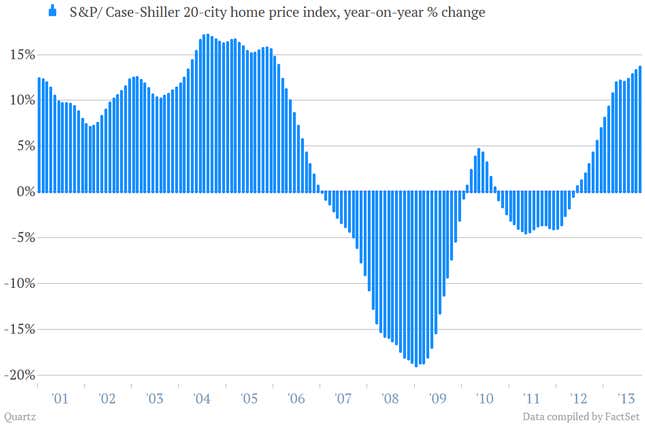

The last US housing data point of the year came on strong. The Case-Shiller 20-city home price index was up 13.6% in October—the latest data available. That’s the largest year-over-year price increase in seven years. Here’s a look at the data all the way back to 2001.

This shouldn’t be a big surprise to any regular reader of Quartz. For one thing, Case-Shiller data lags a number of other peppy US housing indicators that have already been released.

But over the course of the year we’ve discussed the importance of American housing rebound story again, and again and again.

Just as housing was at the epicenter of the economic and banking bust that set off the Great Recession, it’s been crucial to helping the US regain its economic momentum.

Rising home prices have pulled the value of many homes back above the amount homeowners owe on them. That means that homeowners can refinance their mortgages to take advantage of the Federal Reserve’s still-remarkably-low interest rates. That, in turn, cuts the amount of pay homeowners spend on housing each month, freeing up cash for other consumption.

The housing bust also sapped efficiency out of the job market, making it harder for workers to change jobs. (If housing equity falls, it makes it harder to afford a new house after moving. As a result, migration declines.) So rebounding house prices grease the wheels of the US labor market.

Rebounding home prices have also bolstered the net worth of American families, at least the ones who own houses. And when people feel wealthier they are more likely to spend elsewhere. In the US, where consumer spending accounts for about two-thirds of gross domestic product, that’s a very big deal.