Tesla is embroiled in another major controversy and its board of directors are at its center.

This latest kerfuffle goes all the way back to the distant year of 2018, when Tesla’s board put together a surprising compensation package for CEO Elon Musk.

The plan, which was approved by 73% of shareholders, gave Musk the right to purchase up to 304 million Tesla shares priced at $23.34 per unit, as long as he met a series of increasingly difficult milestones. Despite the difficulty of achieving the goals, Tesla met enough of them by the end of 2022 for Musk to receive the full package.

But a Delaware judge in January struck down the deal in response to Richard J. Tornetta’s shareholder lawsuit, citing the “deeply flawed” process that led to its approval and calling it an “unfathomable sum” that was unfair to investors. The judge also called into question Musk’s relationships with the board’s directors and slammed some, including chair Robyn Denholm, for a failure to enforce proper oversight of the chief executive.

On June 13, shareholders will vote on a series of proposals, including the re-ratification of Musk’s compensation deal, the reelection of two directors, and a proposal to reincorporate the company in Texas. Tesla’s legal team has said a vote ratifying Musk’s pay would materially affect proceedings in Delaware, where a judge is deciding how much to award to Tornetta’s legal team, Reuters reports.

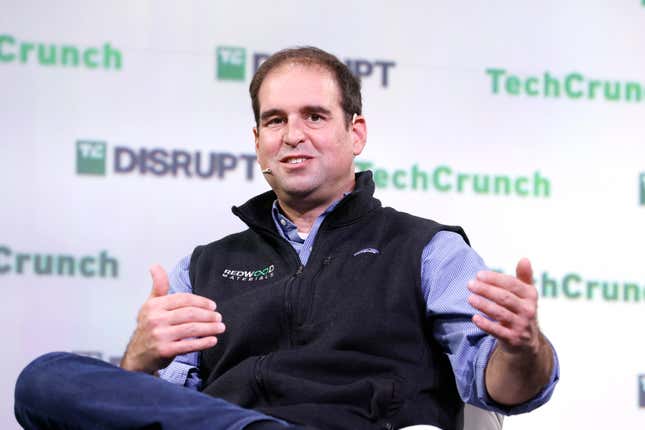

Now, meet the seven members of Tesla’s board who are overseeing Tesla’s future. Excluding, of course, the “Technoking” of Tesla, Elon Musk.