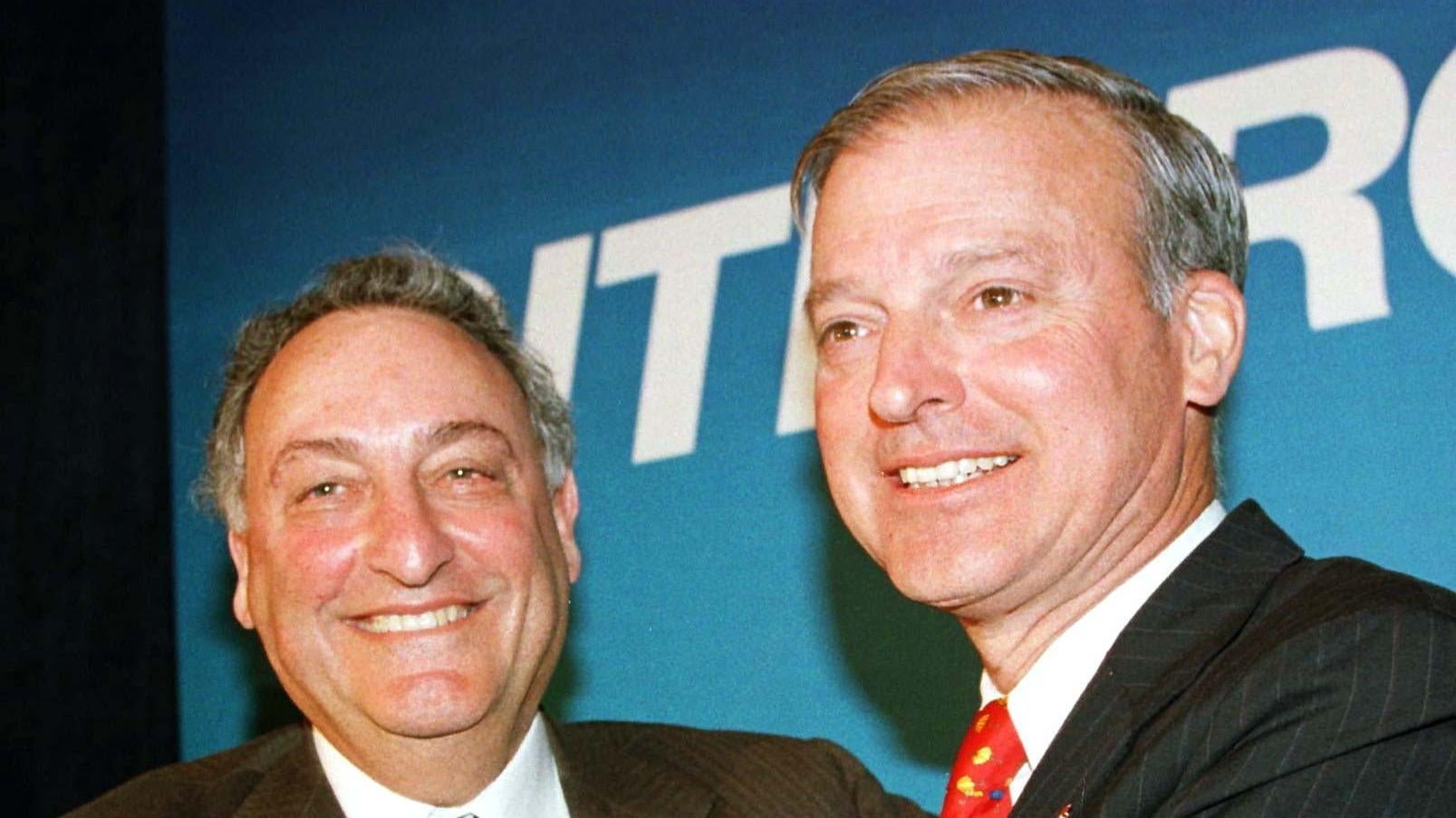

1998: Travelers merges with Citicorp

Dimon becomes president of the merged company, now known as Citigroup, while Weill and Citi’s John Reed briefly serve as co-CEOs. But Dimon’s relationship with Weill sours and within the year he is forced out by his longtime mentor.

5 / 15

2000: Bank One hires Dimon as CEO

After a brief hiatus, Dimon resurfaces in Chicago, where Bank One, another product of industry consolidation, is in desperate need of new leadership to tame the company’s infighting.

6 / 15

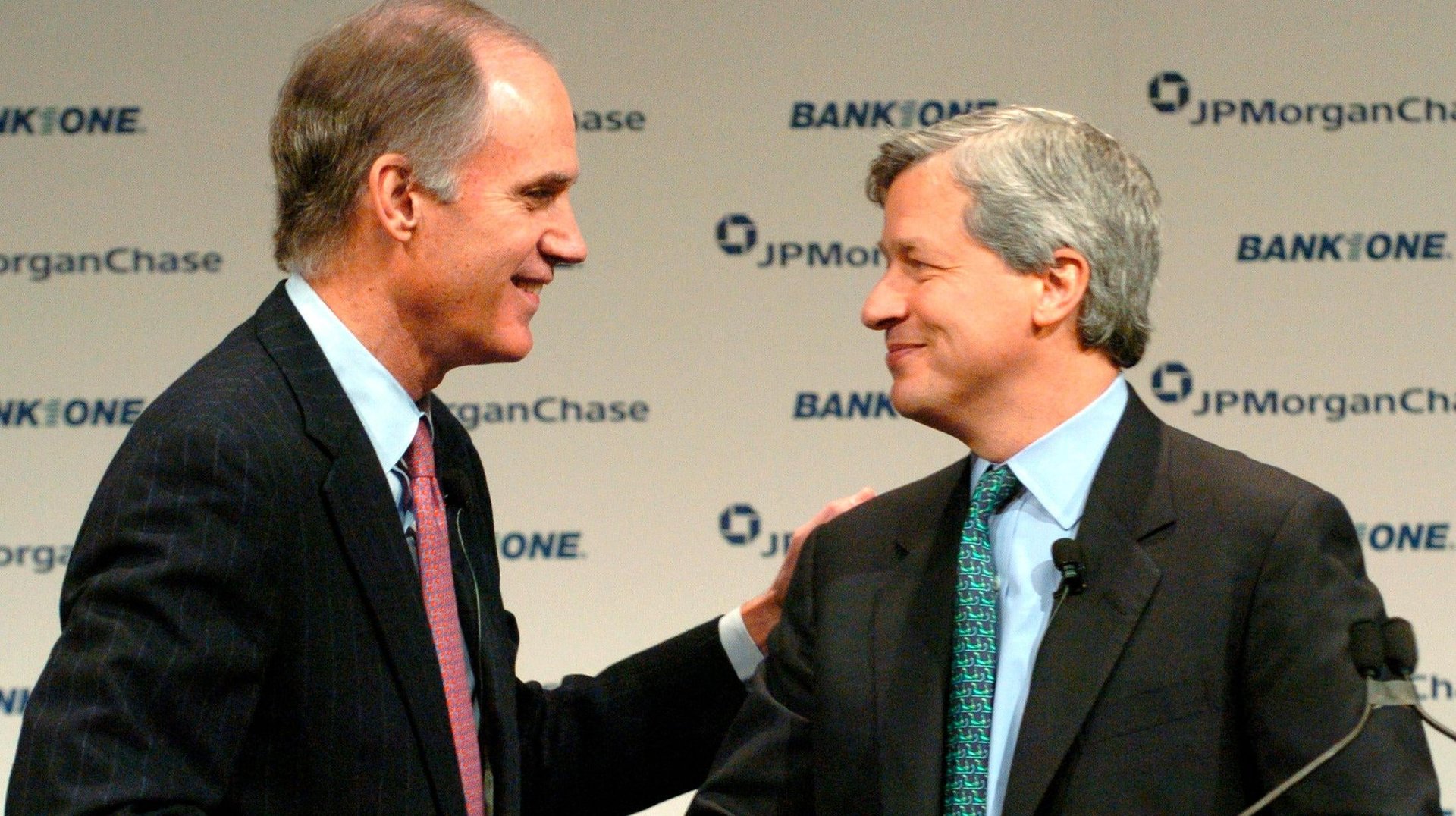

2004: Bank One enters a merger with JPMorgan Chase

After a two-year transition plan mapped out as part of the Bank One-JPMorgan Chase merger, Dimon takes over from JPMorgan’s William Harrison Jr. as CEO of the combined company on Dec. 31, 2005.

7 / 15

2008: JPMorgan acquires Bear Stearns and Washington Mutual

The deals are struck during acute phases of the global financial crisis. They solidify Dimon’s reputation as the bank industry’s elder statesman and as a partner to the US government in crisis situations. But they also drain JPMorgan Chase’s coffers of billions of dollars in legal costs tied to dodgy loans on the books at Bear Stearns and WaMu. Dimon would later say he regrets acquiring Bear Stearns as it imploded and should have paid far less for the failed WaMu.

8 / 15

2009: Dimon is in the mix as a possible pick for US Treasury secretary

Despite the rumors, there is no nomination forthcoming from the Obama administration as the Occupy Wall Street movement makes a splash and anti-bank rhetoric heats up.

9 / 15

2012: A scandal in London gives Dimon a proverbial black eye

JPMorgan Chase’s board slashes Dimon’s pay by 50% in the wake of the London Whale trading scandal, in which bank staffers tried to cover up their losses on a disastrous trade. Even with the pay cut, Dimon earns $11.5 million for the year.

10 / 15

2014: Dimon goes public with his cancer diagnosis

A bout of throat cancer curtails the globetrotting executive’s travel schedule as he undergoes treatment near his home in New York. The treatment is successful.

11 / 15

2016: Dimon is again mentioned as a possible pick for US Treasury secretary

Dimon reportedly turns down incoming US president Donald Trump’s offer of a nomination. The post instead goes to Steve Mnuchin.

12 / 15

2020: Is the third time a charm?

This time, Joe Biden is rumored to consider Dimon for US Treasury secretary. Dimon ultimately is not picked, and says he has “never coveted the job.”

13 / 15

2021: Dimon locks in as CEO for five more years

Already the longest-serving executive among the CEOs of America’s largest banks, Dimon receives a stock option grant worth nearly $50 million to remain CEO at JPMorgan Chase for five more years.

14 / 15

2022: Dimon sharpens his long-running attacks on crypto

He tells CNBC that crypto is a sideshow and likens crypto tokens to “pet rocks.”

15 / 15

2023: Dimon takes the lead on First Republic

As First Republic Bank gets caught up in a gathering banking panic, Dimon works with US Treasury secretary Janet Yellen to secure an infusion of billions of dollars in deposits from 11 big US banks. When the rescue plan fails and First Republic teeters into receivership, JPMorgan Chase emerges with the winning bid for substantially all of First Republic’s assets and deposits—and says it will return the deposits put up by the other big banks that attempted to help stabilize First Republic.