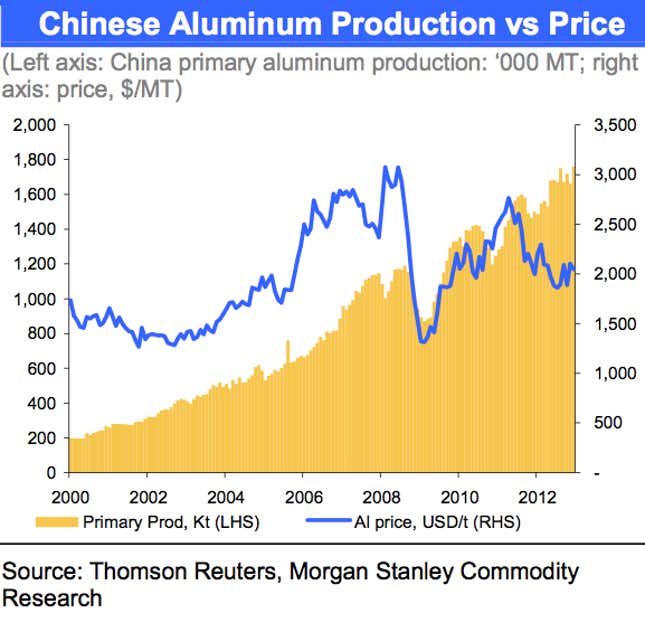

Ahead of Alcoa’s after-the-close earnings report today, we found these Morgan Stanley charts illuminating. They explain the big problem Alcoa, and all other aluminum companies, are facing at the moment: Supply. China’s burgeoning aluminum industry continues to churn out the stuff at a near record pace, even as prices slump significantly.

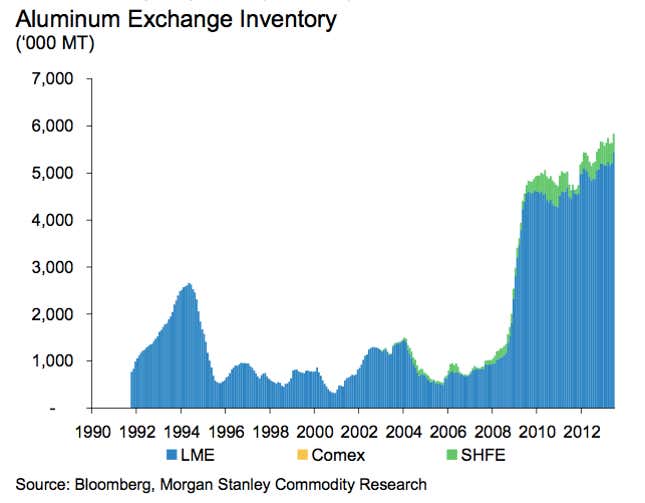

And the stuff just keeps piling up.

Why would any business continue to churn out its products at a pace so clearly outstripping demand? Well, this is China, where understanding politics and patronage is just as important to economic activity as supply and demand. As Quartz has reported before, China has made a decades-long push to boost aluminum production, which provides jobs for both coal miners and smelters.

Meanwhile global producers such as Alcoa and Rio Tinto’s Alcan are forced to deal with the declining prices that are the natural outgrowth of excess supply. That’s why all ears will be on Alcoa’s discussion of plans to curtail production when the company reports earnings after the close.