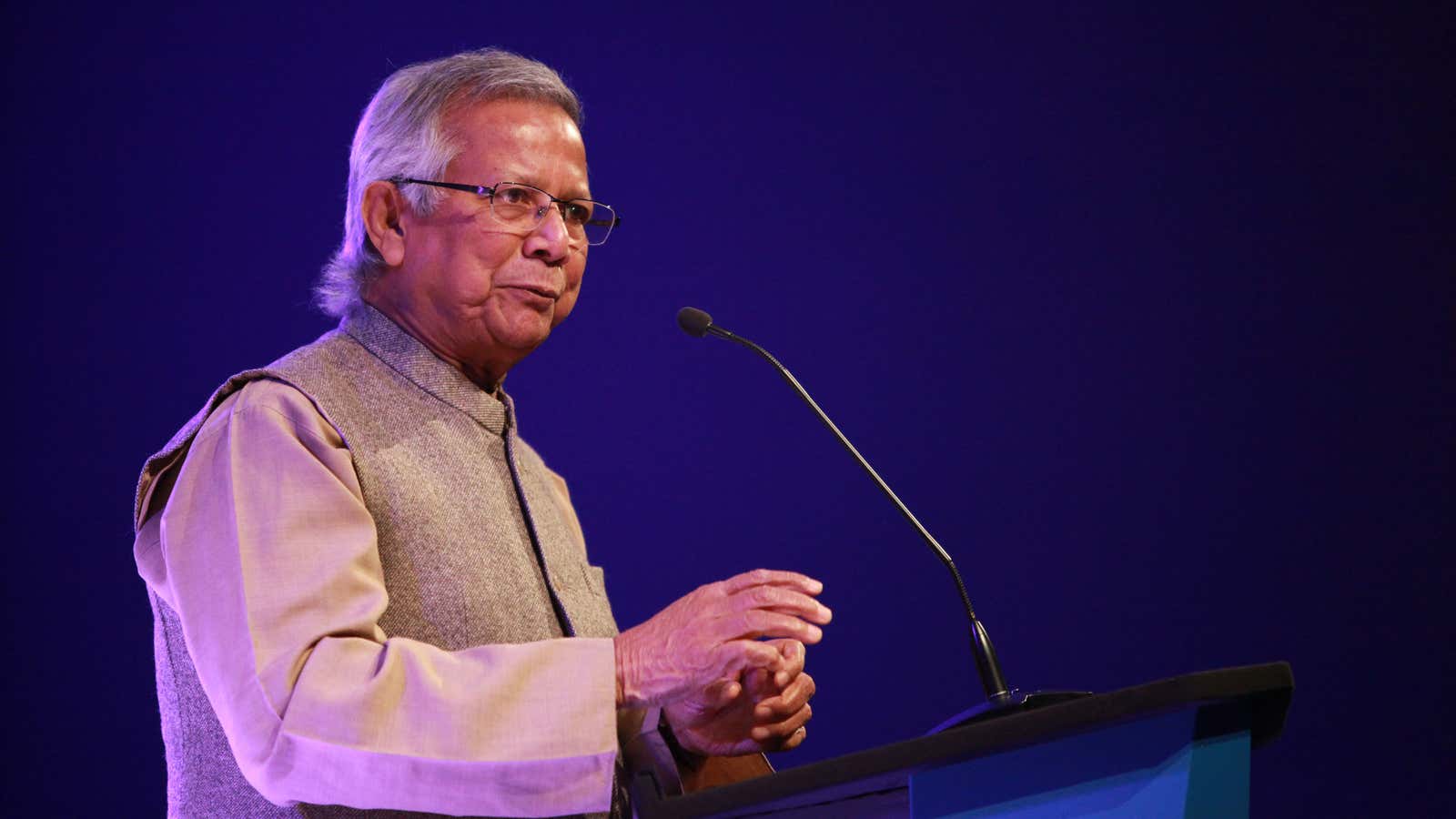

For more than 40 years, Muhammad Yunus has been building a financial system for people who lack sufficient access to the one that already exists. In 2006, the now 78-year old won the Nobel Peace Prize for his work as “banker to the poor.”

In the 1970s, Yunus began work on what would shortly become Grameen Bank in Bangladesh, which provides small loans to entrepreneurs, primarily women, who otherwise couldn’t access funds due to a lack of collateral and other resources. This model of microfinance has since been replicated all over the world. Grameen Bank takes deposits to finance the loans it offers; it decided in 1995 that it wouldn’t accept donations. For Yunus, ending poverty isn’t about charity.

Last month, the 10-year-old US division of Grameen announced that it had provided more than $1 billion in loans to 106,000 women. Over the next decade, it plans to provide $1 billion in loans every year, and nearly double the number of branches, to 42.

Quartz spoke with Yunus at the One Young World summit at The Hague, which brings together 2,000 young people from 190 countries who are working to improve their societies, and the world at large, by fighting to end sexual violence, improve access to education, and demand justice and human rights accountability from governments. This conversation has been edited and condensed for clarity.

Quartz: Since the 1970s, has your view of microcredit changed?

Yunus: Microcredit still remains the same as when we started in Bangladesh 40 years back. But many more people around the world have started microcredit programs. Some took advantage of credibility of the word “microcredit”—they used it to make money for themselves, turning into loan sharks.

But after 42 years of our work, it’s not gone into the mainstream. Microcredit has remained at the NGO level, a footnote in the financial sector.

Earlier this year, the World Bank showed how little progress there has been: The proportion of people with active accounts has stagnated and the gap in financial inclusion between men and women has stayed the same.

The very word “inclusion” is suspect. This is not about inclusion; it’s about having a separate kind of banking institution to address the people at the very bottom. Today, there’s only one kind of financial institution, which are banks for the rich. You are asking the banks for the rich to lend to the poor. The very system is designed in a completely different way. This machine doesn’t work for them. The way to really address the problem of the rejected people from the financial system is to create a new financial system.

What does that new system look like?

Like a Grameen bank. It’s a bank for the poor and it doesn’t lend money to the rich. The bank for the rich doesn’t lend money to the poor. That’s a simple division. Two systems.

How do you convince the world to create this dual system?

For the same reason you want to change the situation of poverty. Governments are used to giving grants to poor people for survival. Whether you are a rich country or a poor country, every country does that. Instead of giving grants, it’s much cheaper to do it as a loan. The money comes back, covers its own cost, and is sustainable. It’s a market-based system.

What is the most effective way you’ve seen to tackle poverty in recent years?

Whichever way you do it, it has to create income. In order to create income you have to encourage people to become entrepreneurs.

If you talk about poverty, often you hear about education. “Give them education” is the common response. Education, and then what? The job market has not done much good. In many countries, 50% of young people are unemployed.

Entrepreneurship is also risky, though. Not every venture succeeds. What about safety nets to encourage young people to take risks?

I try to avoid safety nets because if you create them you are giving assurance that you don’t have to work. That’s a disincentive to begin with. That creates dependency. So I say don’t give the money but put the money in some other fund, in a social business venture capital fund. So when young people fail, this money will come to help them do it again so they don’t feel afraid.

We can build security, but not as a dependence. It can be an insurance program because that is not a dependence.

There’s a lot of new research into direct cash transfers. What’s your view on giving cash to entrepreneurs versus credit?

If it comes as a grant then there’s no responsibility, and the money can be misused easily. A loan comes with responsibility: you have to create a return from it. People become very relaxed if they are guaranteed money because they will get it again. If you fail, the second round of cash transfers will come, so why make an effort?

That puts a lot of pressure on young people. It also suggests that many people would be too relaxed about a cash-transfer system. It’s similar to the debate around universal basic income, with one side claiming that people would become lazy and stop working.

The welfare system never produced any entrepreneurs. The welfare system in every country, you don’t see anybody coming out. They go in and stay there because you take care of them. UBI is the same thing; it’s a welfare system. Charity doesn’t create activity. Charity is a dependence creation. Dependence creation is always a negative thing for a society. Systems should be geared towards us creating activity. Creating entrepreneurship rather than dependence. Taking risk. That’s what human beings are for.

This seems to be a system dependent on capitalism, but an idealized one that serves everyone. However, the very need for microcredit is an example of a market failure.

The whole capitalist system has failed. The very number of poor people showed that it failed. It pushes all the wealth to the top continuously and the top became very fat and owned by few people. What kind of system is that? We have to redesign the system.

What would this system look like?

Capitalism went wrong because it started with the wrong premise. It misrepresents human beings and says we are driven by self interest. I think this is a grossly wrong statement. Human beings are both driven by self interest and selflessness. The economic system forgot the selflessness part, and once we include it into the business then you have two kinds of business: business to make money and business to solve problems. Then the economic system becomes different.

Finally, I want to ask about sustainable finance, which is gaining momentum by promising more environmental, social, and governance considerations among investors.

These are buzzwords. There’s nothing called “sustainable finance” because the poor people are not included in that financial system. It’s a system for the rich. It’s as simple as that. Unless you have a financial system which includes the poorest person, then sustainability doesn’t exist.