Most of the time, employers value creativity. But sometimes imaginative thinking is not just unwelcome but also illegal. Then we call it fraud.

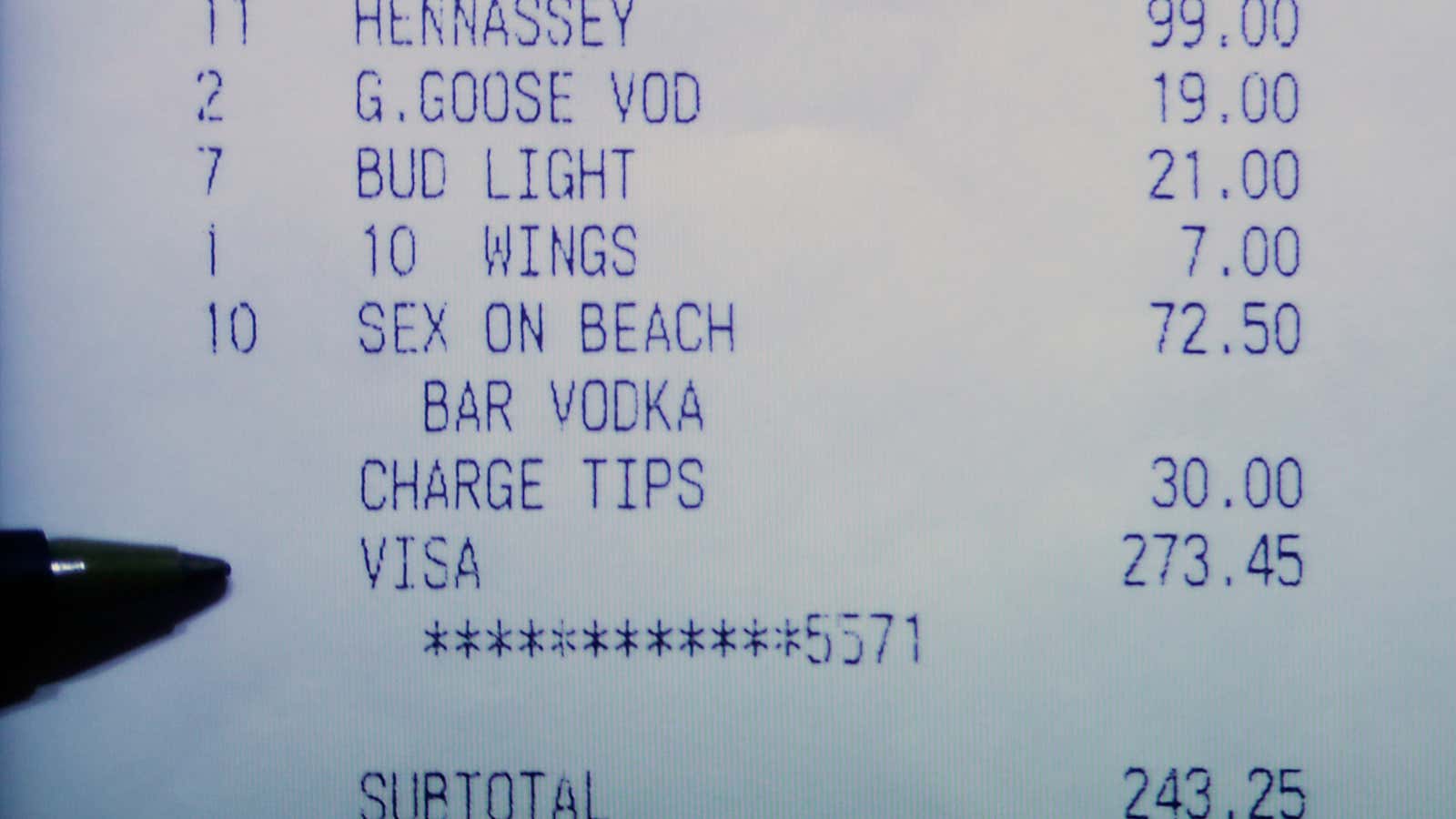

More than a dozen employees at Wells Fargo learned this the hard way in recent months, as they were caught altering the timestamps (paywall) on after-hours meal receipts. Those involved included analysts and managing directors, who ordered food during normal office hours and charged it to the bank, even though Wells Fargo only reimburses employees for meals eaten when they have to stay late at the office. For their ingenuity, the culprits have been either suspended or fired.

Worldwide, the median annual impact of expense reimbursement scandals on an individual business is around $31,000, according to the Association of Certified Fraud Examiners, and US companies tend to be hit with such scandals more than other countries. Reimbursing employee expenses also makes a surprisingly large dent in big firms’ bottom line, so much so that Wells Fargo aims to save billions by the end of 2019 just by cutting the number of things it pays out for.

Bankers are far from the only ones to write expense reports like the Brothers Grimm did fairy tales. In 2009, a sweeping parliamentary expenses scandal in the UK ended with six ministers and the speaker of the House of Commons resigning. Former prime minister Gordon Brown was alleged to have claimed for the same plumbing bill twice and to have paid his brother more than £6,000 ($7,800) for cleaning services.

In the US, Veteran Affairs secretary David Shulkin was found to have expensed $4,312 worth of travel costs for his wife, which his chief of staff tried to cover up. Meanwhile, Jim Harrick coached UCLA to a national basketball championship, only to be dismissed the following year for falsifying receipts (paywall).

Despite the risks, expense fraud is still one of the easier ways to steal from your employer, notes Stonebridge Partners, because most companies assume their employees are honest and trustworthy. At Wells Fargo, that assumption is particularly ironic.