Should you pay off your student loans as fast as possible, or make smaller payments over a longer period of time? It depends on how much you value your youth.

Ten years ago, if I lost a 20-dollar bill I would have been despondent. Today, it would be annoying, but not as big of a deal. I make more money now, and the things I like to do are a bit pricier. To get the same amount of enjoyment I got for $20 before, I might need to spend around $60 today.

In economic terms, the “utility” I get from $20 is less to me today than what it was just out of college. Economists tend not to obsess about money, but rather they think in terms of utility—the satisfaction or happiness that people derive by making a certain decision or purchase. One of the goals of life, from an economist’s point of view, is to maximize the utility you derive from the money you make during your lifetime.

In the US, students are offered a variety of plans for paying back their student loans. These options vary by length of time and whether they are dependent on income. Young adults are often told they should always choose the plan that allows them to pay off as much of their loan as possible, because unpaid balances gather interest. This is bad advice.

When deciding how much to pay back on student loans every month, it is utility you should consider, not how much you will owe in 10 years. For some, paying back as little as possible on student loans is the right decision, while others should go all out to pay back as much as they can right away. It depends on how much you expect to make in the future and the lifestyle you seek in the present. With a higher expected salary, future payments are less of a burden. In terms of lifestyle, if you don’t really care about being cash-strapped now because you have a big financial goal to save towards, then money in the future is more valuable than money today.

Consider two imaginary people, Alexis and Casey. They are both 23, make $40,000 a year, and have student loans worth $80,000.

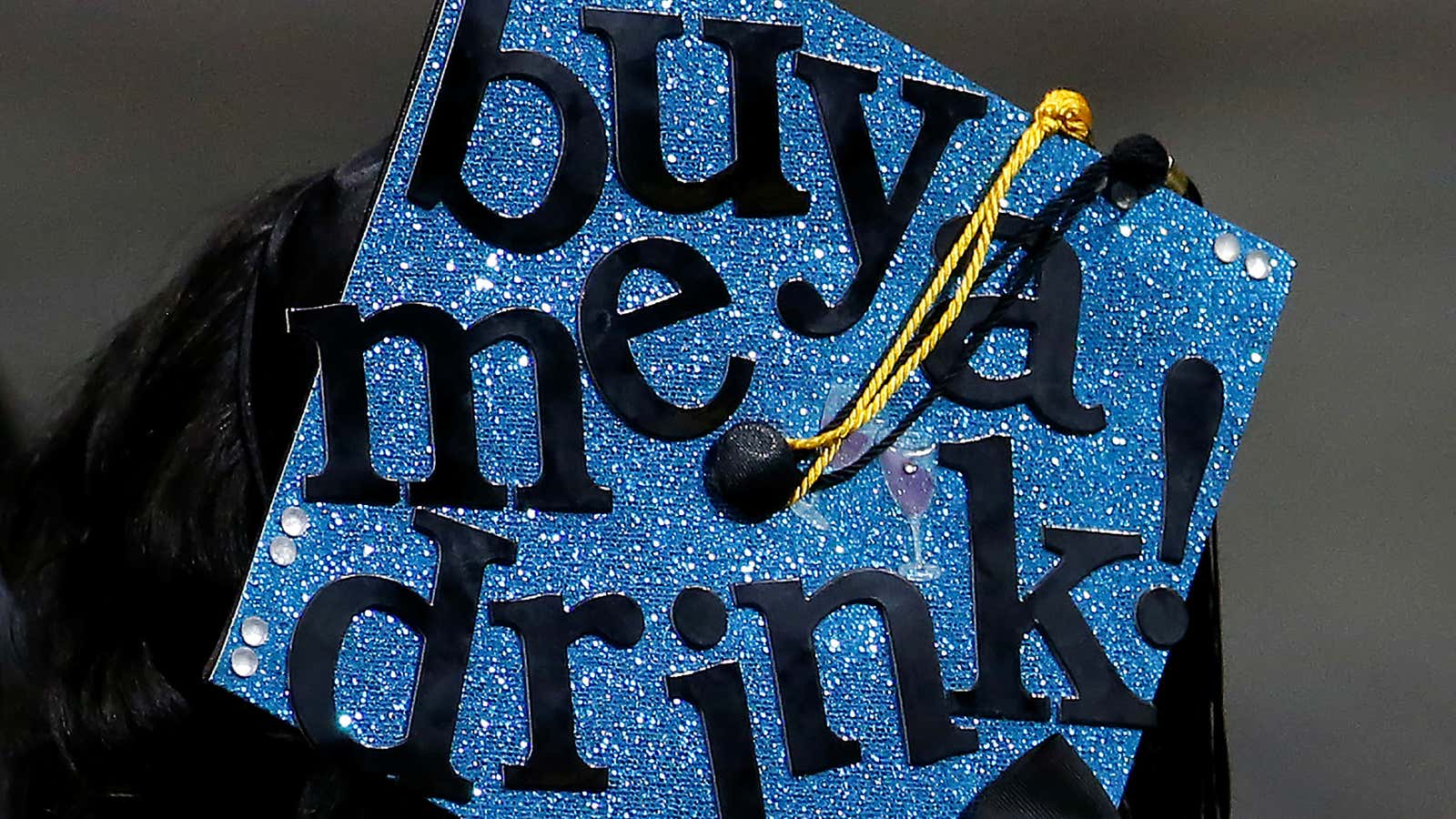

Alexis is in sales and loves to party. Given Alexis’s line of work, they expect to make a lot more money 10 years from now. Alexis is an extrovert, enjoys living with other people, and never really thinks about buying a house. Based on utility theory, Alexis should probably pay off as little as possible of their student loan, and spend money on what makes them happy now, like going out. They can pay back more decades from now, when payments won’t seem like a lot of money, relative to today. The risk Alexis takes is that their future earnings may not be as plentiful as expected, so the forgone interest payments make the debt burden heavier relative to Alexis’s earnings.

Casey is an elementary school teacher and homebody, and having debt is a source of stress. They love their personal space and can’t wait to buy a house. As a teacher, their salary isn’t likely to go up by much in the future. Utility theory suggests Casey should probably pay back as much of the student loan as they can. This way, they can quickly get to the point where they start saving to purchase a home. The risk here would be if, even after paying down the loan and building some savings, it still might not be enough to afford a house (perhaps Casey lives in San Francisco). In that case, Casey may have got more enjoyment out of spending some of the money that went to paying down debt.

Student loan payments are all about priorities. When deciding your repayment strategy, consider your priorities and goals, and make a prudent choice based on those. Don’t automatically think you have to pay loans back as quickly as possible—you might miss out on the time of your life.