They’re not the most riveting reading. But the minutes of the Federal Reserve’s last rate-setting get-together—the one in which the Fed decided to announce a new round of money-creation and bond-buying—lays out a pretty clear case for what was announced.

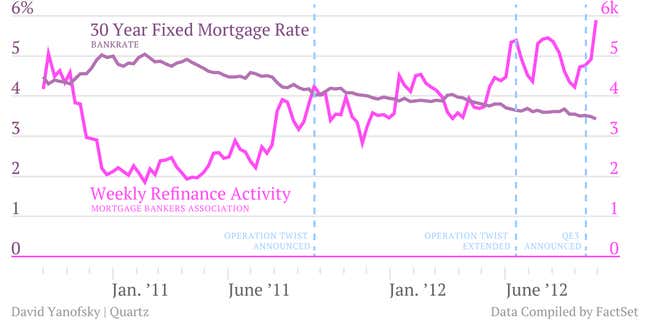

The plan is to create about $40 billion in new money each month and use it to buy the packages of mortgage bonds where nearly all US home loans eventually end up. That has helped lower mortgage rates a bit–they are at all-time lows–and given an additional kick to the mini-wave of refinancing that we’re seeing lately. In this chart of the latest numbers, you can see how refinancing has picked up steam.

This is exactly the kind of effect the Fed was after. And in the minutes, we get a heavily filtered view of the conversations that eventually led to the decision to launch QE3. Here’s what was said about the housing markets and how it fits into the broader economy:

Housing market conditions continued to improve, but construction activity was still at a low level, reflecting the restraint imposed by the substantial inventory of foreclosed and distressed properties and by tight credit standards for mortgage loans…

…A few participants, however, mentioned the possibility that economic growth could be more rapid than currently anticipated, particularly if major sources of uncertainty were resolved favorably or if faster-than-expected advances in the housing sector led to improvements in household balance sheets, increased confidence, and easier credit conditions. Participants’ forecasts for economic activity, which in most cases were conditioned on an assumption of additional, near-term monetary policy accommodation, were also associated with an outlook for the unemployment rate to remain close to recent levels through 2012 and then to decline gradually toward levels judged to be consistent with the Committee’s mandate…

…Although the level of activity in the housing sector remained low, the somewhat faster pace of home sales and construction provided some encouraging signs of improvement. A number of participants also observed that house prices were rising. It was noted that such increases, coupled with historically low mortgage rates, could lead to a stronger upturn in housing activity, although constraints on the capacity for loan origination and still-tight credit terms for some borrowers continued to weigh on mortgage lending…

Mortgage rates remained at very low levels over the intermeeting period. Refinancing activity increased but was still restrained by tight underwriting conditions, capacity constraints at mortgage originators, and low levels of home equity…

…Participants suggested that, all else being equal, MBS purchases could be preferable because they would more directly support the housing sector, which remains weak but has shown some signs of improvement of late.

Translation: The Fed sees the beginnings of a virtuous cycle in housing. Prices are starting to rise. The more that happens, the more some American homeowners resurface after being “underwater” on their mortgage. (Being underwater means that you owe more on your house than it is worth, which usually means you can’t easily refinance your home.) Once they resurface, those US homeowners will have a better chance at being able to refinance at the historically low mortgage rates now prevailing in the market. That reduces their monthly mortgage payments and puts more money in their wallets, which they can spend, helping the economy further. In short, QE3 is all about the Fed making a big bet on trying to keep things moving in the right direction in the housing market.