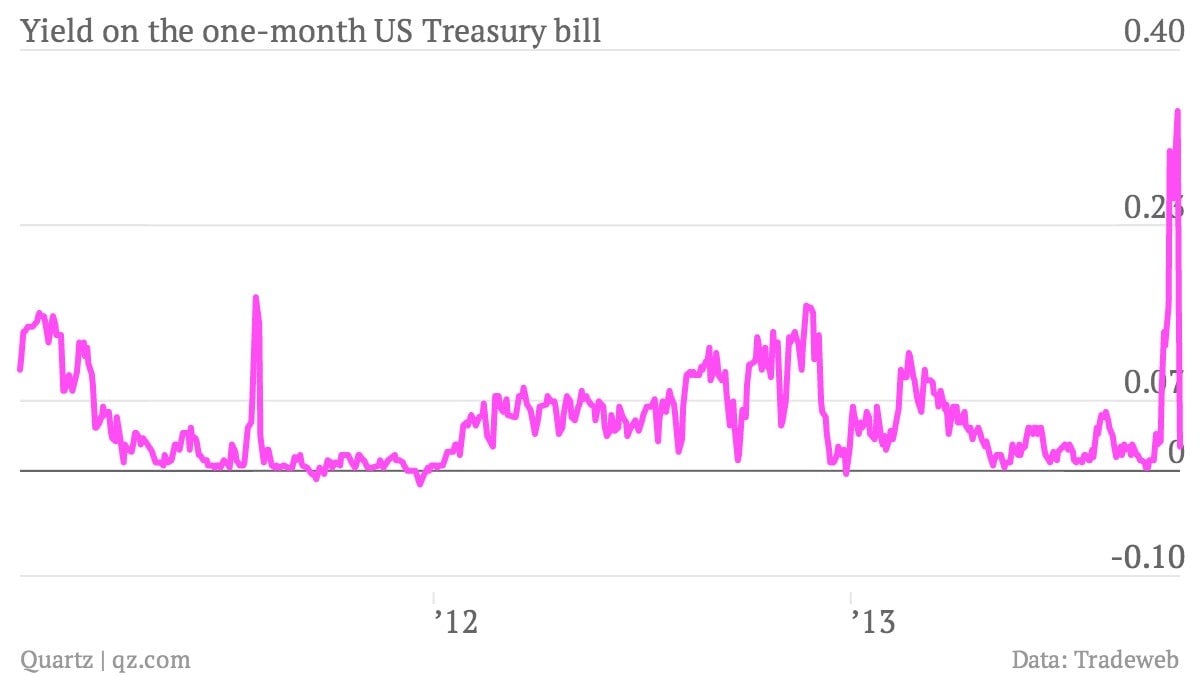

This is what it looks like when the bond market breaths a giant sigh of relief

Over the last few weeks we’ve been reporting on the sharp jags taken by the yield on the one-month Treasury bill, normally one of the most boring and safe investments available on earth. Yields—which move in the opposite direction of the price of the bill—shot higher along with the tensions related to the US government shutdown.

Over the last few weeks we’ve been reporting on the sharp jags taken by the yield on the one-month Treasury bill, normally one of the most boring and safe investments available on earth. Yields—which move in the opposite direction of the price of the bill—shot higher along with the tensions related to the US government shutdown.

Then they climbed still further as worries mounted that the US wouldn’t raise its legal debt limit in a timely fashion, possibly pushing the US into a previously unthinkable default. And now, after all the political theater resulted in a deal to both reopen the government and raise the debt limit until early next year, the yield on the one-month bill has crashed back to earth. The most recent spike and crash in yields is at the far right of the chart above. It dwarfs a similar spike seen back in the summer of 2011, during that year’s debt fight.