Massive data leaks on tax dodging, including the Swiss leaks and the Panama papers, have put an uncomfortable spotlight on the global elite’s role in promulgating global inequality, from celebrities to entrepreneurs to politicians (the backlash even brought down Iceland’s prime minister). But how much blame should be placed on the people who mastermind their convoluted tax avoidance schemes?

Quite a lot, according to Brooke Harrington, author of Capital Without Borders, a deep dive into the workings of wealth managers and their intimate relationships with ultra-wealthy clients. In researching the book, Harrington traveled to 18 countries, interviewed 65 wealth managers, and even trained as one herself to better understand how tax avoidance works. In an interview last week with the Nation, she said although tax evasion would exist even without wealth managers, they have massively accelerated the trend. Tax dodging couldn’t happen “on the grand scale that we are seeing today without expert intervention,” she said.

These money movers have created a stateless upper class whose wealth eludes borders, she explained. “There’s a certain group of well-to-do people who don’t want to be subject to the laws that bind the rest of us,” she said. “With the help of wealth managers, they put themselves above the nation-state system by changing passports at will, having multiple residences, and bouncing around strategically to ensure that no national laws apply to them.”

The wealth management industry breeds a sense of privilege. The culture of its trainings is intensely clannish, and predicated on the idea that the goal is to help families. Around 25% of the wealth managers she interviewed endorsed what she describes as “libertarian anarchy,” which argues that all taxation is theft. This notion is even embedded in training materials for wealth managers, which Harrington said explain that “taxation is doubly immoral because it will be redistributed to the poor who then won’t learn initiative and will be deprived of the opportunity to bootstrap themselves up.”

The expertise wealth managers employ is far more sophisticated than just stashing money in bank accounts in the Cayman Islands or Switzerland. There is a “whole global ecosystem that is orchestrated by wealth managers who often write the laws in these places,” she said. As global tax evasion has dramatically ramped up in recent years, so too has the neglect of public education, infrastructure, and welfare, thanks to low tax bases. Harrington cites the example of Omaha, Nebraska, which recently stopped paving its streets because its tax revenue is too low to fix potholes.

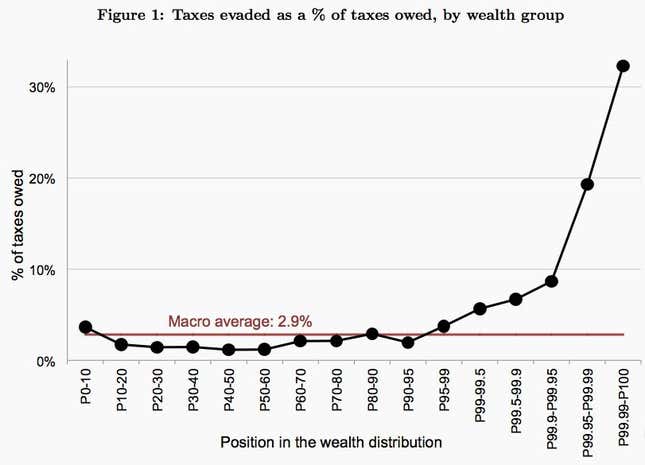

In a recent study, economists analyzed data from the Swiss leaks and the Panama papers and combined them with income and wealth records in Norway, Sweden, and Denmark. They found that the top 0.01% of the wealthy in these countries evade about 30% of their respective personal income and taxes. That’s compared with the average evasion rate of 3%.

While some critics have warned that significant tax cuts for the wealthy, such as those proposed by US president Donald Trump, will only exacerbate the problem of wealth equality, Harrington urges policy makers to focus on the experts doing the dirty work. For the industry to truly change, she calls for “more John Does, like the person who leaked the Panama Papers information from the Mossack Fonseca law firm in Panama. We want to welcome more turncoats and whistle-blowers.”