Comparing PayPal, Venmo, Zelle and Cash App, by the numbers

Peer-to-peer payment apps are growing in popularity, but there are some key differences

Peer-to-peer payments are changing the retail landscape, with major names such as Starbucks and Walmart embracing the convenient and flexible payment option. According to a recent report by PYMNTS intelligence, 51% of consumers use P2P payments in the U.S.

Suggested Reading

With an increasing demand for digital wallets, demand for P2P-enabled apps such as PayPal (PYPL), Zelle, Cash App (SQ) and Venmo is transforming how consumers make transactions.

Related Content

According to a recent survey by the Motley Fool, over 57% of Americans choose to use digital apps to make purchases and pay back friends and families. PayPal is the most popular digital payment app, with 85% of respondents using the app, followed by Cash App, Venmo and Zelle.

Digital wallets are now the fastest-growing payment method in the U.S., especially among younger generations. When comparing generations, millennials are more likely to use Venmo than Gen Z, while Gen Z prefers Apple Pay (AAPL), compared to older generations.

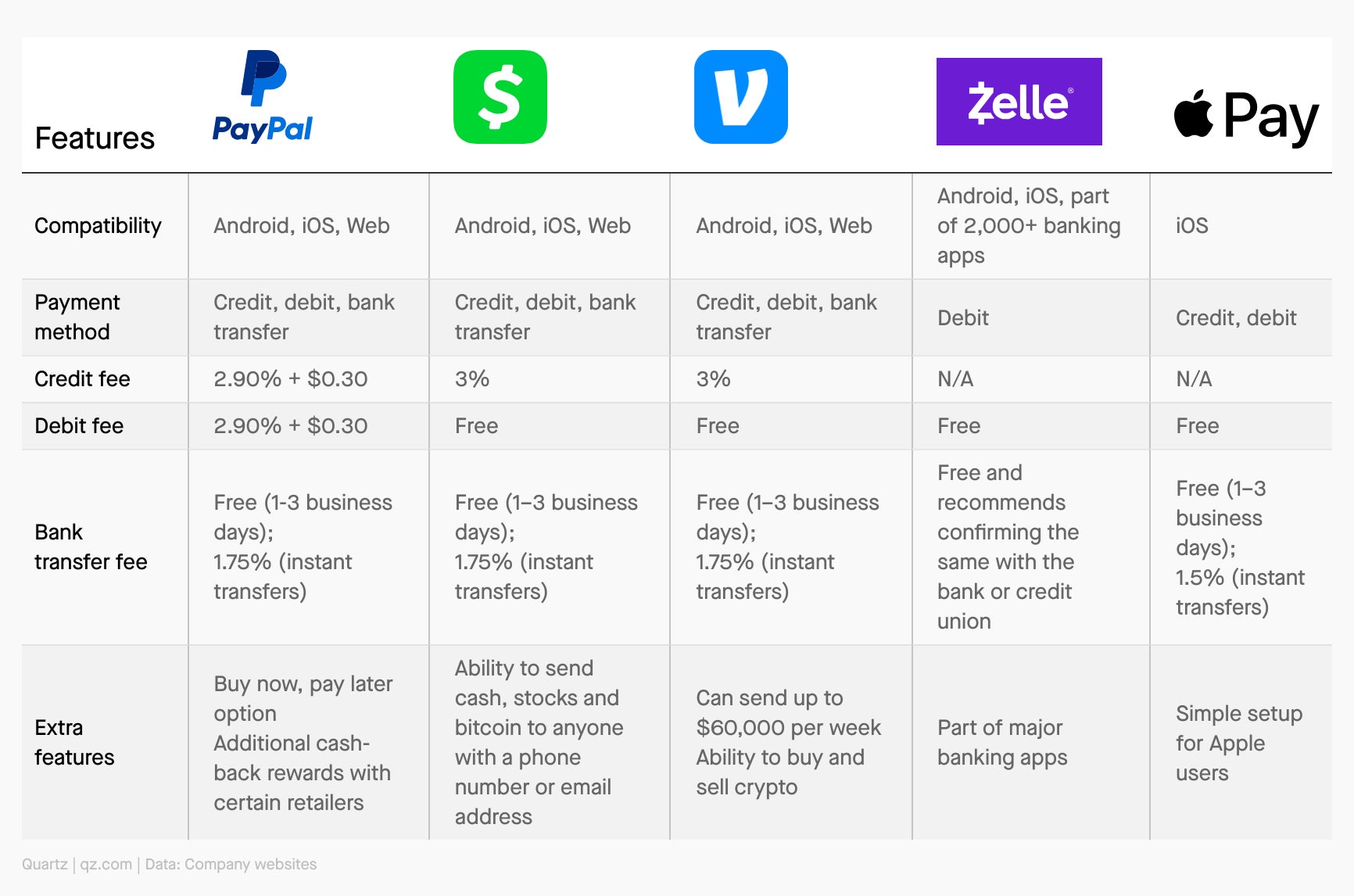

We stacked up the most popular P2P payment apps to see how they compare.

PayPal

PayPal allows users to send money to each other via a linked bank account, a debit card or a credit card. The app allows users to send money to 160+ countries in any currency — international fees apply. Users can transfer money to other registered users by searching for their name, email or phone number. The app also allows for online transactions and is integrated with many online retailers. The app offers multiple payment methods for money transfers such as a debit card, a credit card, a bank account, PayPal balance and PayPal Credit, an individual credit line offered by PayPal.

However, a linked bank account or PayPal balance are the only free options for sending money, which can take anywhere from one to three business days, depending on the bank. There is a 2.9% transaction fee to use a credit card, debit card or PayPal Credit for sending money. PayPal Credit carries interest rates that are on par with credit cards. For instant transfer, PayPal charges a fee of 1.75% of the amount transferred, with a maximum fee of $25.

Cash App

Created by Block Inc. (formerly known as Square), Cash App allows users to send money through the app, linked bank account, credit card or debit card. The optional debit card known as Cash App Card also allows users to spend money and receive offers, which are savings applied to different vendors. In December 2023, Block saw a 20% jump in Cash App Card monthly active users. The app can be downloaded on a smartphone or tablet and can be connected using a debit card, a credit card or a bank account. The Cash App users can also use the account to invest in Bitcoin, which is the largest revenue-maker for the company.

The app charges a 3% fee to send money from a linked card. When transferring money from Cash App to a linked account, there’s no fee for a standard cash out, which typically takes 1-3 business days. However, for an instant deposit there is a fee of 0.5% to 1.75%.

Venmo

Owned by PayPal, Venmo allows users to send money via a linked bank account, Venmo card or credit card. The app offers an optional, free debit card. The Venmo credit card allows the user to automatically earn 3% cashback on the top spend category. It can be added to mobile wallets such as Apple Pay and Samsung Pay. There is a 1.75% fee for the Instant Transfer feature to move money from a Venmo account to any U.S. bank account or a participating credit card account within 30 minutes or less. The standard transfer option is free and takes three to five business days. While Venmo does not charge for sending money from a linked bank account, debit card or Venmo account, it charges a 3% fee for sending money using a linked credit card.

Zelle

Owned by Early Warning Services — which is co-owned by seven leading U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC) and Bank of America (BAC) — Zelle allows customers to send money through most major banks or via the Zelle app. The free app is considered easy to use, with connections across 2,000 banking apps. There are no fees to send or receive money, but Zelle recommends confirming with the bank or the credit union. The app, however, does not allow you to connect a credit card to pay others and typically requires a smartphone for access in case the service is not available through your bank. Zelle also only works for U.S. banks, so users cannot send money internationally.

Apple Cash

Apple Cash allows Apple users to send and receive money using the Wallet app on their iPhone, iPad or Apple Watch. Combined with a Secure Element chip, the Apple Pay system operates using Near Field Communication (NFC) technology, which enables data transmission over short distances. Users can link their debit card to Apple Wallet and transfer money through the Wallet or even Messages. Most retailers now offer Apple Cash at checkout. While friendly to Apple users, it can’t be used on Android devices.