A spate of massive leaks showing the inner-workings of global tax evasion has given the public a window into how the super-wealthy—including celebrities, politicians, and criminals—leverage the globalization of finance to hide their wealth from the authorities.

But the leaks, which encompass just one Panamanian law firm, Mossak Fonseca, and one Swiss bank, HSBC Switzerland, offer only a small peek at these illicit flows. Can we use this data to make a general observation about the prevalence of tax avoidance?

Economists Annette Alstadsæter, Niels Johannesen, and Gabriel Zucman have taken the data (pdf) from the two leaks and combined them with unusually detailed income and wealth records in Norway, Sweden, and Denmark to estimate the size and scope of tax evasion. Adding these additional sources to the mix has allowed the researchers to make up for the consistent problems of random national audits. These audits fail to effectively measure the behavior of the super rich, who are a tiny share of the populace despite owning a disproportionate share of the wealth.

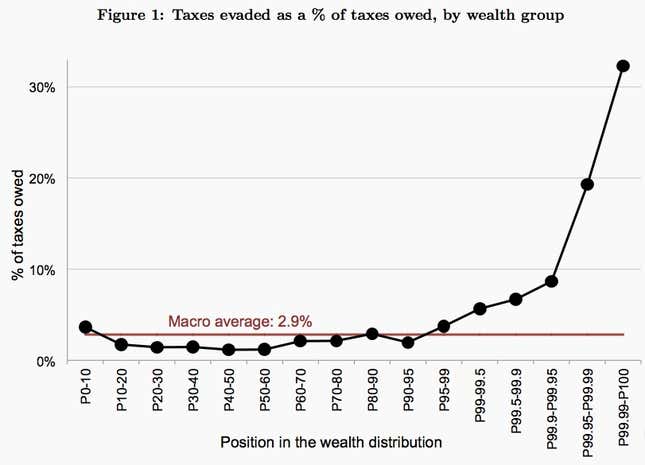

The economists’ surprising finding: The top .01% of the wealthy in these countries (those with more than $40 million in net wealth) evades about 30% of their respective personal income and taxes, compared to the average evasion rate of 3%.

These findings complicate two arguments commonly made by defenders of the status quo: One, that tax evasion is a relatively uncommon practice among the very wealthy highlighted by extreme cases, and two, that tax evasion among lower-income earners—working under the table or failing to declare tips, for example—is more pernicious than the use of offshore banks.

This also has implications for attempts to measure inequality, which often rely on tax data that under-measure inequality because hidden funds are not taken into account. Zucman has argued in previous work that as much as 10% of the world’s wealth is held in tax havens and reinvested elsewhere.

The idea that the super wealthy are the most likely to participate in the black market of tax evasion makes a good deal of sense, of course, given the incentives at hand: They have the most to lose, and organizations like Swiss banks and rule-bending law firms have an incentive to work with as few clients as possible in an effort to avoid discovery, suggesting they will prioritize attracting the wealthiest potential customers.

This doesn’t mean that cracking down on evasion is a fool’s errand, however. One interesting note in the study is that wealthy evaders who participated in a Norwegian tax amnesty since 2006 continued to pay higher taxes over the following years rather than emigrate or use legal restructuring to conceal income.

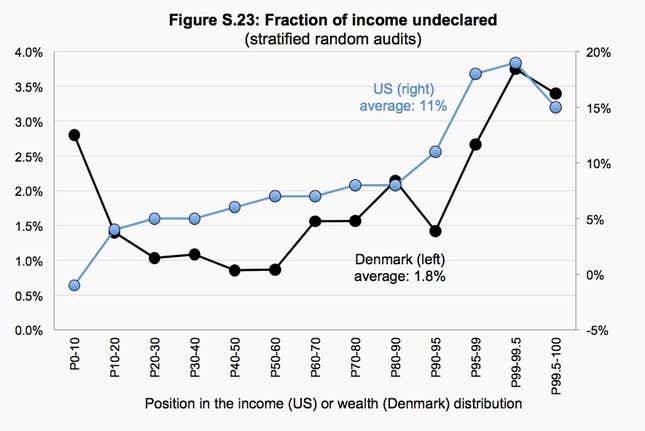

Of course, these Scandinavian countries, despite their wealth and advanced economies, are still fairly small players in the global economy. But the researchers think that the results will likely show more tax evasion among the ultra-wealthy in more unequal countries, like the United States. One signal that the results will be at least comparable is that tax audits in the US and Denmark show Americans declaring less income in general, suggesting that the addition of the leaked data will reveal an even larger gap between the US super wealthy and their Scandinavian counterparts.

Perhaps most saliently to the US political debate, these findings come as Donald Trump’s White House prepares a major tax cut targeted at the wealthy, even as the administration proposes cutting dramatically cutting domestic public spending to make up the difference (kind of). If the ultra-rich are already dodging taxes at a legendary pace—and even the billionaire US president himself has yet to release his tax returns to the public—is this the time to give the super rich an even bigger break?