As we mentioned, the strong November jobs report turned attention once again to the timing of the taper. But it’s worth remembering the oft-mentioned dual mandate of the Federal Reserve. By law, the US central bank must focus on both maximizing employment as well as ensuring “price stability.”

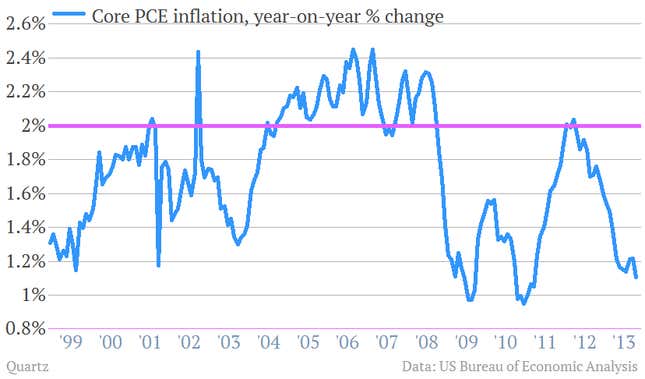

And while the employment picture seems brighter, there are still worries when it comes to price stability. The main concern? Inflation is quickly losing momentum. In fact, the Fed’s favorite measure of inflation, the core price index used in the personal consumption expenditures report, was just released today. And core PCE inflation fell yet again, with prices rising just 1.1% in October compared with the previous year. That’s down from 1.2% in September. And it’s way, way below the Fed’s target of 2%. Check it out:

Now it’s important to note that prices are still rising, just more slowly than before. (This is disinflation, not deflation.)

This means that there is zilch in terms of worrisome price pressures in the pipeline. And that means the Fed can feel comfortable in keeping its bond-buying program rolling for a while longer. After all, if the Fed is still not happy with the employment situation—which it isn’t—and inflation continues to fall, the bank is essentially misfiring on both of its Congressionally mandated targets. So why not keep on keeping on with QE?