The U.S.-China deal on rare-earth mineral exports has a time limit, report says

Beijing is holding on to a valuable bargaining chip, despite reaching an agreement on US-China trade.

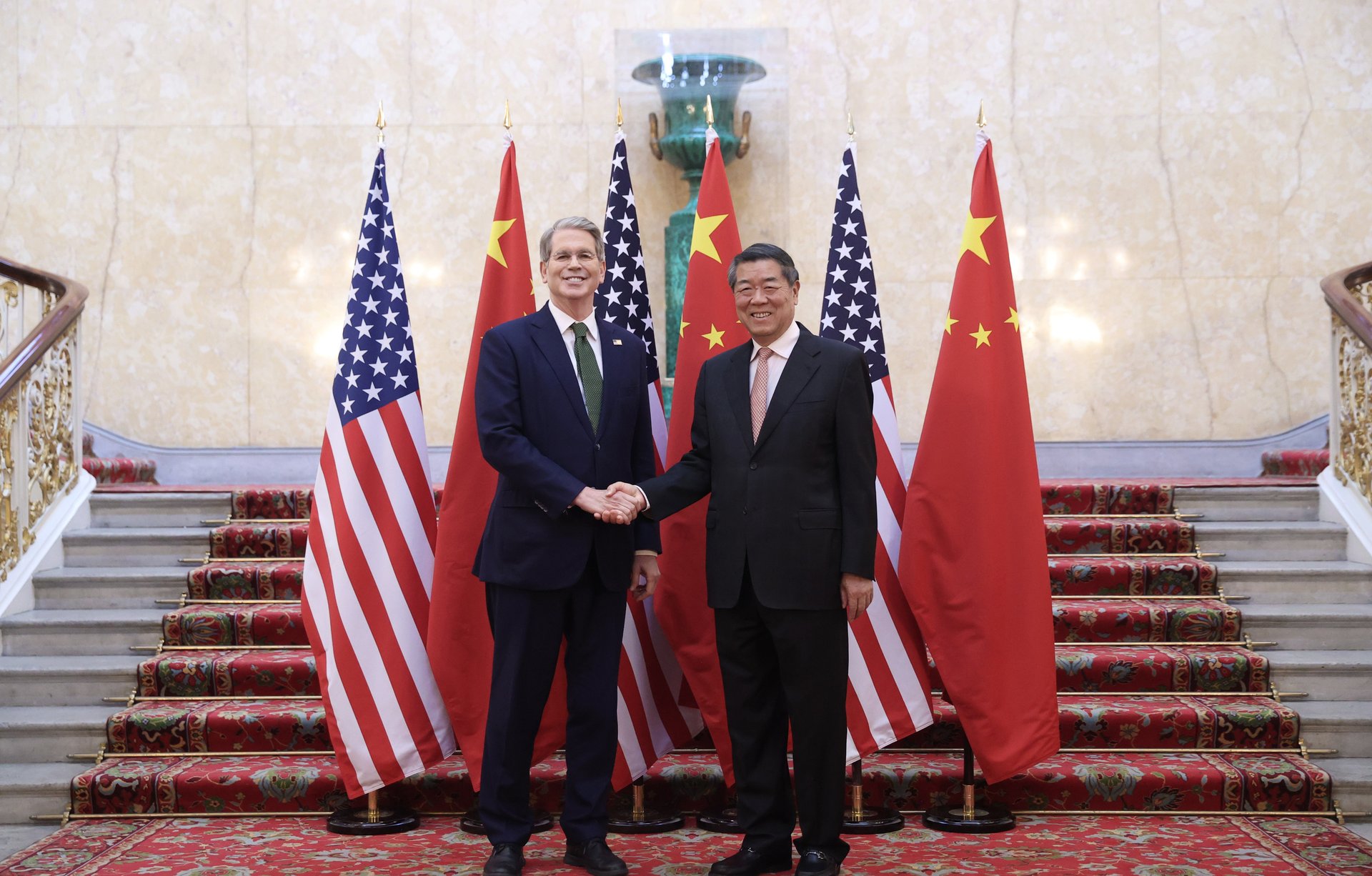

Xinhua News Agency / Getty Images

China is subjecting U.S. automakers and manufacturers to a six-month limit on rare-earth export licenses, sources familiar with the matter told The Wall Street Journal on Wednesday.

Suggested Reading

The aim is to give Beijing leverage should its trade war with Washington escalate again, while amplifying uncertainty for American businesses, sources say.

Related Content

Beijing had agreed to temporarily restore the licenses during trade talks with the U.S. negotiators in London this week, which was deemed to be a major breakthrough of the meeting. Yet, the six-month limit suggests that there's still a desire to keep hold of bargaining chips. Beijing knows its grip on the supply of critical minerals is a valuable weapon for future negotiations, sources said.

In return for reinstating the licenses, the U.S. has agreed to ease some restrictions on exports to China, sources said. These include jet engines and related parts, and ethane, a chemical used for manufacturing plastics. China has agreed to start approving U.S. companies’ license applications imminently, contingent on President Donald Trump and Chinese leader Xi Jinping’s approval of the trade framework, sources said. At that point, the U.S. will also begin to drop the export controls on the jet engines and ethane, they added.

The White House could not be immediately reached for comment.

The London talks have finalized a trade framework which was only agreed "in principal" during the US-China trade talks in Geneva, Switzerland, on May 11 and 12. Trump said in a Truth Social post on Wednesday: “Our deal with China is done." Treasury Secretary Scott Bessent led the American delegation in the talks with Chinese Vice Premier He Lifeng.

The Geneva meeting took place with the aim of defusing tensions and easing export restrictions that threaten global manufacturing.