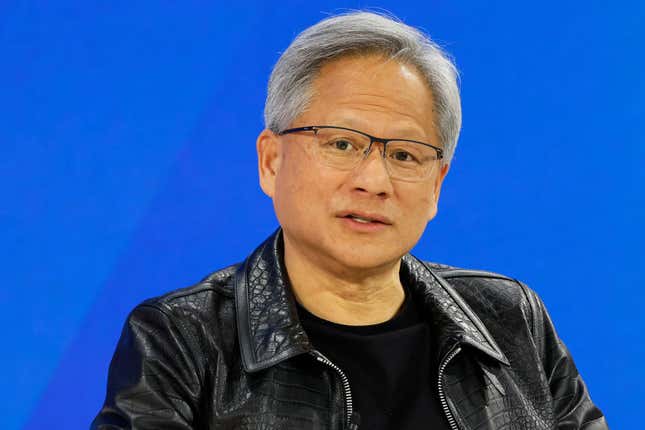

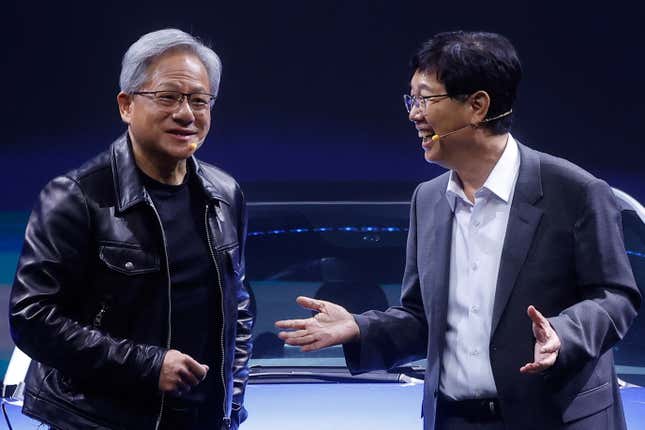

For a moment, it looked like the Nvidia rally might finally hit a wall. The stock had its worst day in months, Microsoft inked a deal with rival Intel, and Wall Street’s earnings expectations were sky-high.

Nvidia beat them anyway. And the AI chipmaker ended a wild week as the first chipmaker to be worth $2 trillion. Check out the slideshow above for the week in Nvidia news.