Is a recession coming? Here's what Trump, Elon Musk and the president's allies are saying

"There are no guarantees," said one cabinet chief. "It's worth it," said another

As Wall Street grapples with the increasing likelihood of a U.S. recession, the Trump administration has gone to bat defending President Donald Trump’s stock market-slamming trade policies.

JPMorgan (JPM) chief economist Bruce Kasmun told reporters last week that he sees a 40% recession risk, up from 30% at the start of 2025, while Moody’s chief economist Mark Zandi raised his recession odds to 35% from 15%, Fortune reports. Larry Summers, who led the Treasury Department under Former President Bill Clinton, said the odds are “getting close to 50/50.”

The S&P 500, Nasdaq, and Dow Jones Industrial indexes were slammed last week by Trump’s tariffs, which are poised to affect major U.S. corporations and consumers. An escalating tit-for-tat trade war with Europe alone threatens $9.5 trillion worth of business.

The Trump administration has announced new tariffs on imports from China, Canada, Mexico, all foreign steel and aluminum, and European alcohol. China, Canada, and the European Union have announced retaliatory measures, while other nations have held off — for now.

“We will feel better about calling a stock market bottom when the market is no longer ‘tarrified’ by Trump’s tariff threats and actions,” Yardeni Research wrote in a note. “It might bottom after April 2, when Trump imposes reciprocal tariffs all around the world, if they lead to tariff-reduction negotiations.”

Here’s what Trump and his allies have said about a potential recession.

2 / 7

Scott Bessent: ‘There are no guarantees’

“You know that there are no guarantees, like who would have predicted Covid, right?” Scott Bessent, Trump’s Treasury Secretary, told NBC News’ “Meet the Press” on Sunday when asked about the possibility of a recession.

Bessent, a former partner at Soros Fund Management and the founder of Key Square Group macro fund, said there could “be an adjustment” because of the Trump administration’s policies.

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal,” the treasury secretary said. “What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis.”

Bessent also said he wasn’t worried about the markets, something that he and other federal officials have said over the past several days.

3 / 7

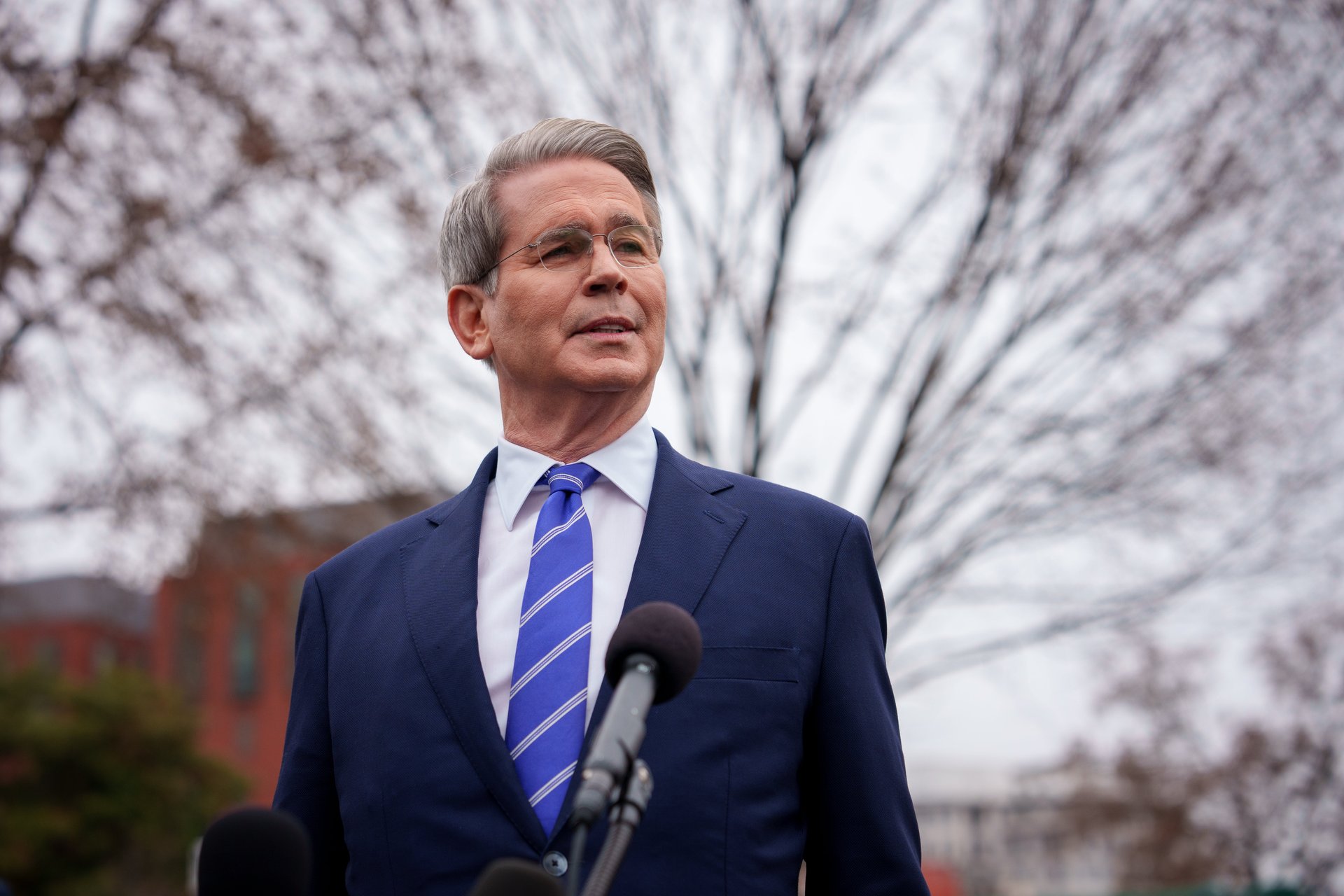

Howard Lutnick: ‘Worth it’

Recessions are no joking matter. They can lead to job losses, slam workers’ bargaining power, and retirement accounts can take a near-term hit. Banks may also get stricter about issuing loans, while credit card companies could reduce limits for some cardholders.

But Commerce Secretary Howard Lutnick thinks a recession is worth it in the long run.

“These policies are the most important thing America has ever had,” Lutnick told CBS News last week. “It’s worth it.”

“The only reason there could possibly be a recession is because the Biden nonsense that we had to live with. These policies produce revenues. They produce growth. They produce factories being built here,” Lutnick added.

Just a few days before that media appearance, Lutnick had told NBC News that “there’s going to be no recession in America.”

4 / 7

Trump: ‘What we’re doing is very big’

Last week, Trump was asked by Fox News host Maria Bartiromo if he was expecting a recession this year. The president didn’t rule it out as a potential outcome.

“I hate to predict things like that,” Trump said. “There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing, and there are always periods of, it takes a little time. It takes a little time, but I think it should be great for us.”

“Have no fear, we will WIN everything!!!” he wrote on his Truth Social on Thursday. “Our economy will BOOM, like never before!” the president added on Friday.

5 / 7

Elon Musk: ‘Temporary Hardship’

Although Tesla (TSLA) CEO and White House Senior Advisor Elon Musk hasn’t directly commented on the risk of a recession, he has discussed the potential impact of Trump’s trade policies.

Back in October, Musk backed up a forecast that said the then-presidential candidate’s plans would cause “temporary hardship” in the pursuit of a healthier economy. The forecast, tweeted out by X user FischerKing64, hypothesized that government spending cuts and mass layoffs would cause an overreaction in the economy and crash the stock market.

“But when the storm passes and everyone realizes we are on sounder footing, there will be a rapid recovery to a healthier, sustainable economy,” the user wrote. “Sounds about right,” was Musk’s reply.

6 / 7

Mike Johnson: ‘Give it time’

House Speaker Mike Johnson, a Louisiana Republican, called for Americans to stay calm and carry on, even in the face of economic uncertainty.

“It is a shake-up and he said there is going to be a shake-up right now but this is what is required, in my mind, to start the process of repairing and restoring the American economy,” Johnson said last week when asked about Trump’s tariff strategy.

“I believe the strategy is going to work ... I think you got to give it time,” he added, according to ABC News. “Give the president a chance to have his policies play out.”

7 / 7

Stephen Miller: ‘Four years of bleeding’

“It’s not our job to make these kinds of prognostications,” White House deputy chief of staff Stephen Miller said last week when asked about Trump’s comments on the possibility of a recession.

“It’s our job under President Trump’s leadership to fix the economy, to stop four years of bleeding,” he told The Hill.

The White House official cited the February jobs report, which showed that the U.S. added 151,000 jobs last month, as a sign of the administration’s economic progress. Economists had initially projected a gain of 160,000 jobs before revising downward in January.

“For the first time in recent memory, all job growth was the private sector, only the government sector lost jobs because, of course, we’re downsizing government, which is, again, what is driving inflation, is the growth in federal spending,” he added.