79 cents on the dollar. By now, most of us are well aware of the gender pay gap. Despite its constant coverage, progress toward equal pay has been frustratingly slow. According to research from the Institute for Women’s Policy Research, if change continues at its current pace, women will not reach pay parity until 2059. And for women of color, the rate of change is even slower: Black and Latino women will be waiting until 2124 and 2233 respectively.

But pay gap represents only one myopic facet of gender financial disparity. Echoing a Nobel laureate: economic inequality is not just a lack of money, it’s an inability to realize one’s full potential in life. Achieving gender equality requires women feeling just as socially, financially, and politically capable as men. And in few measures is disparity clearer than in the way women are vastly less prepared when they choose to stop working or retire.

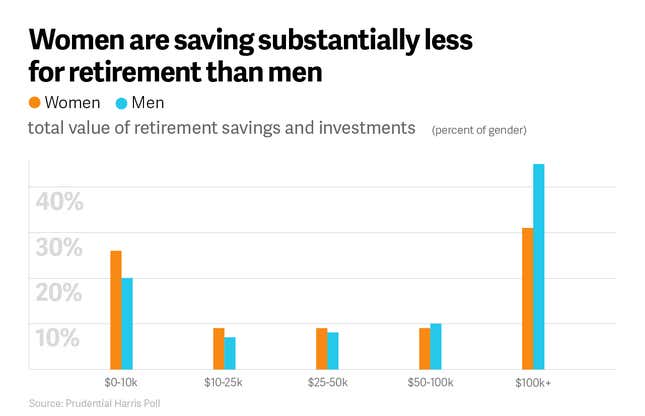

The retirement account balances of employed women are, on average, one-third lower than those of employed men. Lower retirement account balances, coupled with lower average Social Security benefits and longer life expectancies, mean that women are likely to have much lower income to sustain them throughout retirement than men. Asked whether they felt confident that they were saving enough for retirement, 54% of polled women said “no” — a full 14% higher than men (40%).

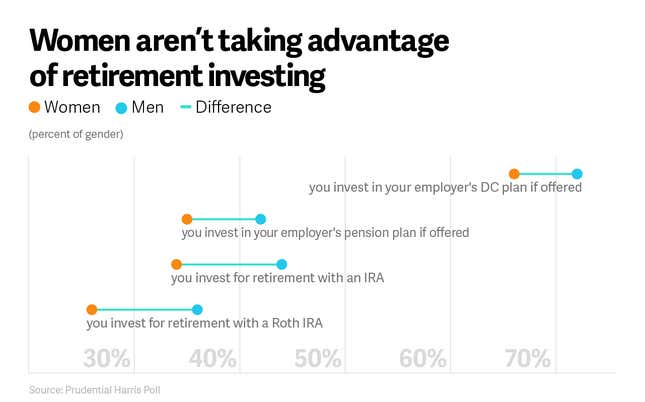

Why? Clearly, if women are earning less, their ability to save and invest for retirement is hindered. But also, according to Prudential’s new research with the Harris Poll, which surveyed several thousand Americans on financial wellness, even when women have access to the same retirement savings opportunities as men (like IRAs or 401(k) matching), they’re substantially less likely to use them.

This lack of investing, despite access, can be explained by a few factors, including women being expected to spend more than men. On average, women contribute a greater portion of their earnings toward things like childcare, groceries, and emergency funds. Additional sources of financial stress not only sap savings, but also foster risk-aversion, leading women to prefer holding cash or lower-yielding bonds than active equity investments. The average woman invests only 46% in equities as opposed to 56% for the average man.

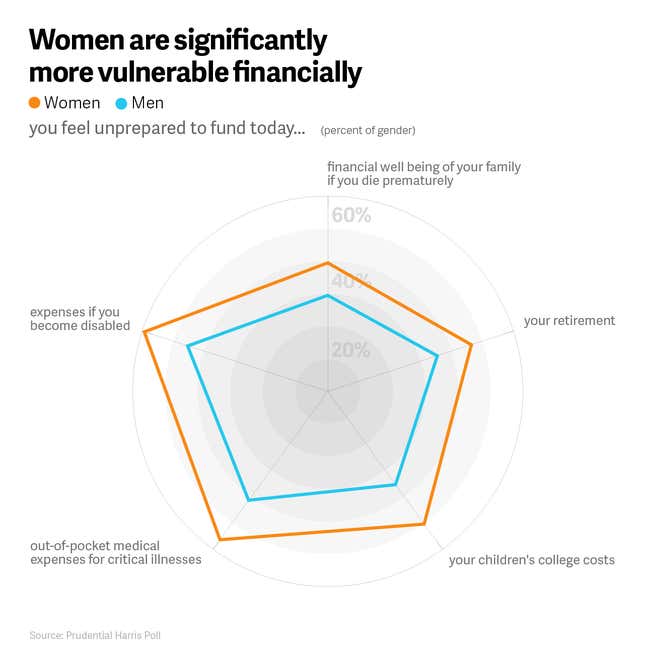

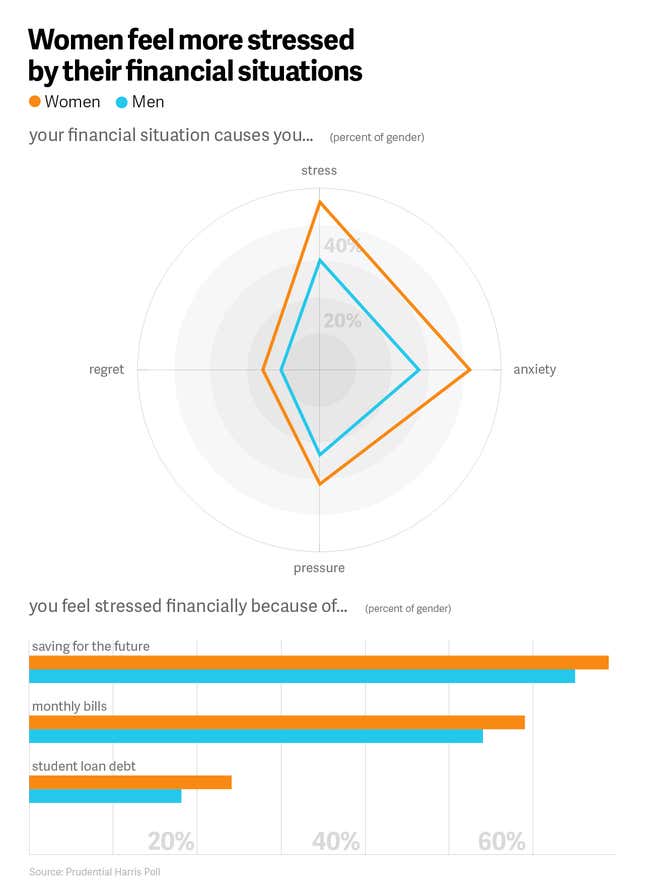

In addition, while parenting duties have always disproportionately affected women’s time, women also comprise two-thirds of the 26 million Americans caring for an aging or disabled family member, relative, or friend. In fact, women are more likely to pause or stop their careers to be caretakers. As a result, they get paid for fewer years and receive fewer salary increases—even when they ask for raises at the same rate as men. So even with the same starting salary, a young woman needs to save 18 percent of her salary (compared to a young man’s 10 percent) to merely match the man’s retirement savings. The combination of earning less and being expected to spend more is perhaps why women feel enormously disempowered and overstressed financially.

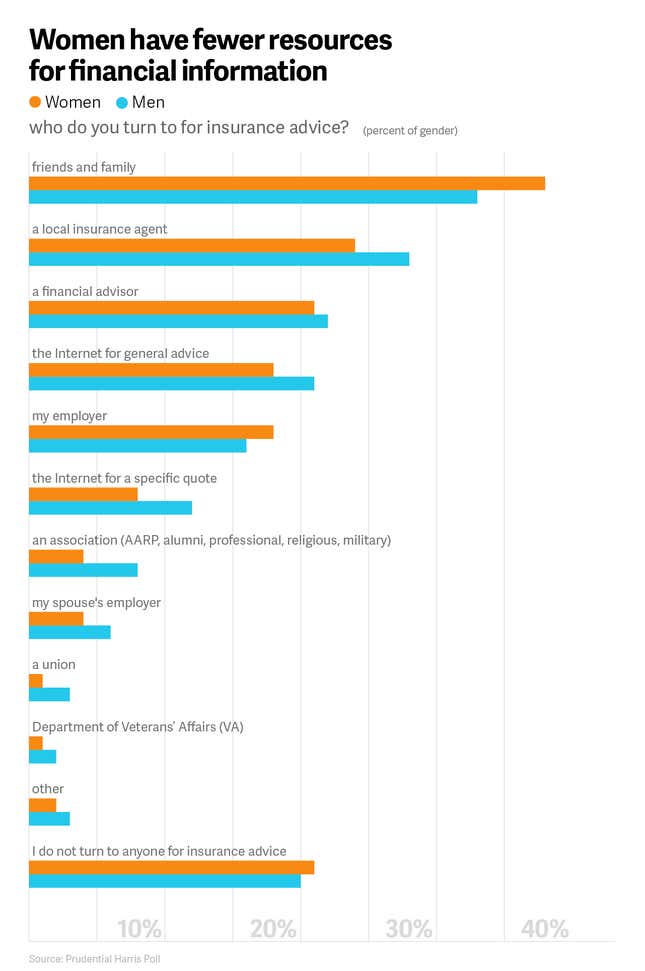

Stress, along with competing demands on women’s time, distracts them from better managing their day to day finances, protecting themselves against the unexpected and achieving long-term financial goals. Just 33% of women have a clear set of retirement goals, compared to 45% of men. Plus, women aren’t getting financial advice from the same sources as men, tending to rely more on advice from friends and family, and are in general provided less financial education than men. A majority of American women―about 75%―say investing is confusing. Less than 20% of women surveyed said they felt “very prepared” to make wise financial decisions.

Employers can help close the financial wellness gap. The exact prescriptions are well-known: By providing women access to affordable child care, paid parental leave, flexible work arrangements, and dedicated financial education and planning resources. It’s increasingly common for workplaces to automatically enroll employees in more stock-heavy retirement plans. This is a helpful step forward in getting women to build savings through high-yield assets. A successful financial wellness program also includes financial education and guidance so that all employees, and women in particular, can understand what financial resiliency entails.

These gender-dedicated resources cannot erase the deeply entrenched social norms and biases that have long been defined by and for men. There’s a whole host of data showing that gender bias runs rampant across all industries, making it difficult for women to achieve the same career or financial success as men. But financial resources provide relief and economic strength to women, which improves gender equality overall.

A successful plan to achieve pay or retirement parity will require creating an inclusive, empowering work environment for women. But financial wellness is critical, for financial wellness empowers women, and empowered women empower us all.

This article was produced on behalf of Prudential by Quartz Creative and not by the Quartz editorial staff.

0310263-00001-00