Adapted from Better, Simpler Strategy: A Value-Based Guide to Exceptional Performance.

Table of contents

- A simple approach to strategy

- Creating a “value map” for your company

- The ethics of value creation vs. value capture

The hundreds of executives I have taught at Harvard Business School are usually already familiar with popular strategy frameworks when they arrive, and their firms have often implemented laborious planning processes to guide investment decisions and managerial attention. Yet in many instances it is difficult, even for these accomplished professionals, to recognize how specific projects are linked to their firm’s strategy. At best, strategy provides them smart arguments for and against business propositions, but it offers little guidance on how to choose and where to focus. As a result, initiatives and activities proliferate. When no one knows when to say no, most ideas (brought forward by talented and ambitious employees) seem like good ideas. And when most ideas seem like good ideas, we end up in the hyperactivity that pervades the business world today.

It’s time to get back to the basics of strategy.

A simple approach to strategy

In my experience, value-based strategy, the approach I describe in my book Better, Simpler Strategy, is well suited to cutting through complexities and evaluating strategic initiatives.

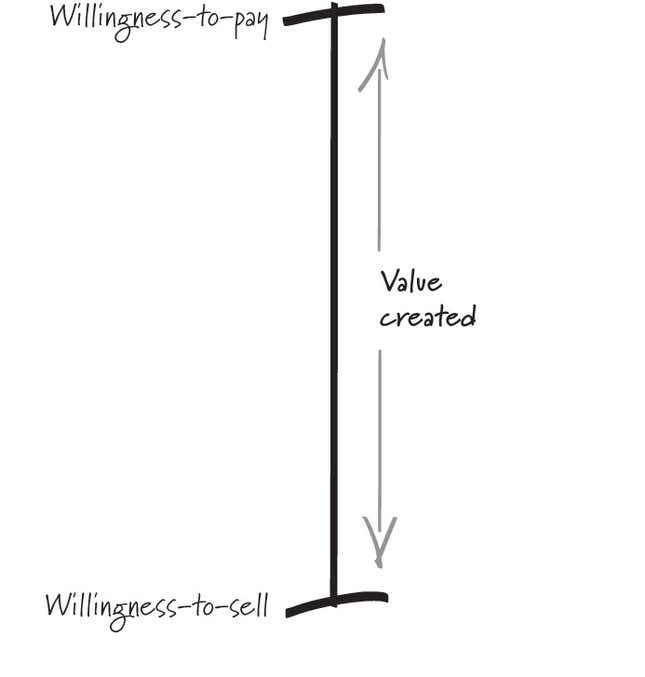

The basic intuition underlying value-based strategy could not be simpler: companies that achieve enduring financial success create substantial value for their customers, their employees, or their suppliers. The idea is best captured in a simple graph, which I call a value stick.

Willingness-to-pay (WTP) sits at the top end of the value stick. It represents the customer’s point of view. More specifically, it is the most a customer would ever pay for a product or service. If companies find ways to improve their product, WTP will increase.

Willingness-to-sell (WTS), at the bottom end of the value stick, refers to employees and suppliers. For employees, WTS is the minimum compensation they require to accept a job offer. If companies make work more attractive, WTS declines. If a job is particularly dangerous, WTS increases and workers require more compensation. In the case of suppliers, WTS is the lowest price at which they are willing to sell products and services. If companies make it easier for their suppliers to produce and ship products, supplier WTS will fall.

The difference between WTP and WTS, the length of the stick, is the value that a firm creates. Research shows that extraordinary financial performance (returns in excess of a firm’s cost of capital) is rooted in greater value creation. And there are only two ways to create additional value: increase WTP, or lower WTS. Strategy is conceptually simple, and simpler strategic thinking, I am convinced, will lead to better outcomes.

Creating a “value map” for your company

Strategy may be conceptually simple, but isn’t it still hard in practice? Sure, but one exercise stands out in my experience as the single best starting point for many companies. In executive education courses at Harvard Business School, we conduct what we call a value map exercise. We must have run this exercise with hundreds of companies. It leaves a deep impression every time.

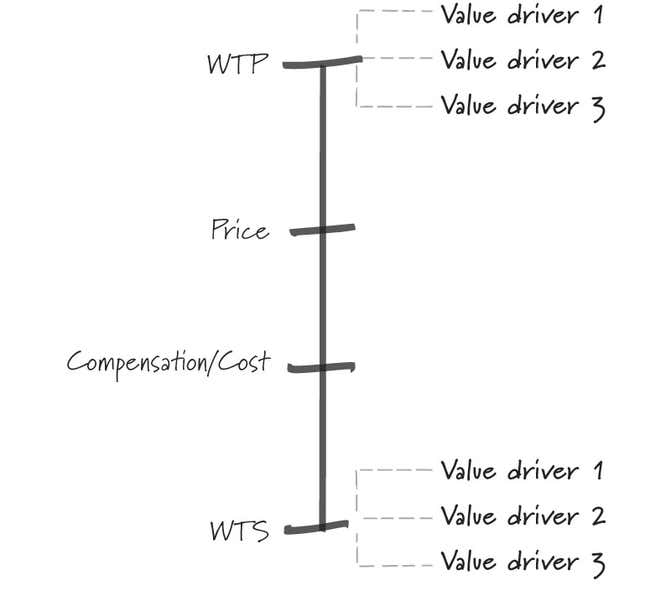

You begin to build a value map by selecting a group of customers—or a group of employees if you create a map for talent. Next, you compile a list of criteria that are important to these customers when they make a purchase. These criteria are called value drivers. Think of them as the product and service attributes that determine WTP (or WTS).

You then rank the value drivers from most important to least important. For example, your customers might value speed of service above all else. In this case, “speed” is value driver number one. If your customers do not care much about the price of your service, “price” goes toward the bottom of the list. Keep in mind that this is the customer’s perspective, not yours. In a final step, indicate for each value driver how good your company is at meeting this customer demand. For instance, “speed” could be important for your customers, but your company might be mediocre at providing fast service.

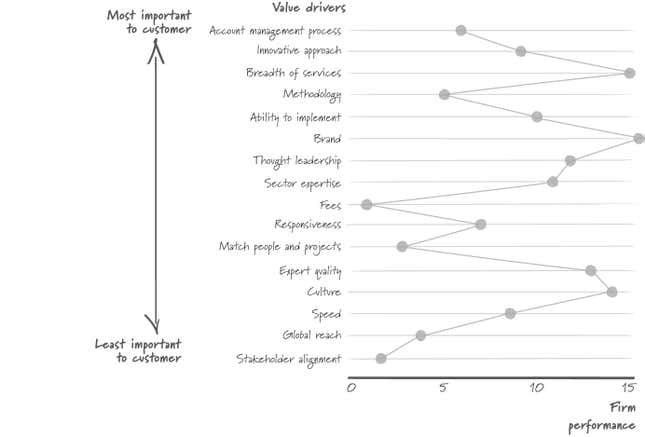

Value maps allow you to see, at a glance, your competitive standing and strategic opportunities. The chart below shows an example of a global consulting company, one of the so-called Big Four firms. This value map is based on interviews conducted by Source Global Research, a firm based in London. To establish the list of value drivers and rank them, Source speaks annually with over 3,000 executives about their recent experience with consulting engagements.

As you can see, the firm’s clients care most about how well their account is managed and the firm’s innovation capabilities. These are the top two value drivers. Global reach and stakeholder management are less critical. The chart also shows that the firm’s value proposition is not particularly well aligned with the clients’ WTP. The firm underperforms on some important service attributes (e.g., innovation), and it exceeds expectations in areas of little importance to clients (e.g., culture).

Many value maps resemble the one shown here. If the value drivers are appropriately ordered from most important to least important, an ideal value curve—the line that connects the levels of performance for each value driver—would tend to slant from top right to bottom left. Firms exceed expectations where it counts, and they sustain excellence by diverting resources from lower-ranked value drivers. Why not be excellent on all dimensions? Trade-offs. The slanted value curve reflects the trade-offs that are necessary to deliver stellar services.

The ethics of value creation vs. value capture

Another benefit of value-based strategy is that it helps clarify the role of business in society by providing a sharp definition of value and a precise means by which we can determine how value gets shared.

The framework makes clear that businesses create substantial value for customers, employees, and suppliers even if their only goal is to maximize financial returns. My book is full of stories of companies—like Best Buy, Apple, Michelin, Quest, Intel, Tommy Hilfiger, and many more—testifying to the ability of business to create significant customer delight, employee satisfaction, and supplier surplus. The first test of a company’s impact on society is the value that it creates by this measure. Competition is our best assurance that companies continue to innovate in service to these stakeholders.

What about the distinction between shareholder-focused and stakeholder-focused companies? Using value-based strategy it is possible to draw up a list of decisions and actions that corporate boards and CEOs would take if they genuinely valued the well-being of all stakeholders.

Stakeholder-focused corporations will take no credit for increasing customer willingness-to-pay—creating value for customers is the essence of business. Raising willingness-to-pay (WTP) is simply good management. Even companies that are solely focused on creating shareholder value will seek opportunities to lift WTP. I know this is a stringent expectation. For a stakeholder-focused company, customer delight has intrinsic value. As a result, the company will make investments in WTP that a shareholder-focused firm would forgo. But because many of these investments still contribute to the profitability of the stakeholder-focused company, in practice it will be challenging to distinguish between (a) increases in WTP that are motivated solely by financial returns and (b) increases in WTP that reflect a mix of shareholder and customer concerns. I like to set the expectation this high because it discourages companies from claiming too much credit for their actions.

Stakeholder-focused corporations will take no credit for lowering the willingness-to-sell of employees and suppliers—the same argument holds at the lower end of the value stick. Creating value for employees and suppliers is how companies contribute to the well-being of their workers and the profitability of their suppliers. But most of these actions are entirely consistent with an exclusive focus on financial returns.

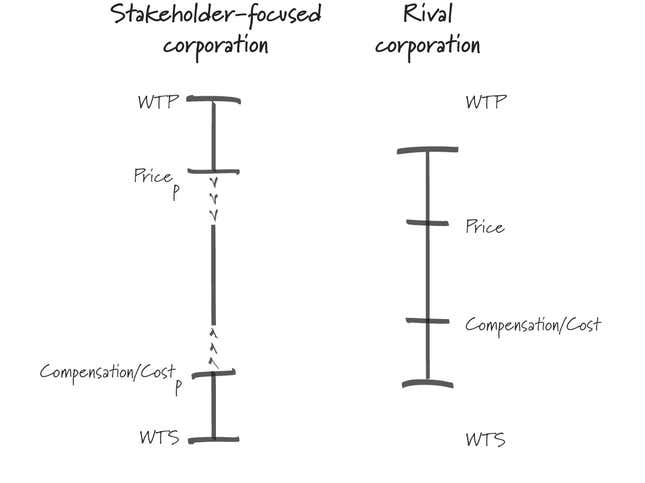

Stakeholder-focused corporations will share the value they create more generously than competitive concerns would lead us to expect—profit-oriented companies will maximize the returns to shareholders, the owners of the company. Corporations that balance the interests of multiple stakeholders are more generous with customers, employees, and suppliers. The figure below illustrates the difference. To attract customers, employees, and suppliers, the stakeholder-focused organization needs to offer at least as much value (customer delight, employee satisfaction, and supplier surplus) as its profit-maximizing rival.

At Price-p and Cost-p, the stakeholder-focused company is not yet living up to its name. It provides the competitively required value to customers and employees; any extra value that it creates flows to shareholders. In other words, the company maximizes profits. If boards and CEOs are serious about balancing the interests of all stakeholders in a novel way, they would be more generous toward customers (by charging lower prices), employees (by offering more generous compensation), and suppliers (by paying more for intermediate products and services).

Stakeholder-focused corporations will take account of the true cost of economic activity, and they will support policies that adjust prices where this is necessary—value sticks misstate the value that companies create if prices do not reflect the true cost of resources. The most important example today is global warming. Because the price of carbon does not mirror the cost of releasing greenhouse gases, we burn too much fossil fuel, causing serious harm to life on the planet. Stakeholder-focused organizations will attempt to correct for the mispricing themselves—they will purchase carbon offsets for flights, for example—and will support public policies that correct prices. Unlike companies with a sole focus on shareholder returns, many of which fight carbon pricing today, stakeholder-focused companies will not lobby against well-designed carbon taxes.

Stakeholder-focused corporations will not use political influence to soften competition—competition forces companies to share value with customers and employees. Lobbying for trade protection and other measures that increase barriers to entry is inconsistent with delivering value to all stakeholders. Limiting competition enhances financial returns to shareholders (and possibly employees) at the expense of customers.

Shareholder capitalism is at its shakiest if prices fail to reflect the true cost of economic activity. Companies that exert political influence to keep prices distorted and limit competition do wonders to weaken the case for any form of capitalism, shareholder or stakeholder. To make matters worse, income and wealth inequality increase the ability (and the temptation) of corporate leaders to undermine, through political means, a fair-minded distribution of value. The consequences are not difficult to spot. In developed economies, 50% of the population now agrees that “capitalism, as it exists today, does more harm than good in the world.”

At a policy level, this means corporate leaders need to pay close attention to benchmarks number four and number five. Undermining markets will surely leave us poorer—and more divided!

The most important work, however, takes place in companies. No matter where you sit in your organization, whether you work alone, in a team, or lead a large corporation, can I ask you to never tire of seeking new ways to increase WTP and to lower WTS? Can I convince you that your role is both vital and noble? What better way to lead a life than being preoccupied with creating value for others, to touch their lives in ways both big and small? The key to progress is a relentless focus on value creation, not value capture.

Reprinted by permission of Harvard Business Review Press. Adapted from BETTER, SIMPLER STRATEGY: A Value-Based Guide to Exceptional Performance by Felix Oberholzer-Gee. Copyright 2021 Harvard Business School Publishing Corporation. All rights reserved.