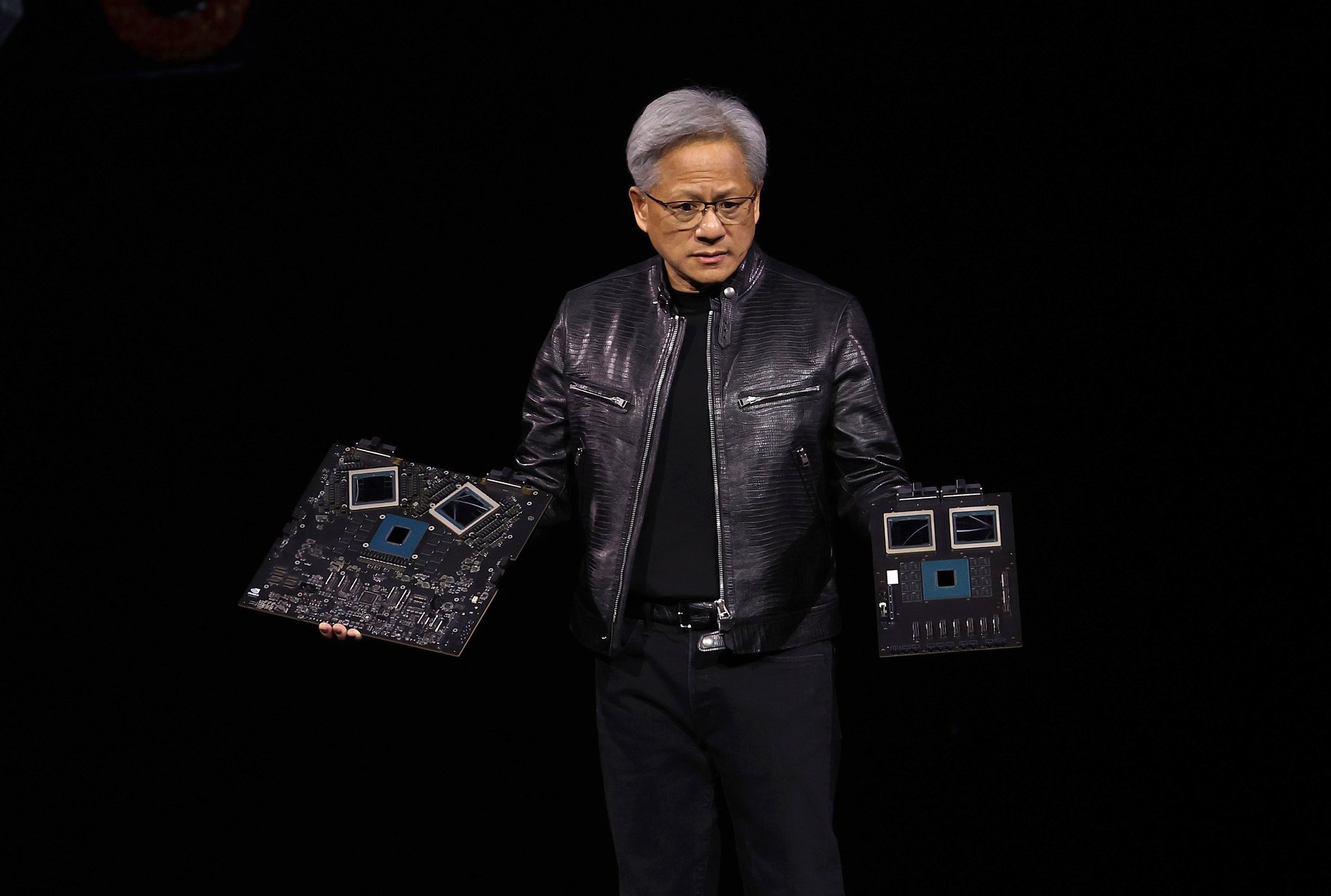

Nvidia is trying not to lose a key part of its China business

The chipmaker is reportedly working on a version of its Blackwell AI chips that would comply with U.S. export controls

As the U.S. considers tougher trade restrictions to prevent advanced chip equipment from reaching China, U.S.-based chipmaker Nvidia is reportedly working on a version of its new artificial intelligence chips to comply with those rules.

Suggested Reading

Nvidia is working on a version of its new Blackwell AI chips for the Chinese market, Reuters reported, citing unnamed people familiar with the matter. The chipmaker will reportedly work with a local distribution partner, Inspur, to launch and sell the chip, tentatively called the “B20,” in China.

The B20 is expected to start shipping in the second quarter of 2025, a source told Reuters. Nvidia declined to comment.

The chipmaker has three chips designed specifically to comply with U.S. export controls, including the H20, which it cut prices for amid weak sales to compete with chips from homegrown competitor Huawei. However, H20 sales are now growing, sources told Reuters. Nvidia is expected to sell more than one million of its H20 chips in China this year, worth around $12 billion, despite U.S. trade restrictions, the Financial Times reported, citing SemiAnalysis data. Nvidia’s expected sales are almost double Huawei’s sales expectations for its Ascend 910B chip, according to the data.

Meanwhile, Nvidia’s H20 chips could be at risk under further U.S. trade rules, Jefferies analysts said. When the U.S. does its annual review of U.S. semiconductor export controls in October, “it is highly likely that” the H20 will be banned for sale to China, Jefferies analysts wrote in a note. The ban could happen three ways: through a “product specific ban, lowering the computing power cap, and/or putting a cap on memory capacity,” analysts wrote.

The U.S. could also extend export controls on chips sold to other countries in the region, such as Malaysia, Indonesia, and Thailand, or extend the controls to overseas Chinese companies, although this would be harder to implement, according to analysts.