Gold, the traditional white-knight investment for US investors, is anything but for those in India. Americans turned to gold to shore up their savings when the dollar weakened in the wake of the US financial crisis and recession. An Indian investor buying gold in recent months to escape the tumbling rupee would have lost a good chunk of her money, and contributed to perpetuating the currency’s fall.

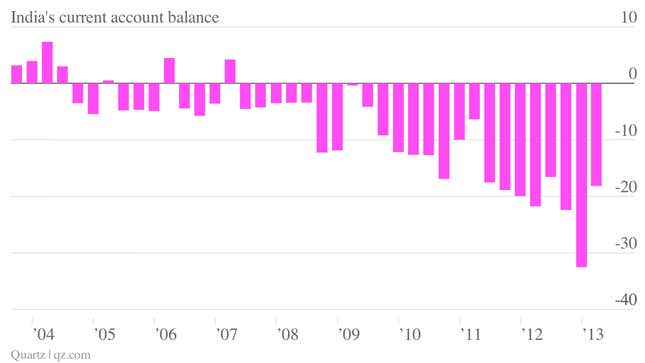

The rupee has devalued sharply after a record deficit in the current-account balance—a measure of trade and international payments. A stampede by foreign investors out of emerging markets and strong Indian domestic demand for foreign gold have both served to push the currency down.

Over the past year gold has weakened considerably against the rupee compared to Western currencies. While the dollar has risen 15.2% against the rupee over the last 12 months, gold is trading 16.4% lower. An investor who changed 10,000 rupees into dollars last August and back into rupees today would now have have 3,165 more rupees than one who had bought gold instead.

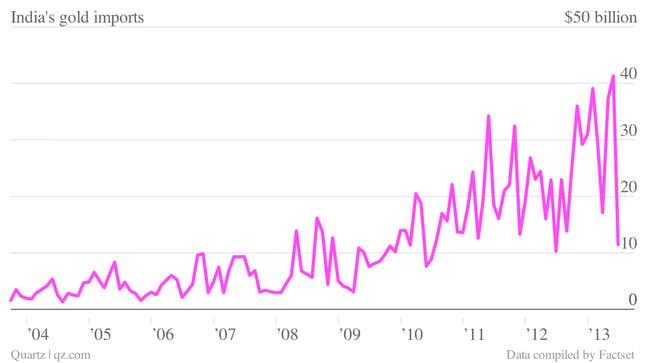

The Indian government has tried to limit gold imports and contain the balance of payments by levying a series of duties on gold and other precious metals. Last week it also reduced the limit on remittances abroad from India, to $75,000 a year from $200,000.

That seems to have had an effect. Gold imports fell by nearly three-quarters from May to June, to $11.4 billion…

And the current account deficit for June fell to $2 billion, from $10 billion in May, according to an estimate by JP Morgan Asia-Pacific. The deficit for the second quarter of 2013 was just 56% of what it had been in the first quarter:

Still, it remains to be seen whether Raghuram Rajan, who takes over the helm of India’s central bank next month, can halt the collapse of the country’s currency.