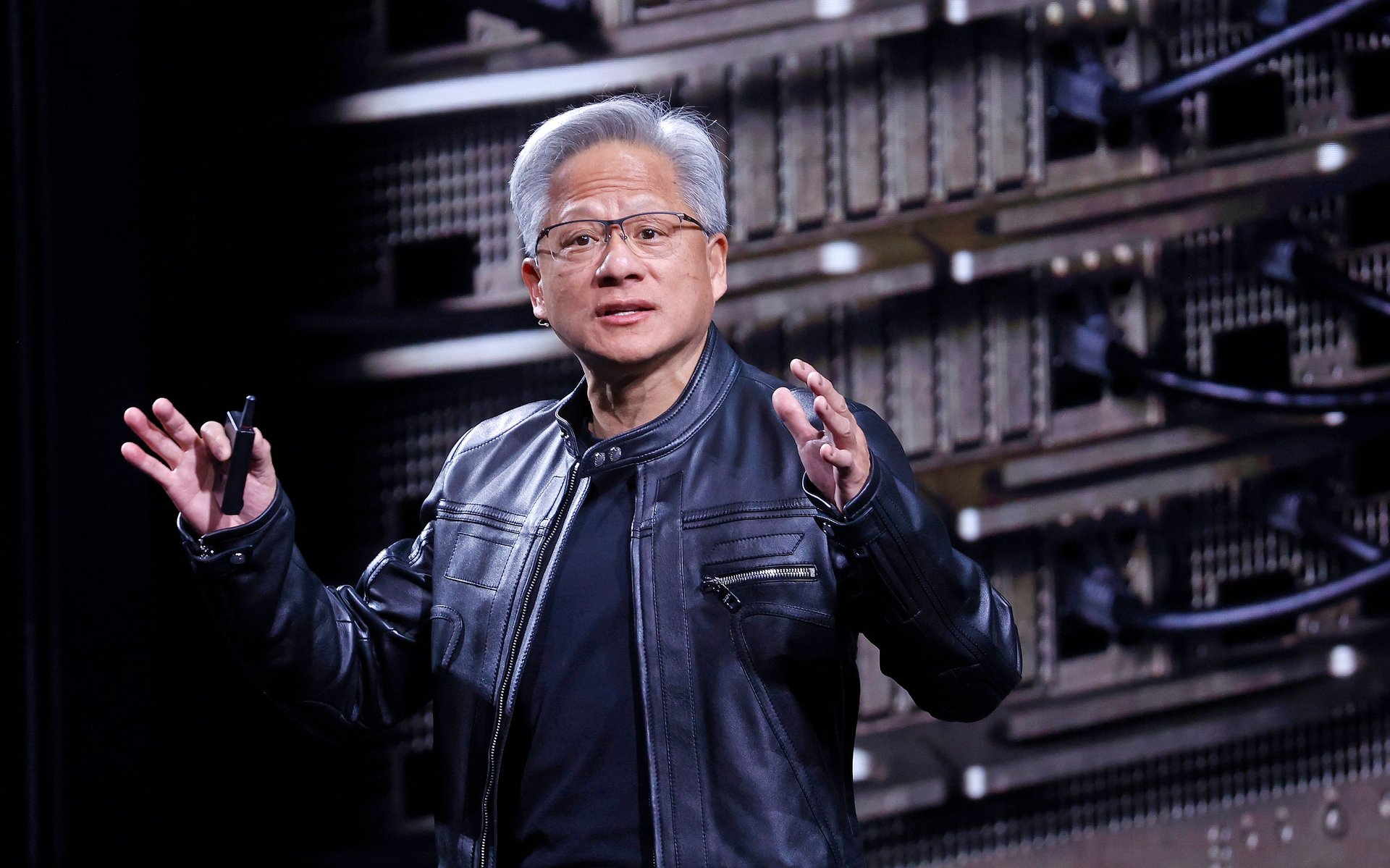

Nvidia CEO Jensen Huang plans Beijing trip amid AI-chip tensions

Huang will reportedly meet with senior Chinese officials ahead of a chip launch designed to navigate U.S. export restrictions

Chesnot/Getty Images

Jensen Huang is heading back to Beijing, and he’s hoping to bring a message: Nvidia isn’t giving up on China, no matter how high the geopolitical stakes get. According to reporting from The Financial Times and Bloomberg, the chip giant’s CEO is expected to meet with top Chinese officials, including Premier Li Qiang and Vice-Premier He Lifeng, while attending the government-backed International Supply Chain Expo next week.

Suggested Reading

Though Nvidia declined to comment on Huang’s agenda, people familiar with his plans say the CEO wants to reaffirm the company’s commitment to China. That means the trip could be part diplomacy, part damage control, and part preview of a key product pivot that’s aimed squarely at navigating tightening U.S. export restrictions. For Huang, who just led Nvidia to a record $4 trillion valuation, the stakes are incredibly high.

Related Content

Nvidia is preparing to launch an AI chip designed specifically for China as early as September. According to The Financial Times, the processor — based on its RTX Pro 6000 Blackwell architecture — will be stripped of advanced features such as high-bandwidth memory and NVLink to comply with rules implemented under President Donald Trump’s administration that prohibit the sale of Nvidia’s most powerful AI hardware to Chinese buyers. This chip won’t be the blockbuster H100 or Blackwell B200 that’s fueling data centers across the West, but it’ll be something — and that, Nvidia hopes, will be enough to keep a $17 billion market alive.

China accounts for about 13% of Nvidia’s total sales and remains the world’s largest ecosystem of AI developers. That has made the country both indispensable and increasingly fraught. The company’s H20 chip, introduced last year to meet the previous round of export guidelines, was effectively banned in April, costing Nvidia $15 billion.

Huang has described chip restrictions as counterproductive. In May, he called the Biden administration’s curbs a “failure,” saying that they’ve only accelerated China’s domestic chip efforts and handed a strategic edge to homegrown rivals such as Huawei. U.S. officials, meanwhile, are showing no signs of backing off. According to Bloomberg, the Trump administration is reportedly preparing to restrict chip exports to Malaysia and Thailand — both major transit hubs — as part of a broader campaign to prevent backdoor shipments to China. Taiwan, a major semiconductor hub, recently blacklisted Huawei.

At the same time, Chinese firms such as Alibaba, ByteDance, and Tencent have been aggressively testing alternatives from domestic rivals and reevaluating their reliance on U.S.-designed chips altogether. Nvidia is betting that any changes to the AI chips being used won’t happen overnight. While Chinese chips are catching up in raw performance, many firms remain deeply tied to Nvidia’s CUDA software ecosystem, which powers AI workloads across industries.

Still, Huang is walking a diplomatic tightrope.

Nvidia wants to maintain a stronghold in China without crossing any red lines in Washington. Launching a purpose-built chip — one that sacrifices cutting-edge power in exchange for regulatory compliance — is Huang’s current middle path. But that road is getting narrower. Whether this latest trip to China results in regulatory clarity, market reassurance, or simply another headline, Huang’s presence in the country should let senior officials know that Nvidia is still playing to win in China, even if geopolitical tensions keep upending the rules.