We know, we know. It’s been a rough half decade for the global economy. The US financial crisis bled into a global recession, Europe spiraled into a debt crisis that threatened to fracture the common currency, and recently, some once-hot emerging markets have been having real difficulties (We’re looking at you, India).

But the world economy is not doomed. In fact, you don’t have to search too far to find widespread signs that things are going reasonably well.

Seriously, look:

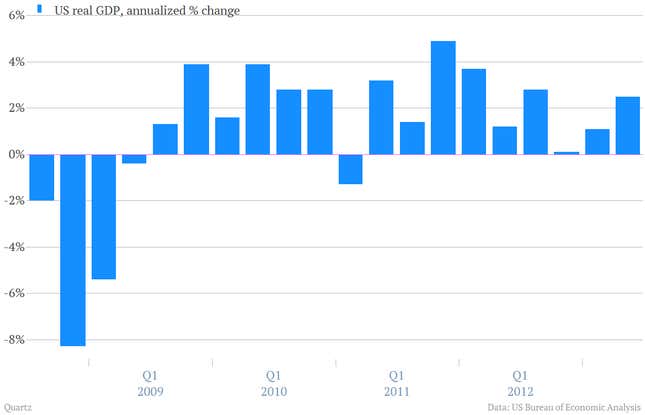

Economic growth in the world’s largest economy is holding up fairly well.

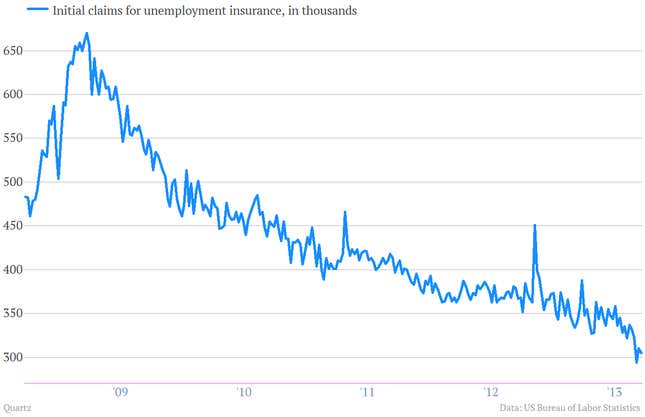

The US job market is getting closer and closer to normal.

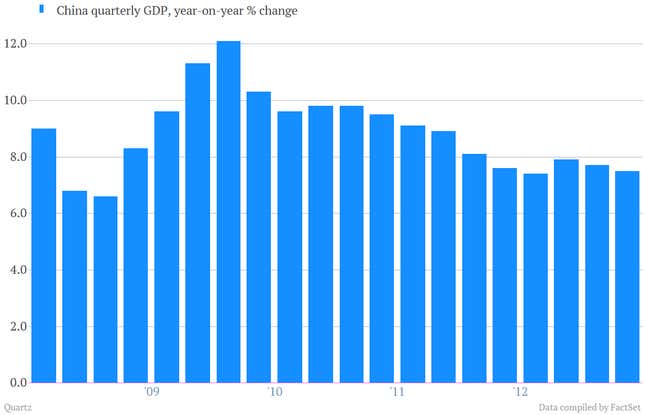

Though it’s wise to be skeptical, China’s growth is stabilizing around the government’s 7.5% target.

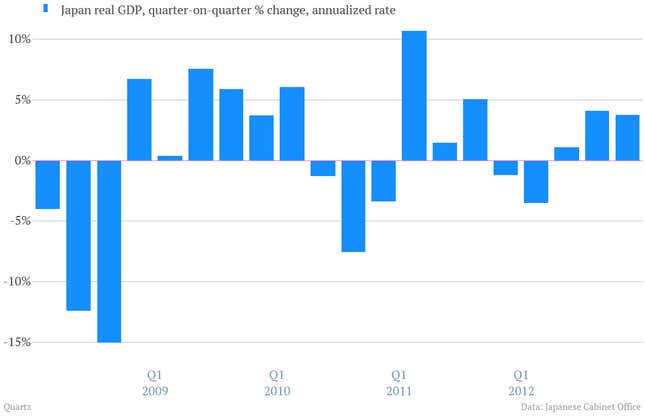

Japan, the third-largest economy, is actually starting to contribute meaningfully to global growth.

The economic overhaul by Japanese prime minister Shinzo Abe is showing signs of working, especially his attempts to weaken the yen:

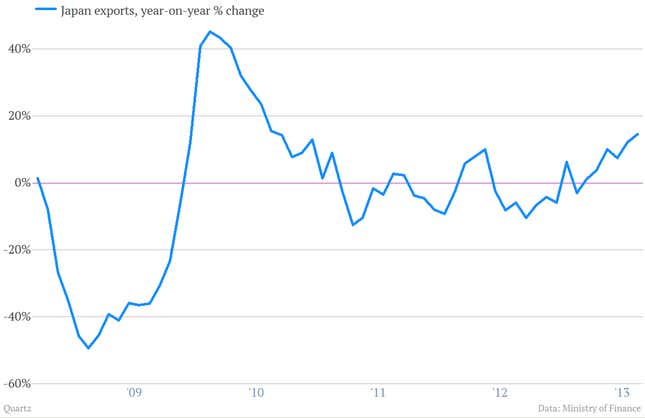

The weak yen boosts the yen value of exports, which is good for corporate Japan.

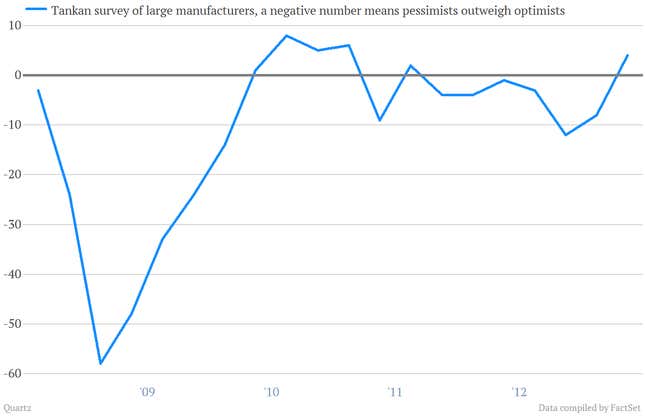

That has put a bit more spring into the step of Japanese manufacturers.

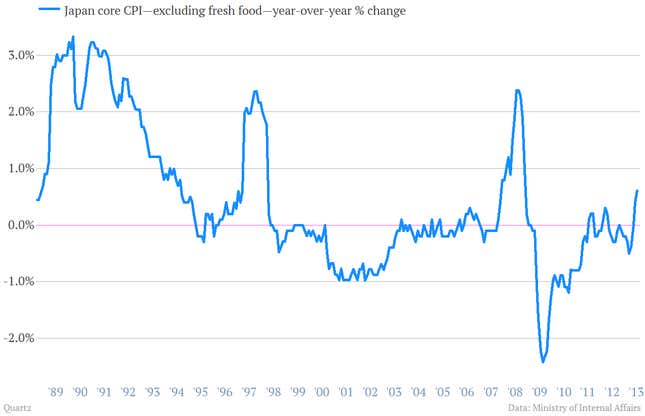

Recently Japan has showed signs of breaking free of deflation (paywall), which has bedeviled the country since the 1990s.

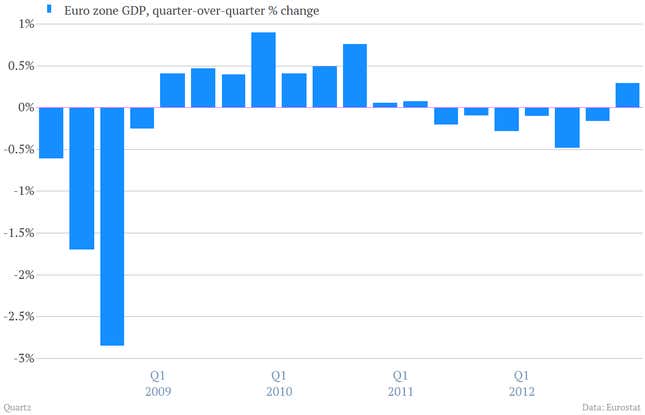

Meanwhile, over in Europe, the euro zone has finally emerged from recession…

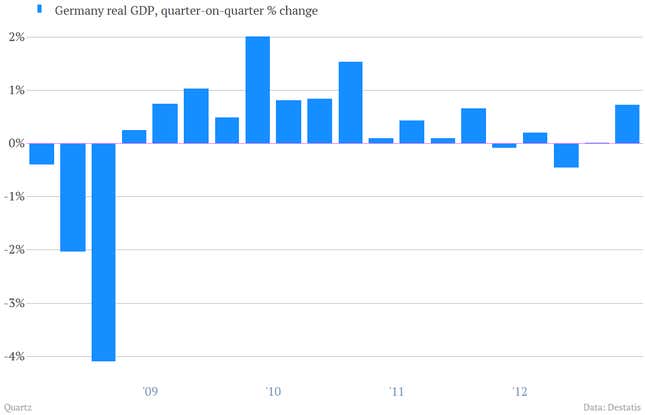

…thanks in part to a relatively strong showing from the monetary bloc’s largest economy.

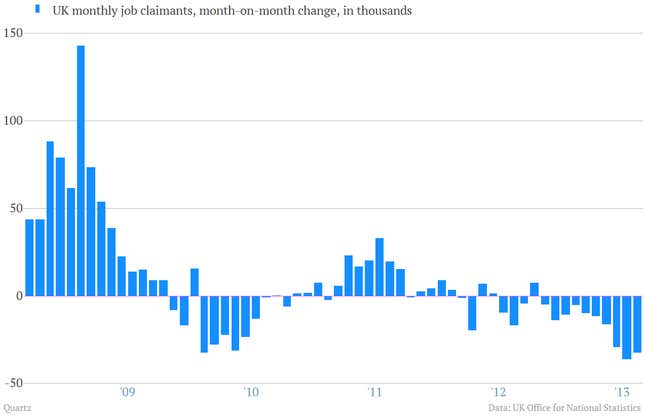

In the UK, unemployment is slowly falling.

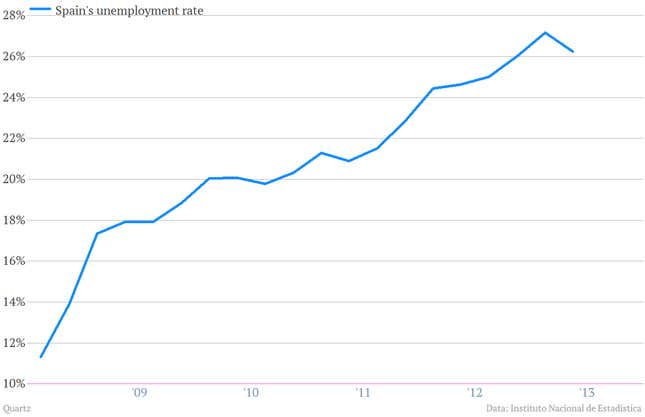

And while unemployment remains a disaster in Spain, there are signs that it has topped out.

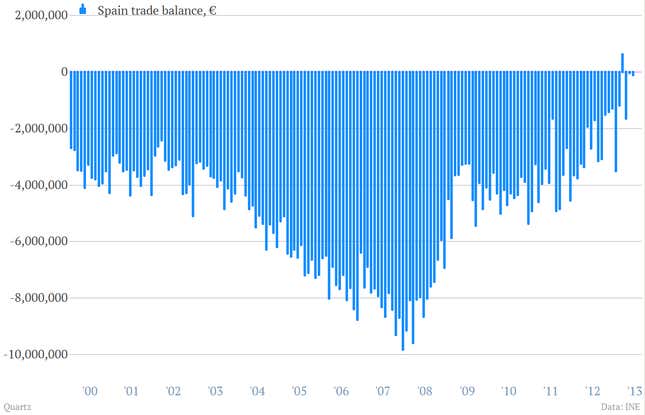

The most problematic euro zone countries are making important adjustments. Check out how Spain’s trade deficit has virtually disappeared:

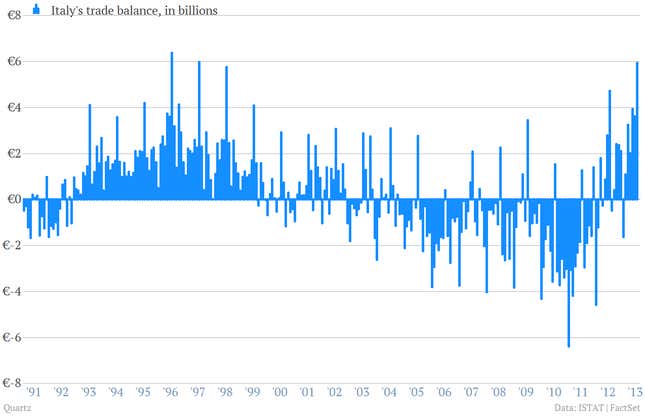

Likewise, Italy has made a concerted move from trade deficits to big surpluses.

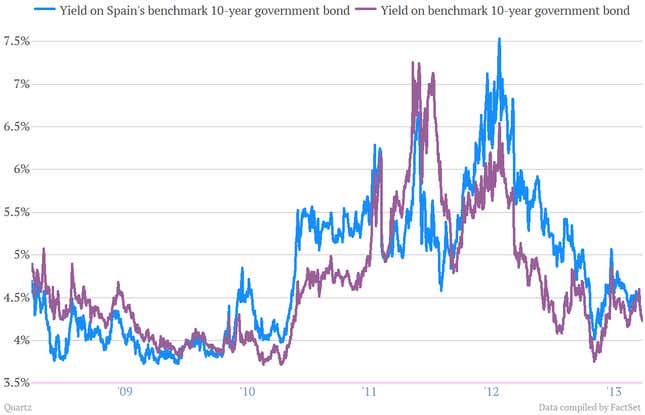

The markets have relaxed considerably about these countries, sending their borrowing costs sharply lower.

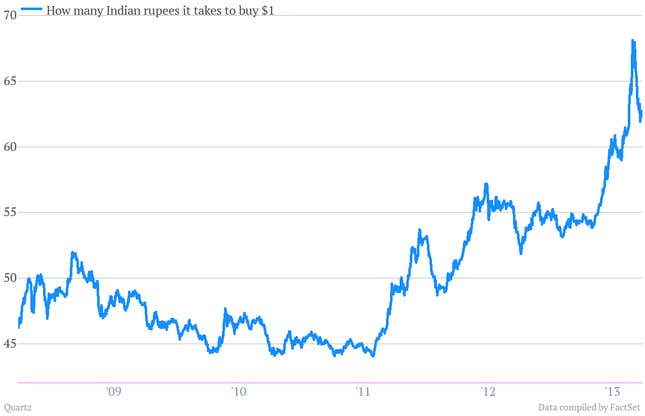

Emerging markets seem to be calming down a bit. India’s rupee has stabilized after some soothing words from the Reserve Bank of India’s new governor.

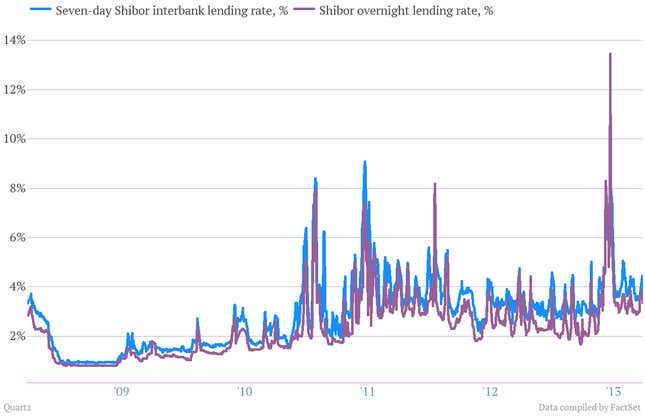

And the worries that swept the Chinese banking system over the summer, which drove Chinese money market rates sharply higher, have also relented.

There are even signs of life in global trade. After three years without a pulse, the Baltic Dry Index—a gauge of shipping costs—has suddenly shot up.

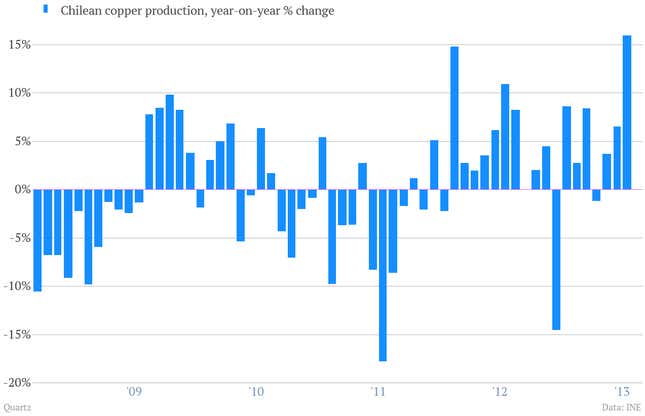

Finally, in Chile, the world’s largest copper producer, mining has been picking up steam—a good barometer of global industrial activity.