India's central bank raises key benchmark rate to pre-pandemic levels

Consumer price index has eased from April's 7.79% but still “remains uncomfortably high.”

The Reserve Bank of India (RBI) today raised a key interest rate by 50 basis points (bps) to 5.40%, continuing with its efforts to rein in inflation.

The repo rate, tweaked by the central bank today, is the one at which it lends to commercial banks.

From March to May 2020, the RBI had slashed it by 115 bps to cushion the economy from the global impact of covid-19-induced disruptions. In May this year, it began increasing interest rates.

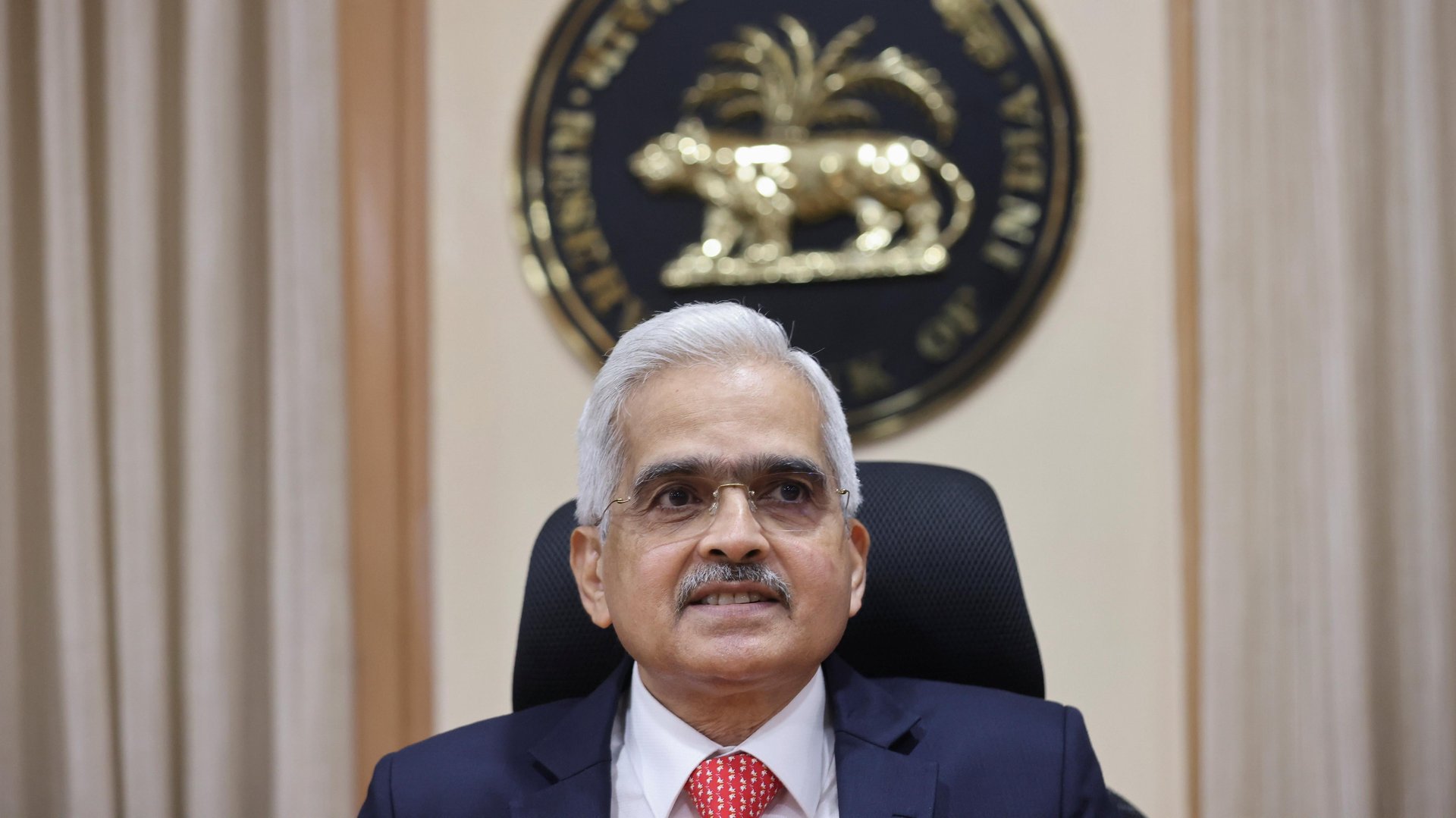

“The Indian economy has naturally been impacted by the global economic situation,” Governor Shaktikanta Das said in his statement (pdf) today announcing the banking regulator’s monetary policy move. “...The volatility in global financial markets is impinging upon domestic financial markets, including the currency market, thereby, leading to imported inflation.”

Consumer price inflation (CPI) has eased from its April level of 7.79%, but it “remains uncomfortably high,” Das said.

Outlook on Indian economy

The RBI’s monetary policy committee believes global geopolitical uncertainties are seeping into India’s inflation and growth trajectory.

While the country’s current account deficit (CAD) has been cushioned by exports of goods and services as well as remittances, the pressures of imported inflation due to elevated commodity prices may widen the deficit this year, the statement said.

India’s CAD is expected to top $105 billion this financial year, according to a report by Bank of America Securities.

For this financial year, the estimated headline inflation stays at 6.7% on the assumption of a normal monsoon and global crude oil prices at $105 per barrel.

“Rising kharif sowing augurs well for the domestic food price outlook. The shortfall in paddy sowing, however, needs to be watched closely, although stocks of rice are well above the buffer norms,” the RBI governor said.

However, edible oil prices are expected to soften in coming months, bringing in some relief for citizens.

The RBI retained its GDP growth projection at 7.2% for the financial year 2022-23.