Many startups get quietly sold or shuttered yet few have suffered as publicly and quantifiably as Blue Apron.

In the 10 months since the meal-kit company debuted on the New York Stock Exchange, its share price has fallen about 80%, to pennies above $2. Wall Street is evidently less bullish than Silicon Valley on Blue Apron’s self-described “powerful and emotional brand connection” and “hard-to-replicate value chain.” Once valued by private investors at $2 billion, Blue Apron’s market cap is now just $400 million.

A good question to ask when a startup stumbles is, who gets hurt? Often the answer is workers. When internet delivery service Kozmo collapsed in 2001, it stopped operating immediately and fired 1,100 people. Many of the on-demand startups that folded over the last five years left legions of contractors abruptly out of work. If Uber pauses service in any market, the first people to feel the impact are its drivers.

Occasionally some people are picked up and moved over to a new company that buys the scraps of the failed one, but these deals are usually reserved for senior leadership and talent, not for run-of-the-mill employees. When food delivery startup Maple sold for parts to Deliveroo, for example, the UK-based company wanted Maple’s senior leadership, but not its New York-based hourly labor force.

All is certainly not well at Blue Apron. Its revenue grew 11% from 2016 to 2017, but losses nearly quadrupled to $210 million. Per a securities filing in February, the company is no longer building a new warehousing facility in Fairfield, California, and is “continuing to evaluate alternatives” for the lease it assumed in December 2017. The original heart-warming vision of selling farm-fresh vegetables in pre-portioned packages to American families has withered into a mess of losses and lease obligations.

Who is hurting at Blue Apron? Shareholders, who filed multiple lawsuits after the company’s lackluster IPO, and whose shares have only lost value since. Staff, who have been laid off by the hundreds. Employees who received stock options in their compensation packages and are now probably stuck with a lot of out-of-the-money assets.

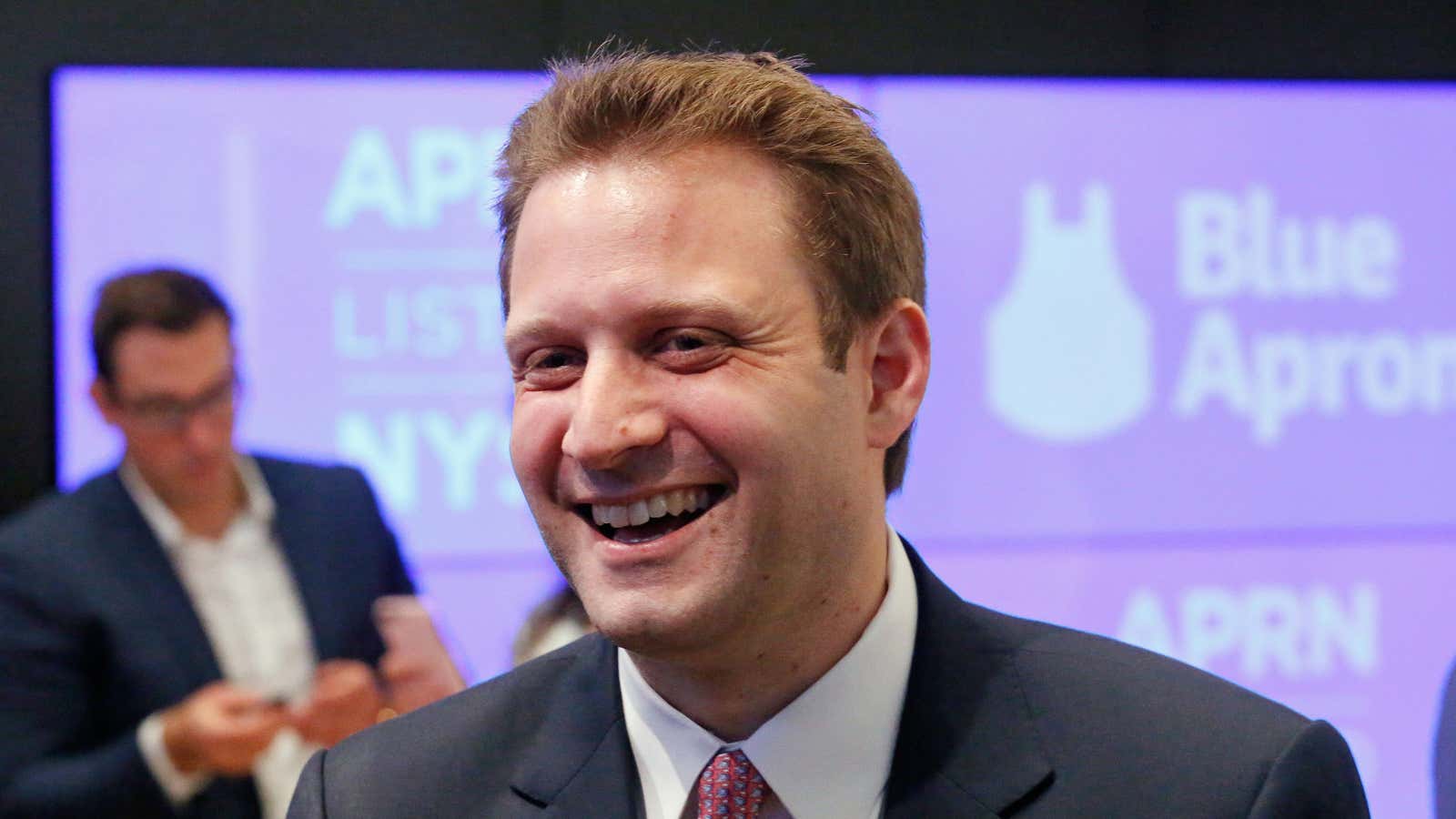

You know who’s not feeling too bad, though? Blue Apron co-founder Matt Salzberg, who was replaced as CEO in November and made executive chairman. The change came with a big raise. His annual base salary increased to $470,000 from $300,000, a 57% jump, as of Dec. 1, 2017, Blue Apron disclosed last week in its proxy statement. Blue Apron also granted Salzberg more than 33,000 restricted stock units, good for an equivalent amount of class A common stock.

Blue Apron says it uses base salaries “to recognize the experience, skills, knowledge, and responsibilities required of all our employees, including our named executive officers.” Amid the poor financial performance, three other executives received bonuses of $100,500, $83,750, and $83,750, “based on their respective bonus targets and the achievement of both individual and company goals.”

There is a good bit of research to suggest that retaining a former CEO as a board chair is a bad idea, in part because the predecessor tends to limit the influence of the new chief executive. But even setting that aside, it’s unclear what skills and knowledge Salzberg demonstrated, or additional duties he acquired in the transition, to justify a 57% raise. Blue Apron declined to comment on the proxy statement.

It’s similarly unclear what “individual and company goals” Blue Apron’s senior executives achieved in 2017 to earn their hefty bonuses, as losses soared and the stock price tanked. It would be interesting to know what the suing shareholders and laid-off employees make of it. The lesson for startup founders seems to be that unless you go full Theranos, the personal repercussions for building an overvalued and financially unstable company that causes a lot of collateral damage to shareholders and employees can, at the end of the day, be pretty minimal.

An earlier version of this post was published in Oversharing, a newsletter about the sharing economy. Sign up for it here.