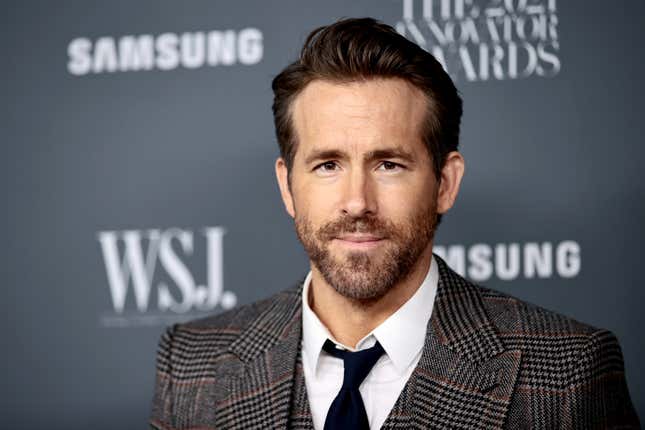

T-Mobile is buying the budget wireless provider Mint Mobile for as much as $1.35 billion. Both companies, along with Mint minority owner Ryan Reynolds, announced the sale on Wednesday (March 15).

T-Mobile—the second-largest wireless provider in the US—reached a deal to acquire Mint’s parent company, Ka’ena Corporation, which will also include the prepaid service Ultra Mobile as well as the cellphone wholesaler Plum.

The payment will include a combination of 39% cash and 61% stock, with the final price determined by future Mint’s future performance.

Mint, which already utilized the T-Mobile network for its wireless service, offers among the lowest-priced wireless plans in the industry. While the company does not release the number of subscribers, CEO and founder David Glickman said that the company had seen 50% annual subscriber growth over the past four years.

Mike Katz, T-Mobile’s president of marketing, said that his company was looking to incorporate Mint’s unique brand into its marketing strategy.

“Mint’s formula works, the brand is growing fast and we can pour more fuel onto that by leveraging buying power for phones and marketing,” Katz said.

Glickman, along with co-founder Rizwan Kassim, will join T-Mobile to continue managing the Mint brand. Additionally, Reynolds will stay on in a limited capacity, focusing on Mint’s marketing strategy while continuing to star in the company’s iconic advertisements.

Quotable:

“We are so happy T-Mobile beat out an aggressive last-minute bid from my mom Tammy Reynolds as we believe the excellence of their 5G network will provide a better strategic fit than my mom’s slightly above-average mahjong skills. I am so proud of the entire Mint team and so excited for what’s to come.” – Ryan Reynolds, Mint Mobile minority owner, in a statement announcing the sale

T-Mobile’s upward trend

Mint Mobile’s rapid growth, a timeline

August 2016: MintSIM is founded by David Glickman as a subsidiary of Ultra Mobile.

November 2019: Ultra Mobile completes a corporate spin-off of Mint, and Glickman founds Mint Mobile as a standalone budget wireless carrier. Glickman invites Reynolds to acquire an ownership stake in the company after being impressed with how Reynolds marketed the Deadpool franchise.

January 2020: Mint takes out a full-page ad in the New York Times offering 3 months of Mint Mobile service for free for new users.

June 2022: Ultra Mobile first puts Mint up for a potential sale.

February 2022: Mint makes headlines for advertising during the Super Bowl, upside down.

March 2023: T-Mobile acquires Mint for up to $1.35 billion.

Ryan Reynolds’ cheeky announcement of the sale:

Ryan Reynold’s flurry of investments

🎥 Maximum effort: Reynolds is the CEO and founder of a production company and marketing agency that has made viral ads for a number of companies, including Mint Mobile. It signed a first-look deal with FuboTV in 2022.

⚽ Wrexham F.C.: Along with fellow actor Rob McElhenney, Reynolds acquired a fifth-tier Welsh football club in 2021, investing roughly $2.75 million. The pair produced a documentary series about the team in 2022 called Welcome to Wrexham.

🍷 Aviation Gin: Reynolds bought a stake in the boutique liquor company in 2018 and subsequently became the brand’s creative director. In 2020, Reynolds sold the gin company to Diageo, a European beverage company, for an estimated $610 million.

🖥️ 1Password: Reynolds is a prominent investor in the popular password management software, frequently starring in its commercials. The company is valued at $6.8 billion.

🤑 Wealthsimple: Reynolds is one of a number of celebrity inventors in the wealth management service, valued at approximately $5 billion.

Related stories:

🍎Apple wants to move its manufacturing out of China

⚽ Marvel’s “Deadpool 3” teaser nods to Ryan Reynolds’ “Ted Lasso”-like soccer club investment