Declining prices of basic materials have put the world’s miners in some tough spots. Tuesday’s $8 billion charge at Glencore Xstrata was just the latest in this year’s series of large accounting write-downs—losses on paper to account for a decline in the value of an asset such as a plant or a mine—amongst companies extracting materials of all sorts from the Earth’s crust. Last year saw some $50 billion in write-downs among miners.

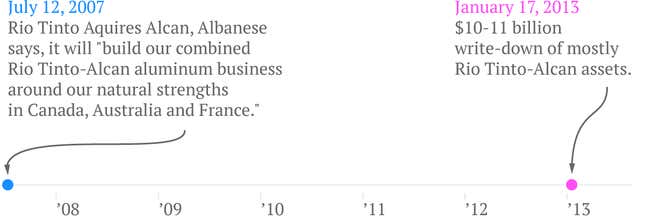

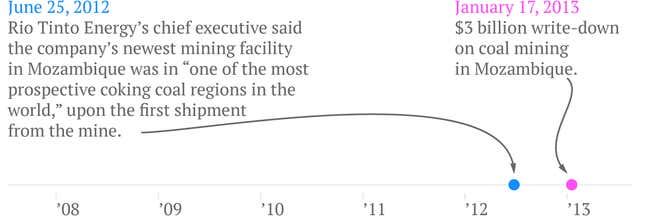

Rio Tinto

In January, Rio Tinto CEO Tom Albanese stepped down from helm of the British-Australian firm after taking a $14 billion write-down related to coal mining in Mozambique and aluminum mining at Alcan in Canada.

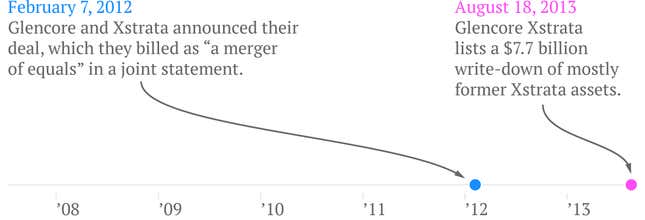

Glencore Xstrata

The Anglo-Swiss company announced a $7.7 billion write down yesterday on some of the nickel and copper assets of Xstrata, with which Glencore merged in May 2013.

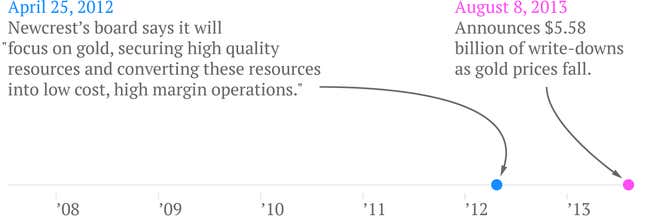

Newcrest

Dramatically falling gold prices resulted in a $5.6 billion write down for Australia’s Newcrest Mining on August 8. Newcrest has provided ever more bleak guidance over the past year as investors have driven gold prices to two-and-a-half-year lows.