Five years after the financial crisis, some economists and politicians are heralding an end to the euro zone’s economic doom. Based on a handful of recently published economic indicators, they predict the region could return to positive economic growth as early as this quarter.

But it’s worth noting that even if that happens, the euro zone economy will still be worse off than it was in 2009.

Why? GDP alone (the total of consumption, investment, government spending, and net exports) is a poor indicator of economic health. Even though the region’s GDP has only fallen about 3% from its pre-crisis high, investors have recoiled from heavily indebted European economies, fearing that some European governments would not be able to make good on their obligations, which has contributed to record high unemployment levels.

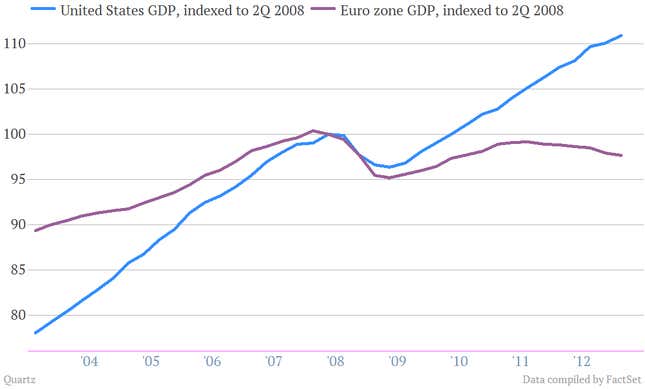

The US faces a similar, if less severe, dynamic. Its economy has rebounded in terms of GDP: Total output is now 11% higher than it was in the second quarter of 2008.

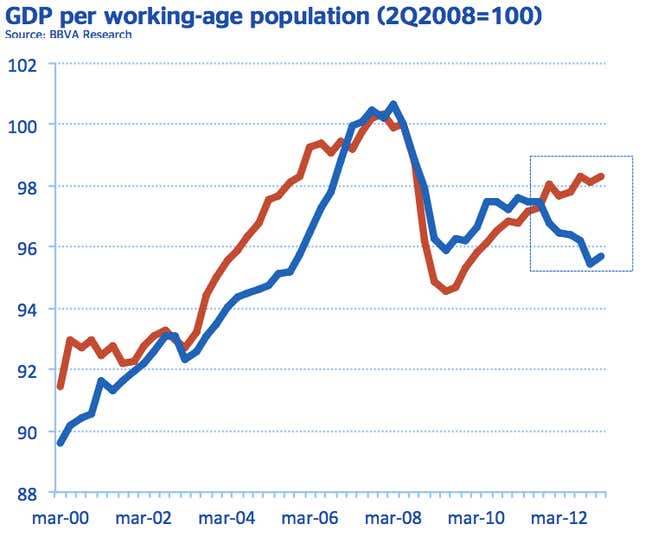

But if we divide GDP by working-age population, as BBVA analyst Rafael Doménech does in a recent presentation (pdf), each worker in the US and in the euro zone produces far less economic output—and thus enjoys a poorer quality of life—than she did before the crisis began. But whereas workers in the US have regained about two thirds of those losses, European workers are even worse off than they were in 2009, at the height of the crisis.

Growth in the euro zone may be a positive sign, but the region is far from recovered.