With the new strictures related to the Dodd-Frank financial regulation reforms, US banks are having a tough time ringing up the sorts of profits to which they have been accustomed. That’s particularly true in trading. As a result, the Wall Street Journal reports (paywall), banks are considering another round of layoffs to compensate for the lackluster results.

Trimming headcount is one of banking’s easiest levers to pull when facing the prospect of lean times. Firms such as Goldman Sachs, where fixed income, currencies, and commodities (FICC) trading units make up some 30% of overall revenues, may look to reduce headcount even after already slimming down in those areas in prior years, the WSJ reports.

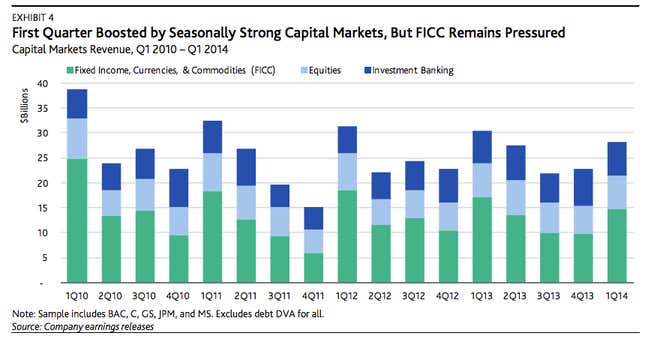

A chart from the rating agency Moody’s Investors Service illustrates the decline in first-quarter profits at some of the biggest banks: Bank of America, Goldman Sachs, Morgan Stanley, Citigroup and JPMorgan Chase.

Cutting staff can be a risky move. Wall Street chiefs are wary of getting caught flat-footed if a lagging market suddenly has a rip-roaring few years. That’s why banks are generally reluctant to trim staff on a whim.

But trading action is trending decidedly weaker (fueled by low volumes and low volatility). And it’s important to note that the first quarter typically represents the strongest performance in trading, in which investors typically make their bets for the year.

As the outlook has continued to look grim, it’s no wonder banks are considering layoffs. In fact, Morgan Stanley already is said to be reducing staff at a bond-trading unit in Canada–a unit that had been overseen by former rainmaker Glenn Hadden, who left the firm earlier this year.