Yesterday’s pleasant surprise: The US economy grew much faster than we thought in the previous quarter: 2.5% on the year, thanks to robust exports.

Another pleasant surprise: That might continue. America’s great manufacturing renaissance continues to attract converts. Companies including Toyota, Honda, Siemens and Rolls Royce have all shifted production to the US in recent years. Boston Consulting Group, which advises companies on their supply chains, recently made an extended case that the United States is like the China of wealthy countries (awesome analogy!) because of how cheap it is to make stuff there.

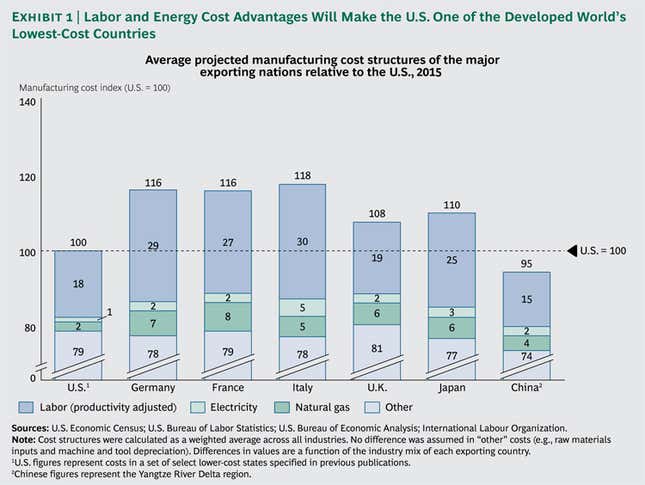

Here’s BCG’s chart. What it shows is that labor and energy costs are a lot lower in the US than in Europe and Japan, and are no higher, combined, than in China. Overall, in 2015, manufacturing in the US will cost only about 5% more than in China.

Even if you doubt the bit about China, the notion that the US will comfortably beat out Europe and Japan makes sense. It has a more flexible labor market, and cheaper energy and plastics thanks to the oil fracking boom. The US also has the transit efficiencies that come with location. It costs more than twice as much to ship a container to Rotterdam from Yokohama as from New York City. And while shipping from the US west coast to Asia is comparably priced to shipping from Europe, it’s faster—and almost as cheap as shipping from Japan to China!

The end result, according to the consultants, is that the US could capture $25 to $72 billion in exports from the four European countries and Japan, creating as many as 1.2 million factory jobs.

That’s quite a claim, considering that in the last three years of the manufacturing rebound, fewer than half a million new jobs have been created—and that hiring has slowed considerably. There are many reasons to be skeptical that manufacturing will expand greatly in the US, starting with the fact that its cheap gas is just as big a boon to factories across the border in Mexico.

But maybe the biggest problem for American manufacturing is that its greatest strength is also a weakness. The report notes that a significant reason for lower US labor costs is that it’s easier to fire people and shut down factories:

In Germany, for example, we estimate government-mandated costs of approximately $8 million to shutter an average, 200-worker plant and more than $40 million to close a 1,000-worker plant. These costs are associated with the need to comply with rules governing severance pay and the advance notice that must be given to long-term employees. However, the actual cost of shutting a German factory can be significantly higher. German law mandates that workers may remain on the job, at full pay, for anywhere from a few months to more than a year, depending on how long they have been employed by the company, while layoff terms are being negotiated and after notification of a layoff has been received. Specific union contracts, asset write-downs, requirements to retrain workers, and other factors can also add to exit costs.

When these consultants advise companies about where to open factories, they also take into account what happens if the factories need to be closed. That may make the US an attractive spot for multinationals, but economies that live by cheap labor costs can die by them, too.