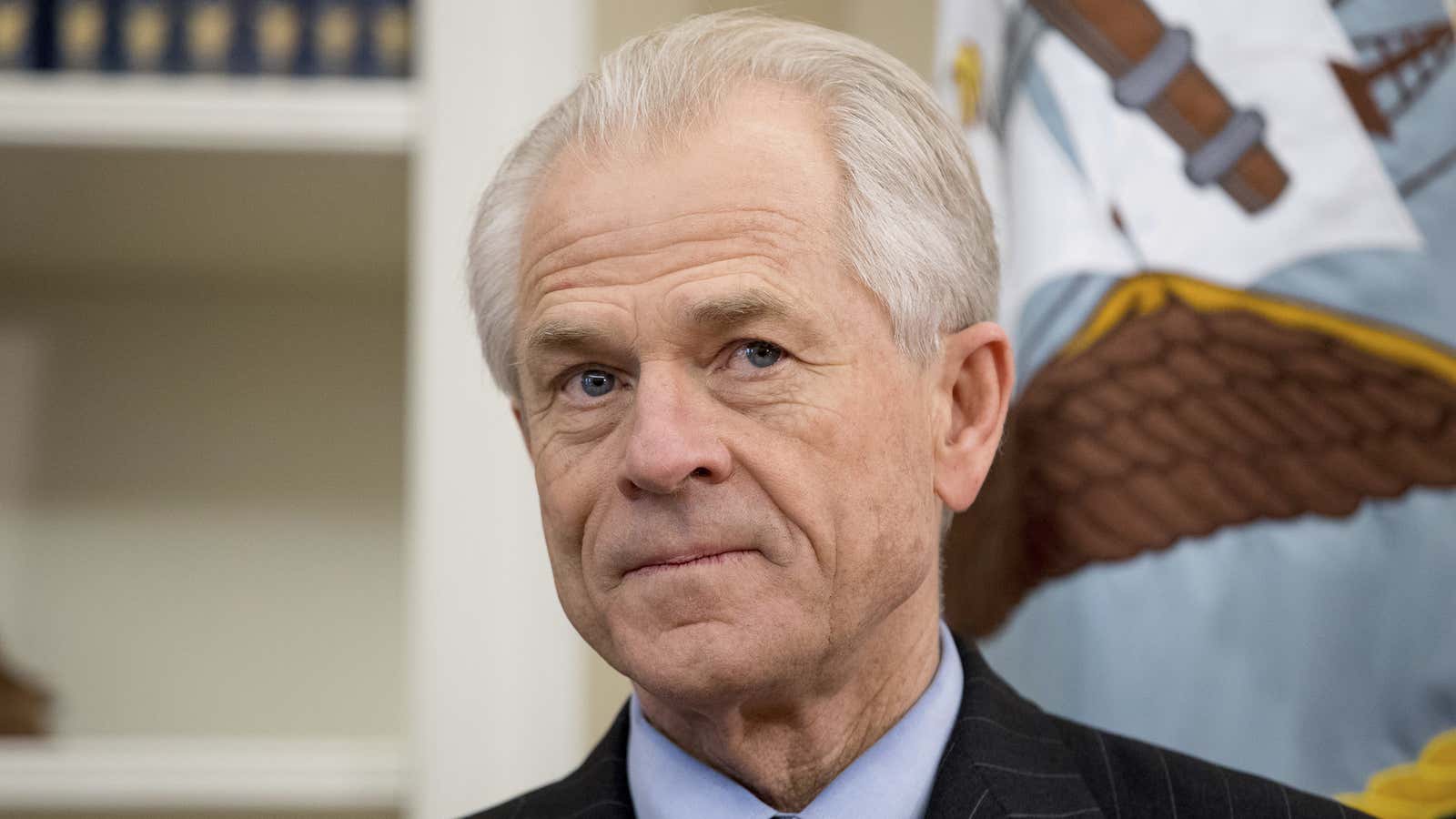

Peter Navarro came to the White House though an unusual path—then-candidate Donald Trump reportedly explained his views on China to son-in-law Jared Kushner, and asked Kushner to do some research. Navarro’s book Death by China came up on an Amazon search. Kushner ended up cold-calling Navarro and asked him to join the team, Vanity Fair reported last year.

With the departure of economic advisor Gary Cohn, Navarro is now one of the strongest voices on trade in the Trump White House. He has long been a fierce advocate for steel and aluminum tariffs, which the White House is expected to formally announce at the end of this week.

Trump’s trade statements have often singled out China for unfair practices. Although hired for his China expertise, Navarro is seen by many China specialists as a protectionist extremist stuck in the 1980s, and more of an expert on California public utilities than on China. Navarro does not speak Chinese, and has spent little time in the country.

In May of 2017, Navarro was named the head of Trump’s new “Office of Trade Manufacturing policy,” which the White House said then sends “an important signal to the world that the United States will no longer tolerate trade cheating while our manufacturing and defense-industrial base suffers.” Last September, that office was moved into the National Economic Council. Calls to the office were not returned.

In the weeks and months to come, Navarro is likely to have a hand in crafting Trump’s international economic policies, together with commerce secretary Wilbur Ross. But his extremism, coupled with the precarious political state in Beijing, where Xi Jinping has just positioned himself as a likely leader-for-life, threatens new tensions between the world’s two biggest economies.

Navarro has held one public press briefing in the White House since Trump was elected, in July of 2017. His televised interviews are rare and sometimes reference campaign trail slogans more often than hard facts. But the books he’s authored and an economic white paper he wrote with Ross for the presidential campaign provide prescient guidelines to Trump’s economic policy, and hint at what could come next.

New tariffs on China

The White House is weighing new tariffs on China, Bloomberg reports, while the US trade representative is reviewing China’s intellectual property strategy, and the US Treasury is studying Beijing’s US investments. Overall, the administration is considering taxes on 100 Chinese products, Politico reports.

In their white paper, Navarro and Ross call for the US to “confront” China’s taxes on US exports, from motorcycles to raisins.

A Trump Administration will confront China’s continued high tariffs on a wide range of American products, from motorcycles to raisins, as well as China’s limits on imports such as cotton from the US. Trump will also insist that China relax its numerous non-tariff barriers now blocking US exports across a wide range of products, including autos, agricultural commodities, fertilizers, and telecommunications equipment.

The US has asked Beijing to submit a plan for a “One Billion Dollar [sic] reduction in their massive Trade Deficit with the United States,” Trump tweeted Wednesday morning—a demand that seems nonsensical given the figures involved: America’s trade deficit in goods with China was $347 billion in 2016, meaning the amount Trump wants to reduce is less than 0.3% of the supposed problem.

Little sympathy for US companies

Navarro’s Death by China, published in 2011, holds US companies, CEOs, and trade groups like the National Association of Manufacturers as responsible as Beijing for US job losses; it accuses US businesses of being “transformed from staunch critics of Chinese mercantilism into open, and often very aggressive, soldiers in the pro-China Lobby.”

In the white paper, Ross and Navarro write that “corporate America does not oppose [trade agreements with foreign countries]. They both allow and encourage corporations to put their factories anywhere. However, Mr. and Ms. America are left back home without high paying jobs.”

American CEOs, especially in manufacturing, have had Trump’s ear in the past. But the scramble in DC to change his mind about the steel and aluminum tariffs he proposed last week shows that he’s more interested in punishing countries he thinks are taking advantage of the US than changing their minds.

A hard line on the WTO

Navarro and Ross’s top solution to attract US companies back to the US is lowering corporate taxes. This already been passed by the Trump administration. But he also suggests going after the World Trade Organization’s value-added tax system, which he says unfairly penalizes US companies. This argument doesn’t have much support outside the White House—one Forbes critic called it a “crock.”

Disrupting the WTO is a larger goal of Navarro and Ross, who threatened in their research paper that the group “would be meaningless without the presence of the world’s largest importer and third largest exporter.” The US “has the leverage” to change the VAT rules, and put pressure on the WTO on other issues, they said.

Already, the US is undermining the WTO by refusing to approve new trade dispute judges, hampering the organization’s work in an attempt to get more leverage on planned re-negotiations.

Destruction of a South Korea trade deal

Navarro has been a long-time critic of the US’s 2012 trade deal with South Korea, and Trump has followed his example. After promising to scrap it entirely in April of 2017, Trump vowed to renegotiate the deal this February, calling it a “disaster” which “produced nothing but losses” for the US.

In the white paper (pg. 21), Navarro seems to suggest that the US could renegotiate the deal to make South Korea pay higher taxes, and import more hydrocarbons from the US.

Correction, March 7, 5:20ET: An earlier version of this article described Navarro and Ross’s white paper as calling for tariffs on Chinese products “from motorcycles to raisins.” In fact the paper criticizes Chinese tariffs on those US products.