With the fracas in Washington over how to stop student loan interest rates from spiking, there’s more attention than ever on the student loan “bubble.” To pinpoint apt solutions, it’s worth considering the college loan issue as a version of two already irksome public policy problems: the debt dynamics of the mortgage bubble and the third-party-payer problem of the health care system.

Echoes of the financial crisis

“The analogies between what we’re doing in higher ed finance and what was going on in mortgage financing are really quite eerie,” says Barmak Nassirian, an education finance expert at the American Association of State Colleges and Universities.

Colleges, for instance, are investing in Sallie Mae, which makes loans to students and sells them as student-loan backed securities. In doing so, they profit from high interest rates on loans given to students who pay their high tuition—and they’re the ones setting the tuition. It’s roughly analogous to banks profiting from mortgage-backed securities while the risk is carried by the investors who bought them and the borrowers who handle the debt.

And, just as ratings agencies and assessors let standards slide for mortgage loans, Nassirian says the accreditation agencies that govern college standards are allowing just about any institution or business to become eligible to sponsor student loans for attendees, driving the business of for-profit colleges with high student loan default rates.

Pay attention to who’s paying

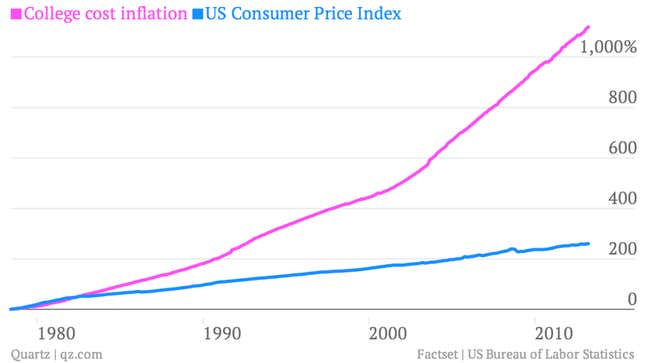

There are many reasons why student loans have ballooned, but a major cause is massive increases in tuition cost, despite the fact that the advantages of a college degree have stagnated in recent decades. Just as with the health care system, another notable area of cost inflation, a big issue is the separation between the people paying for the service and the people consuming it.

Controlling costs requires that borrowers understand what they’re paying for, but measuring the benefits of a college education is hard—especially if you’re 18 years old and some combination of your parents, your government and your school are paying for it. Students saddled with loans also don’t know when they sign on the dotted line if they’re getting a good deal. And it’s easy to say yes when you’re 18 and won’t have to start paying back until after you graduate.

As a result, colleges have resorted to attracting students with massive investments in amenities that go far beyond core education. And yet all the buildings, extra staff, deans and sports may not improve the quality of education.

As default rates rise, there is growing concern about whether students are getting their money’s worth; Unlike credit card debt or auto loans, it’s very hard to get rid of student loan debt, even in bankruptcy. In response, some policymakers have suggested incentivizing schools to control costs and provide better education. “As we learned from the mortgage debacle, insulate someone from all inverse consequences, the downside doesn’t touch them,” Nassirian says.

Invest in students?

The University of Oregon has proposed a way to do this: In exchange for a degree, students pay 3% of their income for 24 years. If implemented, Oregon would have an incentive to ensure that students who graduated could actually make money. Of course, there are some issues with this. Colleges might start competing over students pursuing more lucrative fields of study, and students might still have to borrow money or work to support their education.

“That way schools have enormous skin in the game, an incentive to get kids out into the earnings stream,” says Dr. Richard Vedder, who directs the Center for College Affordability and Productivity and favors having schools invest in their students futures.

Invest in student loans?

A better approach might be requiring that a certain share of each college’s endowment be invested in the market for securitized student loans. The average endowment of the 1,189 schools ranked by US News & World Report is $313 million, although that number skews higher because of the top ten schools, which include Harvard’s $32 billion trust. Colleges are non-profits, which means they get big tax breaks for their ostensibly charitable missions. But the largest ones do very little to decrease inequality or advance any other charitable goal associated with non-profit work. It makes sense, then, that they should pick up some of the cost of financing higher education.

If students failed to pay back the loans, colleges would immediately feel the bite. That would incentivize schools to develop best practices across the education system to reduce loan defaults by providing the most valuable education possible. Just as new regulations require mortgage securitizers to hang on to a percentage of their products, colleges would have a reason to start caring about deteriorating underwriting standards. One problem here is that at current interest rates, investors can still profit even as defaults rise.

Cut off the bad actors?

Another hiccup with this strategy is that it wouldn’t target the schools whose students are most likely to default on their loans: for-profit colleges that don’t have endowments but do have the highest default rates. Private, non-profit institutions, meanwhile, have the largest endowments and lowest default rates. Regulations on for-profit schools to increase their accountability already require that schools demonstrate their students’ ability to get jobs, but experts worry those results will be easy to game, since not all jobs are equally valuable. A better metric to hold colleges accountable might be the level of non-repayment on student loans, whether because of default or delayed payments. This would get right at the heart of the problem: At the very least, college should give students the skills needed to earn an income that pays off student loans.

In the long run, online courses and unbundled education costs could change the way we think about the higher education experience and lower college tuition dramatically. In the meantime, the US doesn’t need another round of indebted graduates weighing on the economy.