Nvidia delivered at GTC again. It wasn't enough for Wall Street

The AI chipmaker's stock slumped after CEO Jensen Huang addressed its annual developers conference

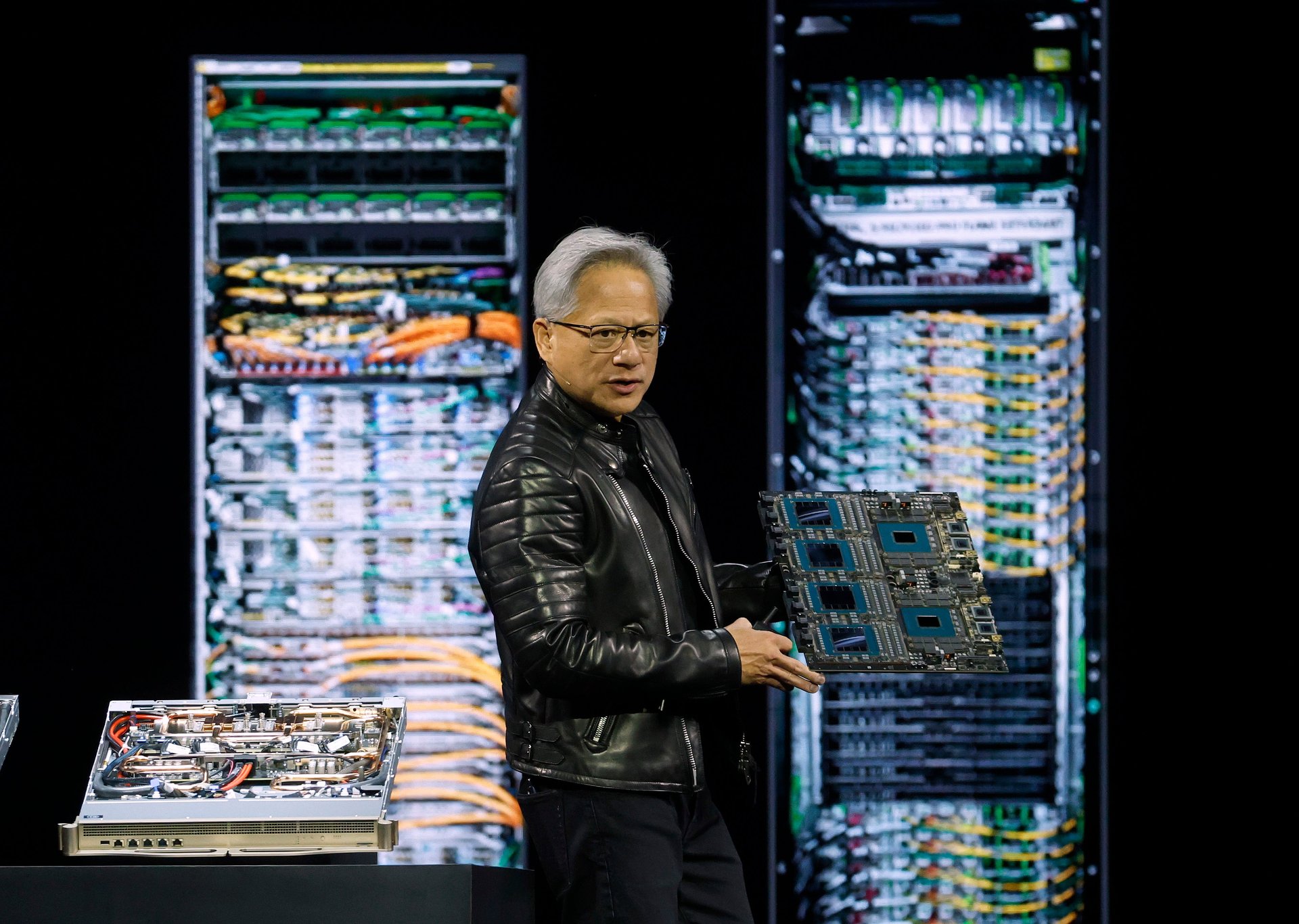

Nvidia (NVDA) unveiled more about its next artificial intelligence chips, humanoid robots, and AI supercomputers at its GPU Technology Conference on Tuesday — but some investors wanted more.

Suggested Reading

The chipmaker’s stock fell by more than 3% after the annual developer conference, also known as the GTC. The stock reversed course during pre-market trading on Wednesday, and was up by 2.2% at the open. Later in the morning, Nvidia’s shares were up by 1.2%.

Related Content

Nvidia chief executive Jensen Huang said the company’s Blackwell chips — which were announced at the last GTC — are now in full production after hitting snags last year. The next Blackwell Ultra NVL72 chips, which will have one-and-a-half times more memory and two times more bandwidth, will be used to accelerate building AI agents, physical AI, and reasoning models, Huang said during his keynote address. Blackwell Ultra will be available in the second half of this year.

The chipmaker’s next-generation Vera Rubin GPUs will be released in the second half of next year, Huang said, followed by Rubin Ultra in the second half of 2027. Rubin Ultra will be four GPUs connected together on a single chip.

The next AI chip architecture will be named Feynman, Huang said, and is slated for 2028.

“The rate of innovation on all fronts continues to impress and suggests a growing moat versus peers,” Jefferies (JEF) analysts said in a note on Wednesday. “However, the updated roadmap does suggest Rubin will only be an incremental update in 2026 with Rubin Ultra the more meaningful leap ahead in 2027.”

Richard Windsor, founder of research firm Radio Free Mobile, shared similar sentiments in a Wednesday note saying that the Rubin launch “promises another big jump over Blackwell, but smaller than the jump Blackwell made over Hopper.”

However, Windsor said the chipmaker “is showing no sign of slowing down meaning that it is quickly expanding into any area where AI will be relevant with the strategy to become the industry standard” before its competitors can start to catch up.

While this will help Nvidia keep its market dominance, having more than 85% of market share for data center chips will keep it “a hostage to end demand,” leading to some “tough quarters when the inevitable correction comes,” Windsor said. He added that there are no signs of this yet, as AI-focused companies plan to continue spending tens of billions of dollars on AI infrastructure this year.

Bank of America (BAC) analysts maintained their “buy” rating for Nvidia, and said they are looking forward to Blackwell Ultra, Rubin, and Rubin Ultra, which show “unmatched roadmap as Rubin advances AI performance 900x (scale-up FLOPs) over Hopper (Blackwell is 68x) in TCO optimized way,” in a note on Wednesday.

Meanwhile, Wedbush analysts led by Dan Ives said in a post-conference note on Tuesday that demand for Nvidia’s GPUs “remains extremely robust” and “is currently outstripping supply 15:1” as enterprises wait to receive their AI chips.

“In essence, Nvidia’s chips remain the new oil or gold in this world for the tech ecosystem as there is only one chip in the world fueling this AI foundation ... and it’s Nvidia,” Wedbush said.