26 charts that surprised me in 2013

A chart is a powerful thing.

A chart is a powerful thing.

As perhaps the fastest way to make an argument backed by data, charts boast incredible capacity to explain and persuade. And while that also means they can be incredibly misleading, charts have clarified my thinking on a number of big issues this year.

Here, in no certain order, are some of the most important ones I’ve created, seen, tweeted, and retweeted. (I tweet a lot of charts. Follow me!)

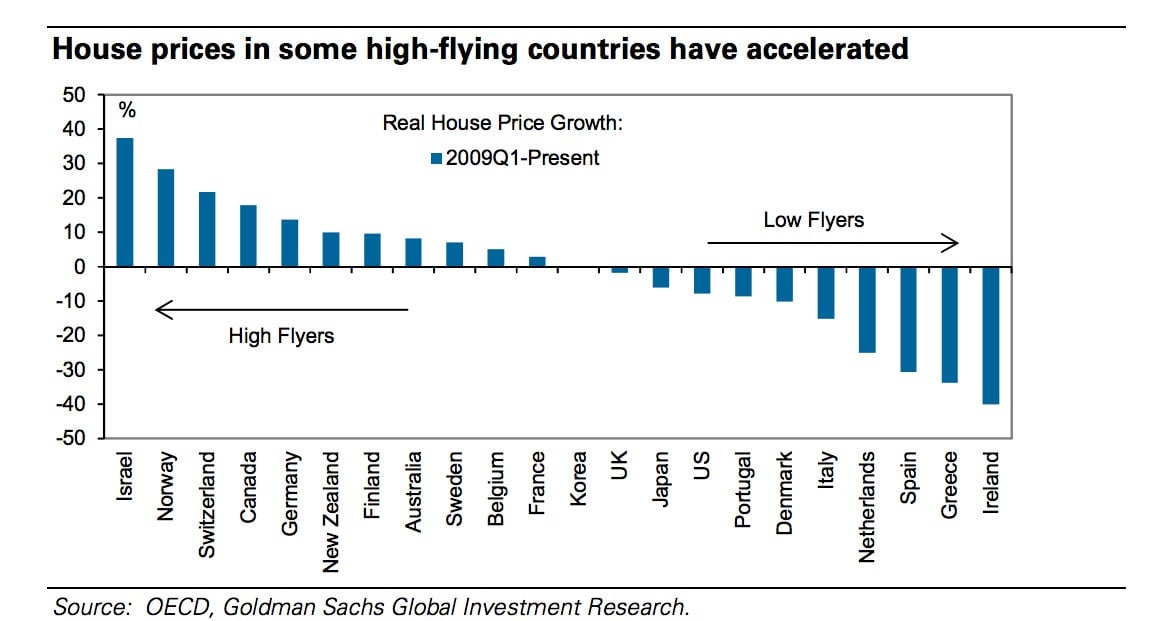

Yes, the US economy is slowly getting better.

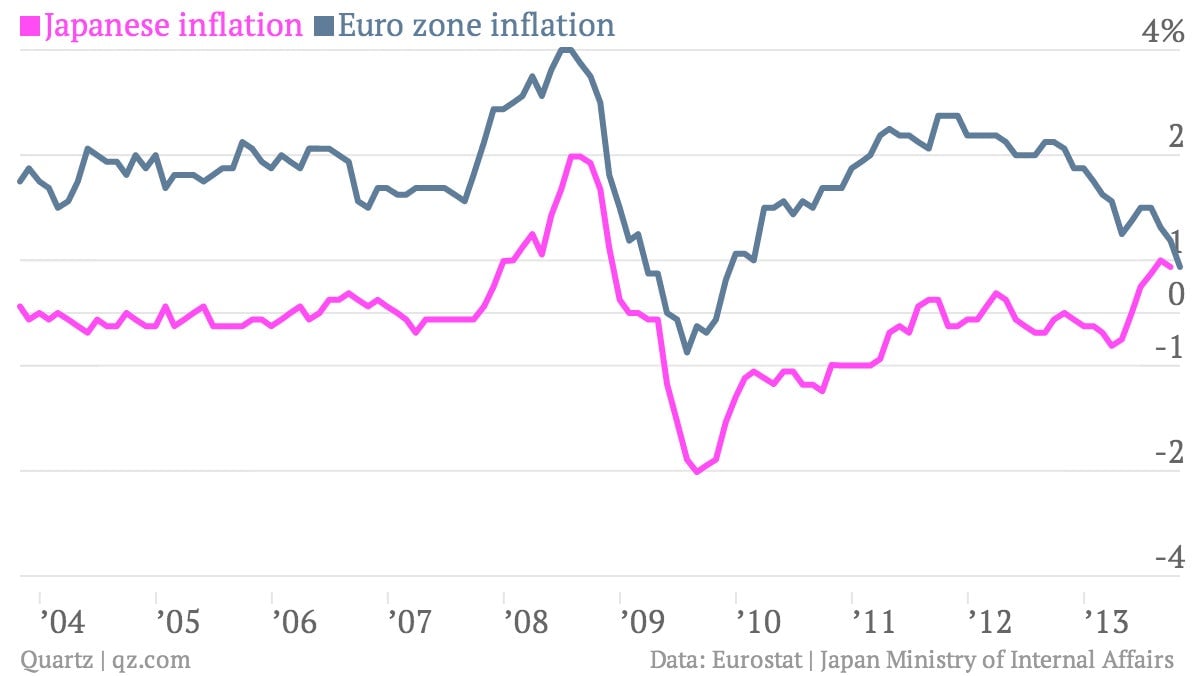

Europe looks like it could fall into a Japan-style deflation trap, just as Japan may be escaping.

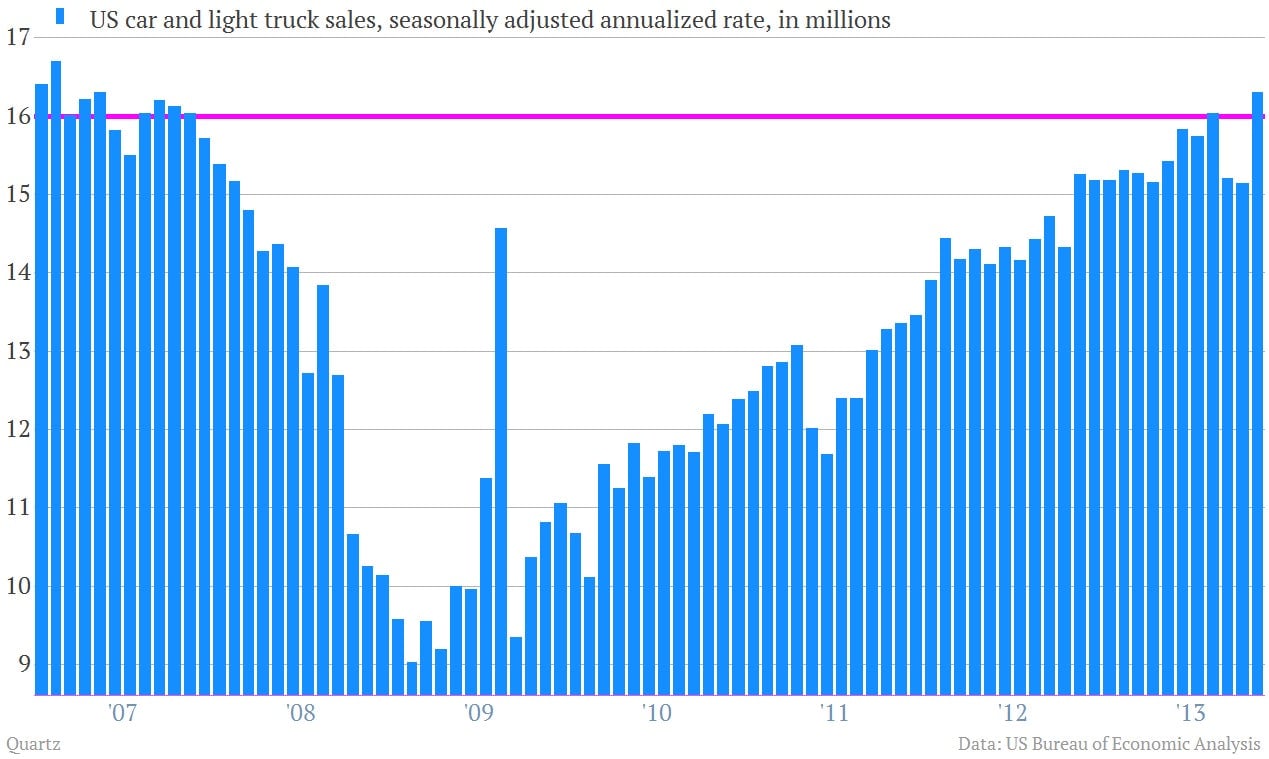

The recovery in the US auto industry has been pretty astounding.

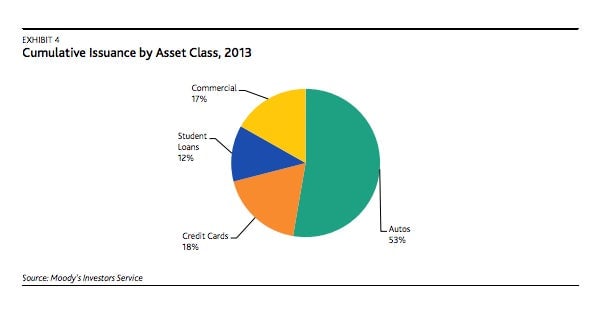

And the reason why is that credit is flowing to the auto loan market via the asset-backed securities market.

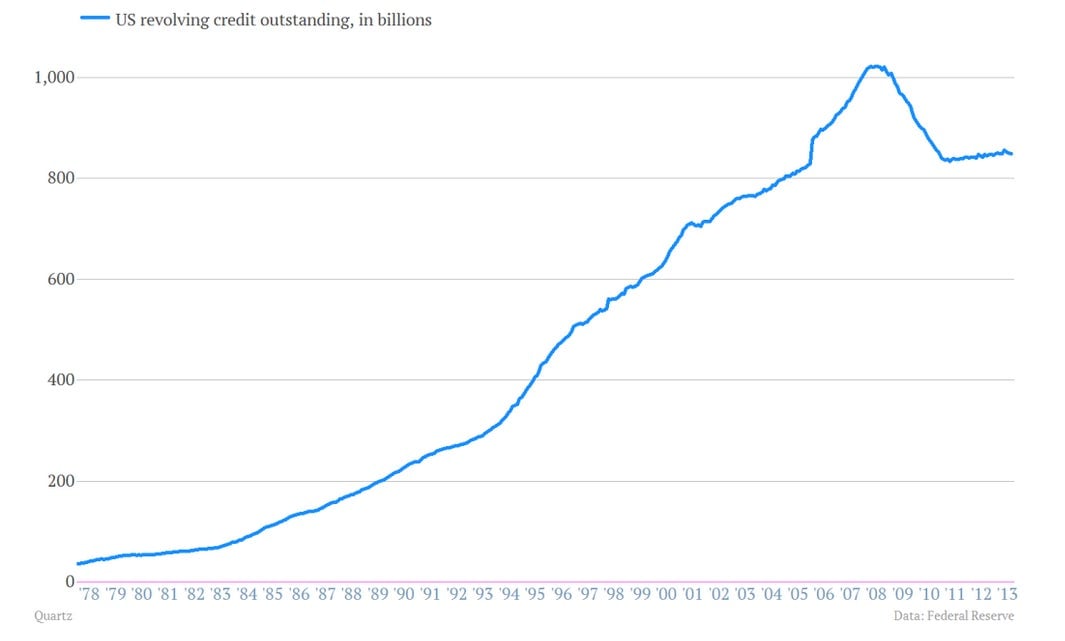

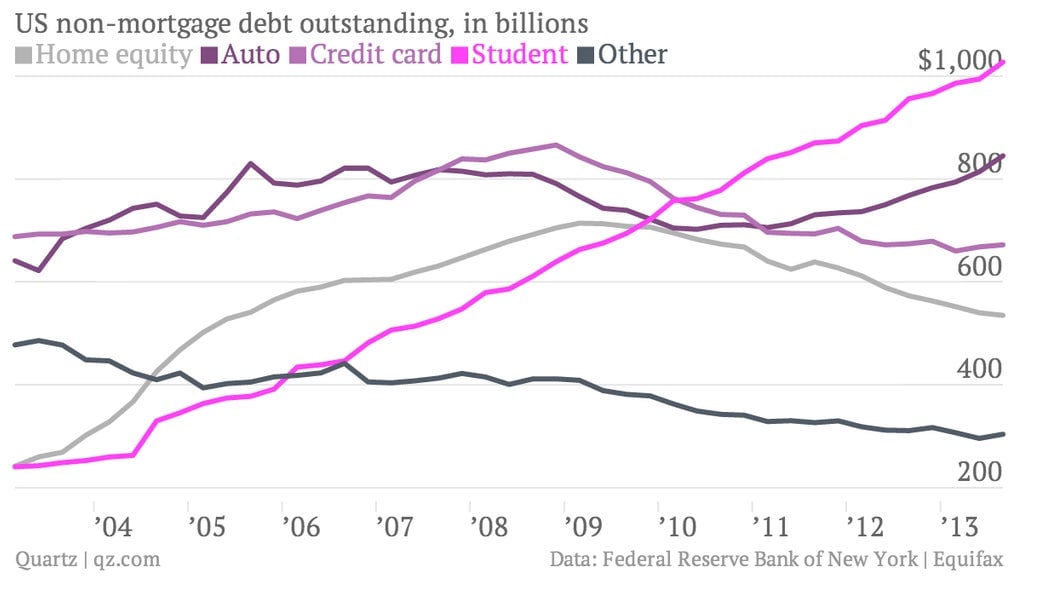

Automotive debt and student loans remain areas where US consumers are leveraging up.

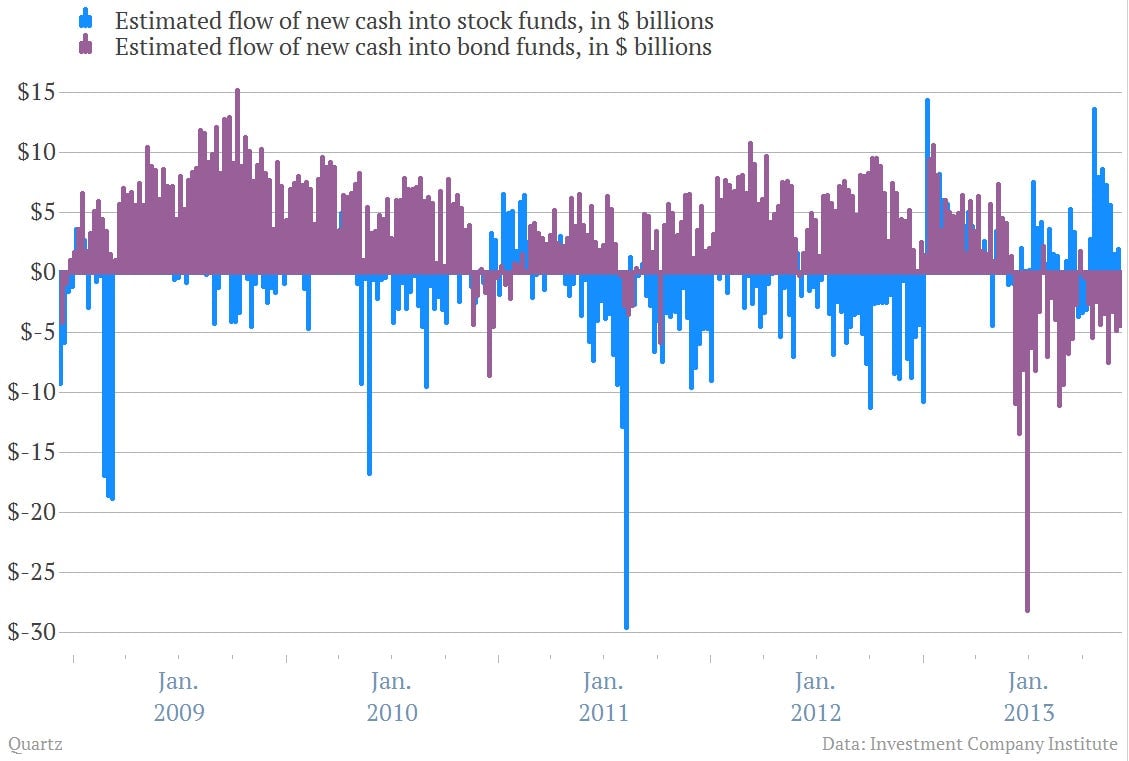

The great rotation from bonds into stocks finally happened. (Investors have hid in bonds since the crisis.)

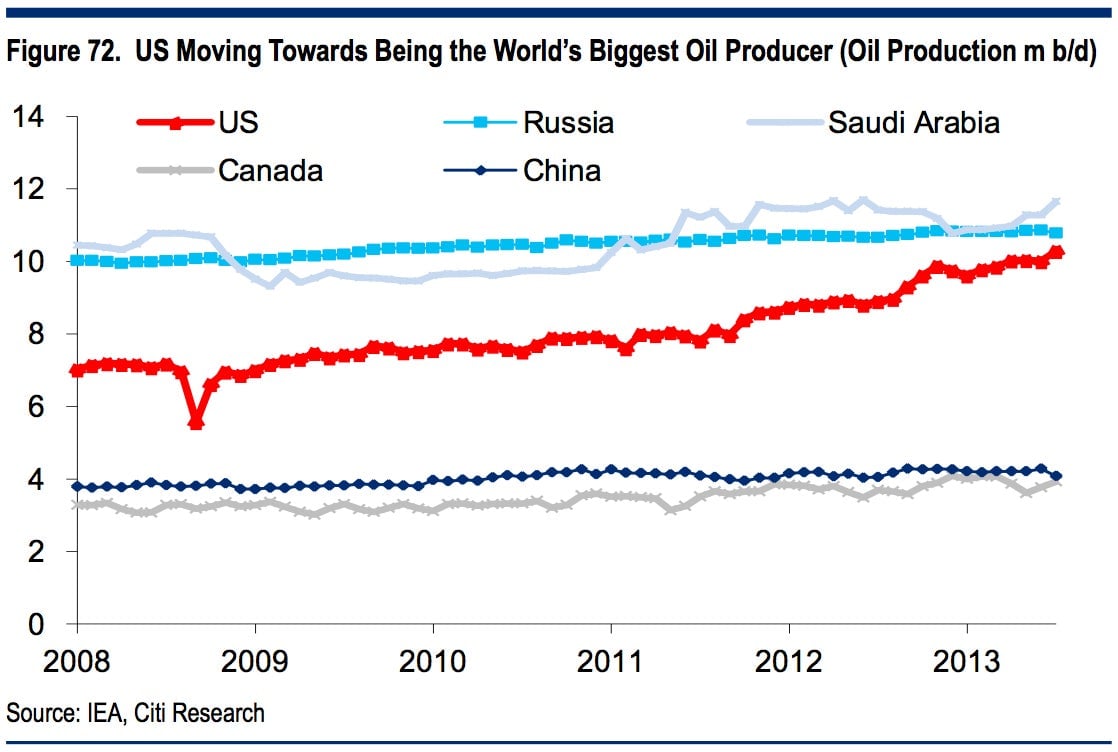

This whole US domestic energy thing is actually happening too.

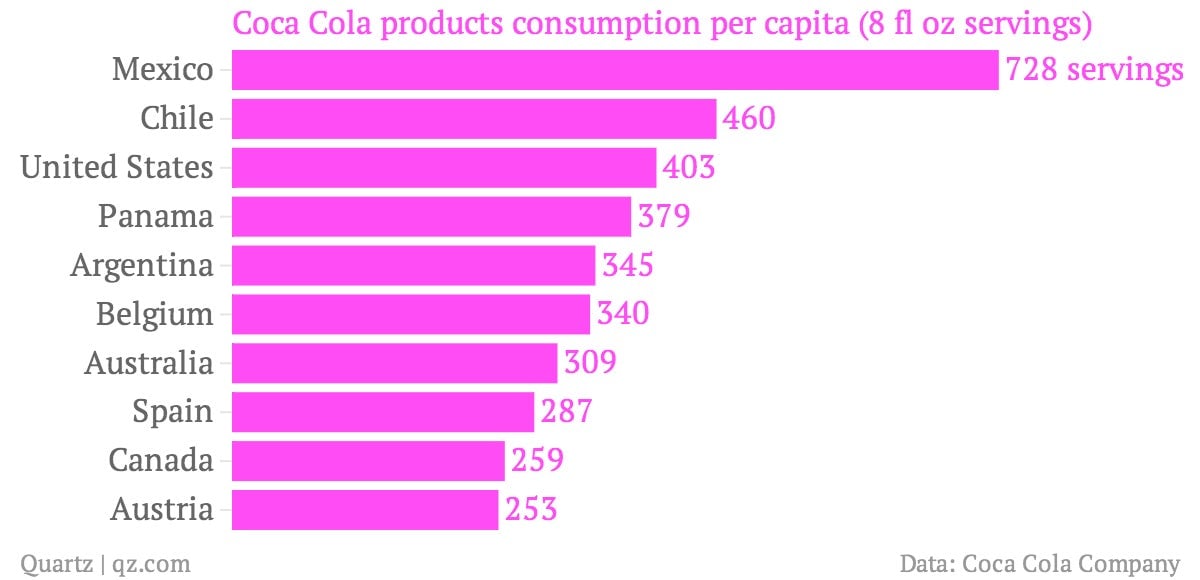

Mexico has a giant diabetes problem.

And, perhaps it’s just a coincidence, but Mexico also seems to really enjoy its soft drinks.

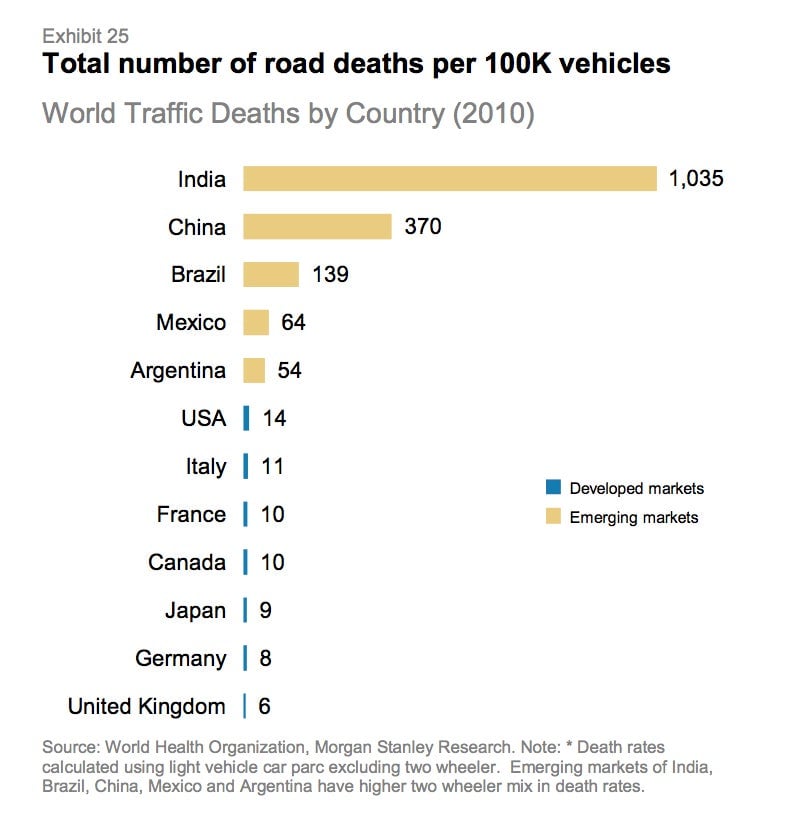

India is a terrifying place to drive.

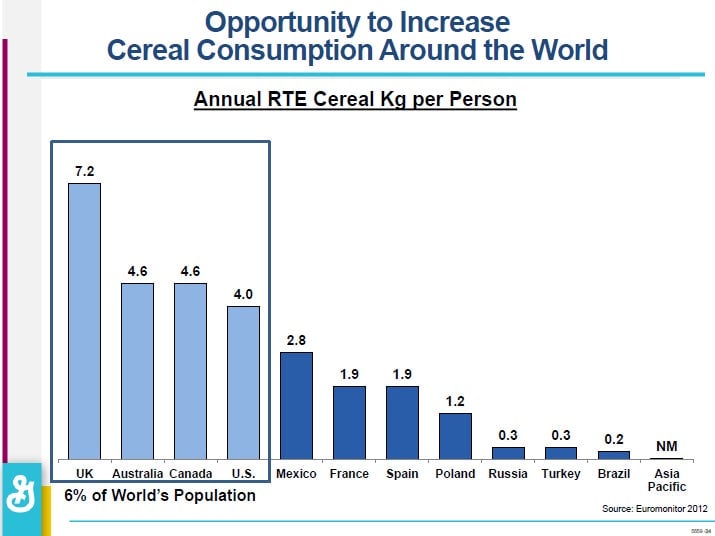

Brits eat the most cereal.

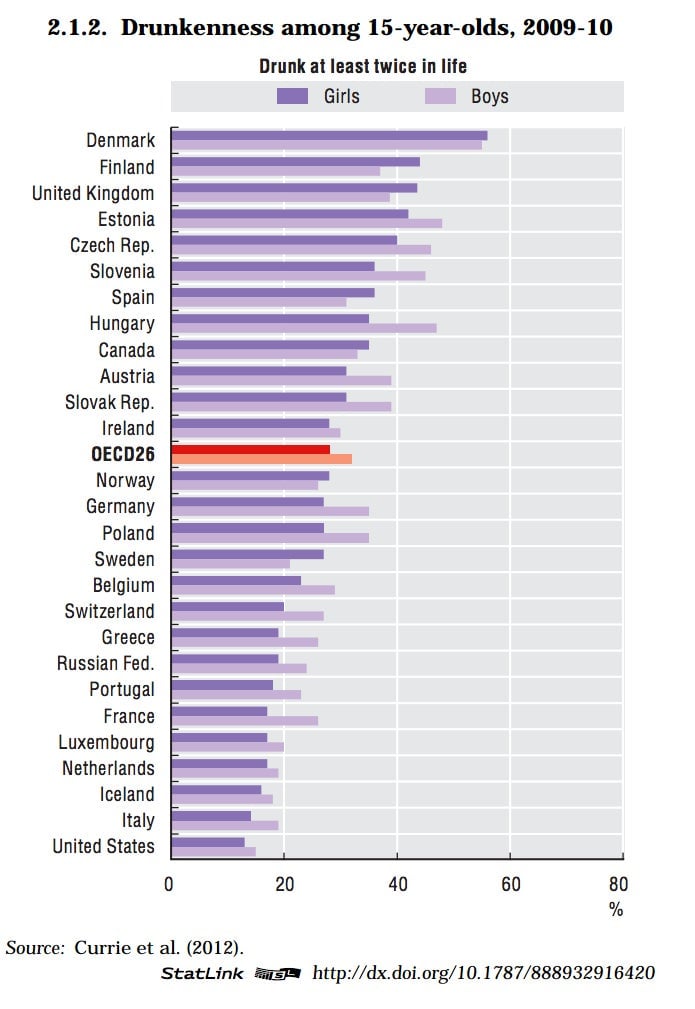

Danish girls are the drunkest form of 15-year-old.

People in Turkey are some of the world’s most hard-working.

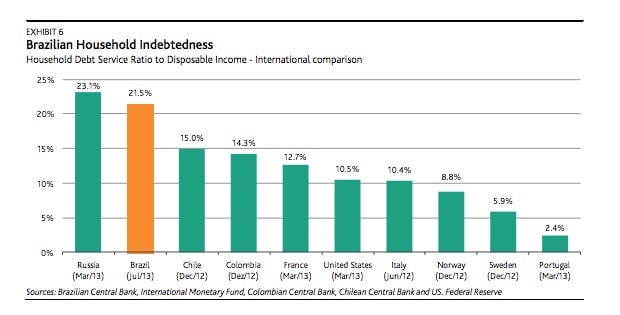

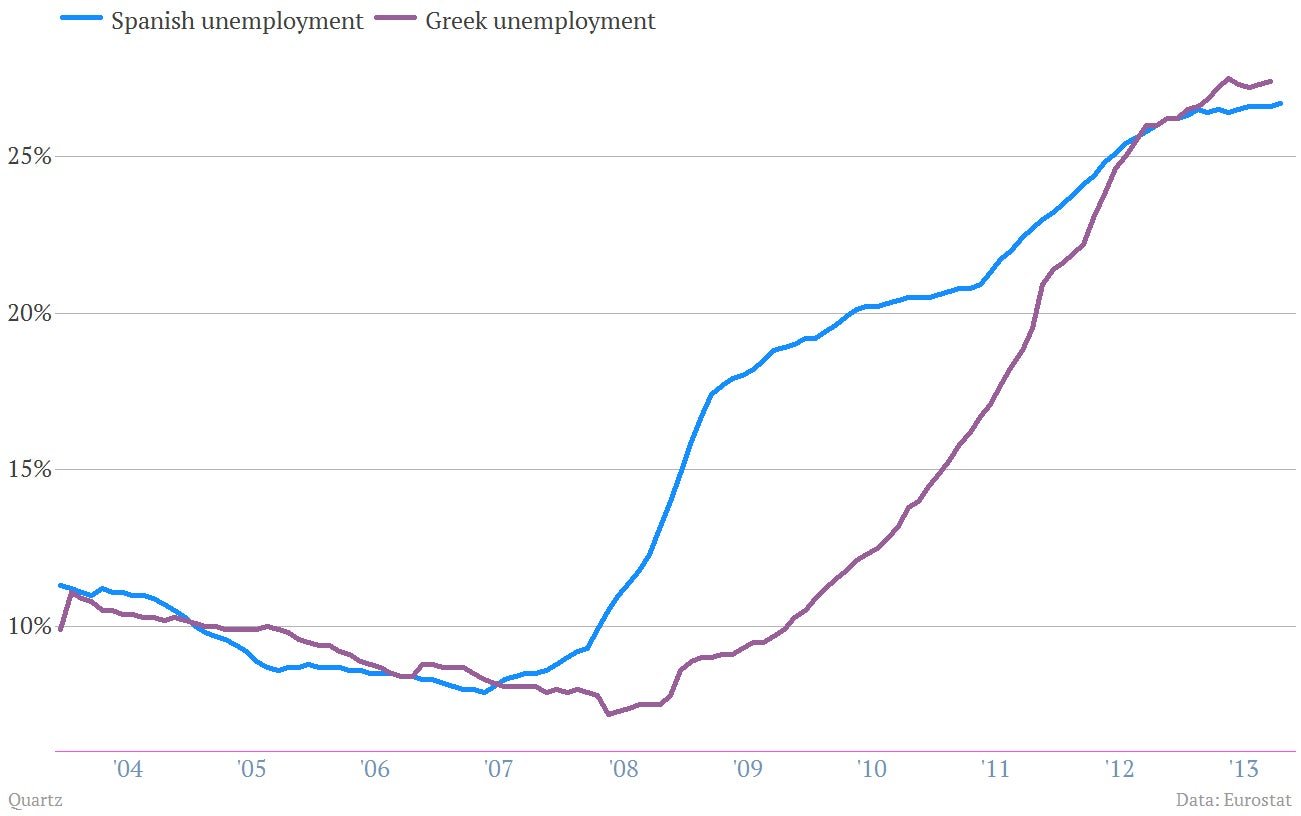

Greece and Spain are neck-and-neck in a race for the most awful economy in Europe.

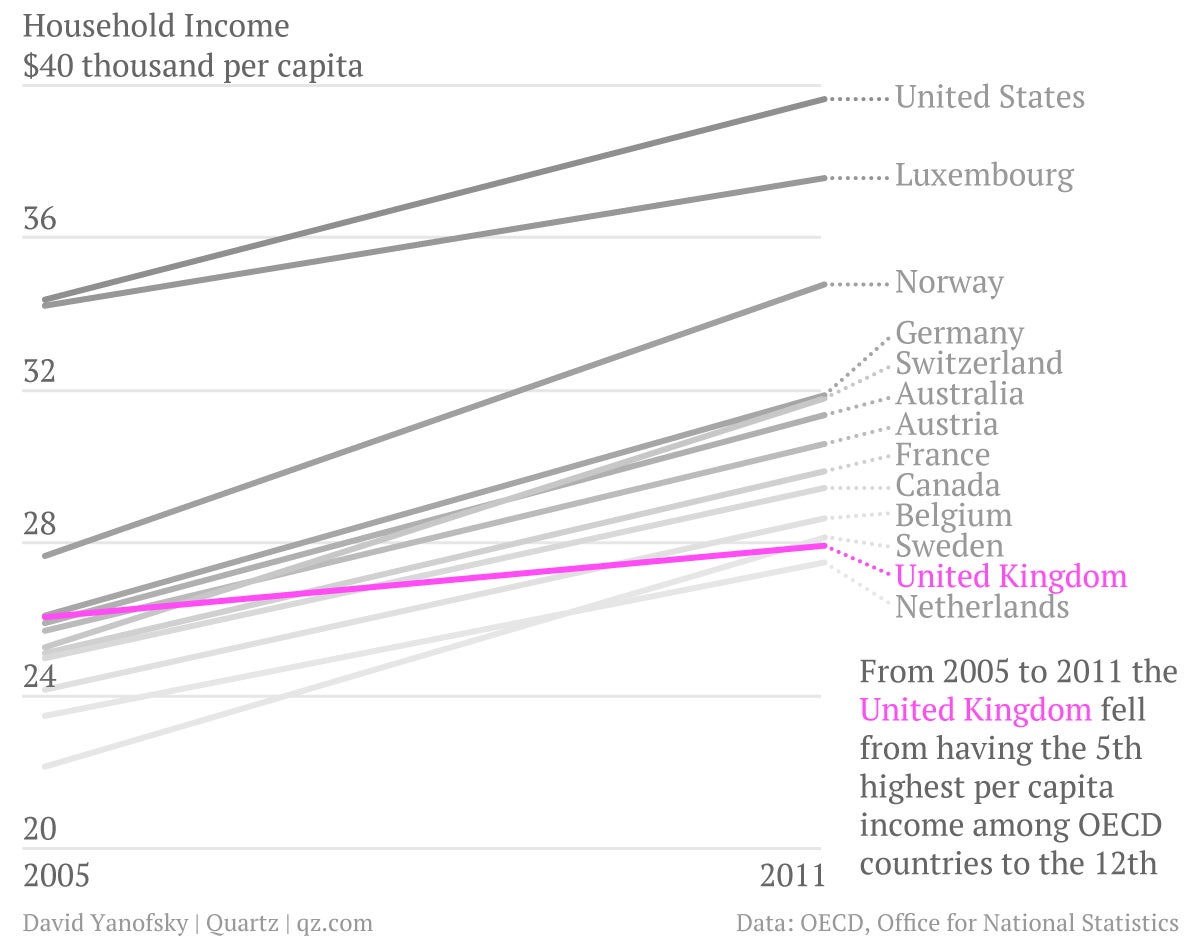

American families made more in 1989 than they did in 2012.

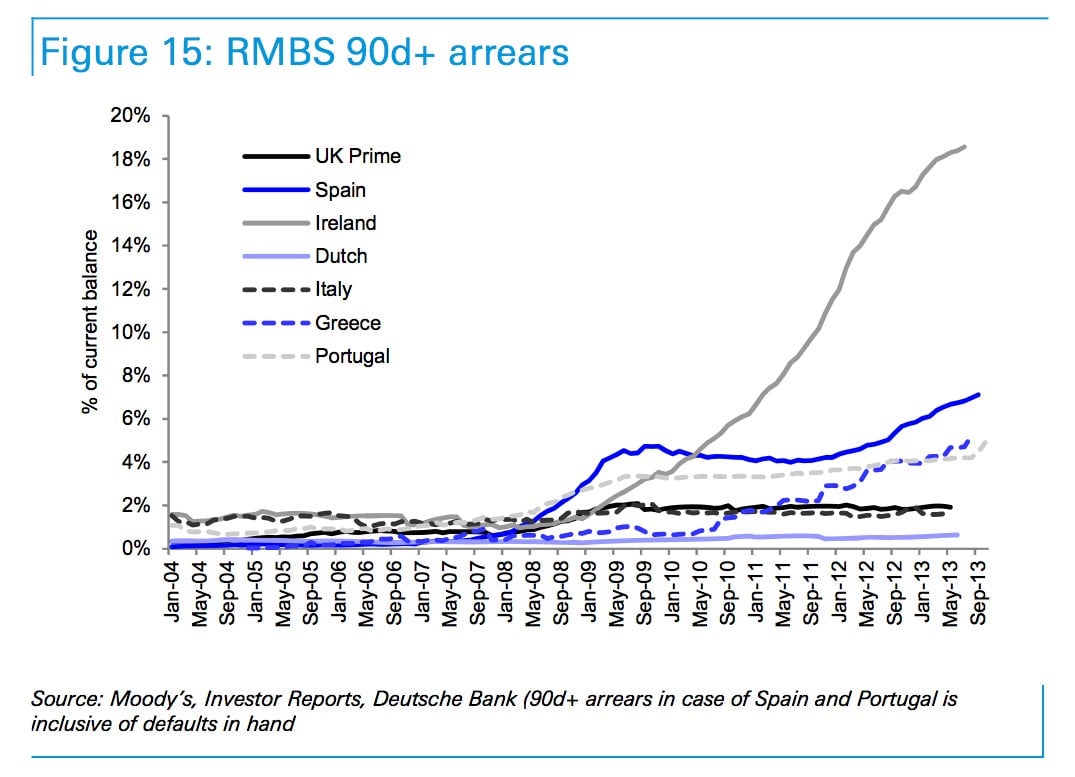

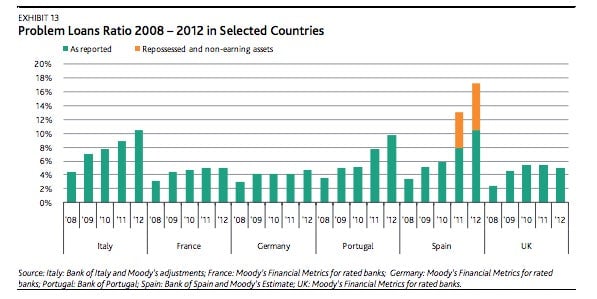

Spain still has a tremendously screwed-up banking system.

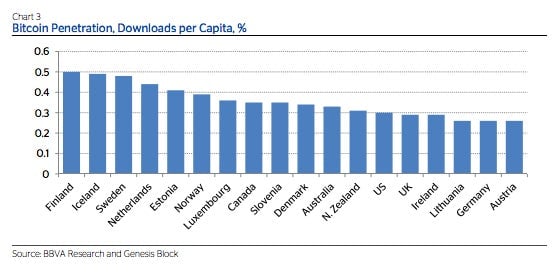

Finland is bitcoin crazy.

The US wants to take the title of “world’s largest wine consumer” from France.

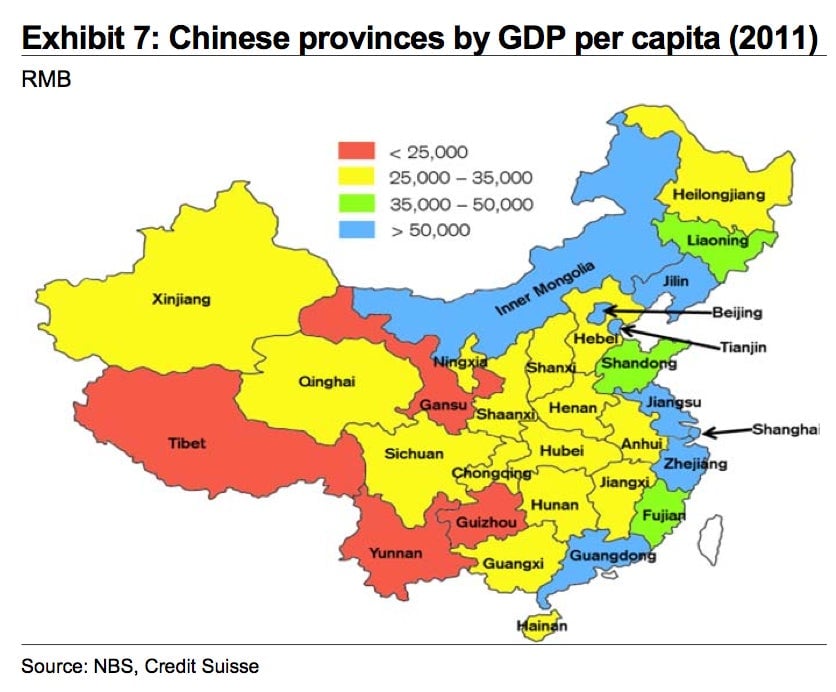

Inner Mongolia is way richer than I knew.

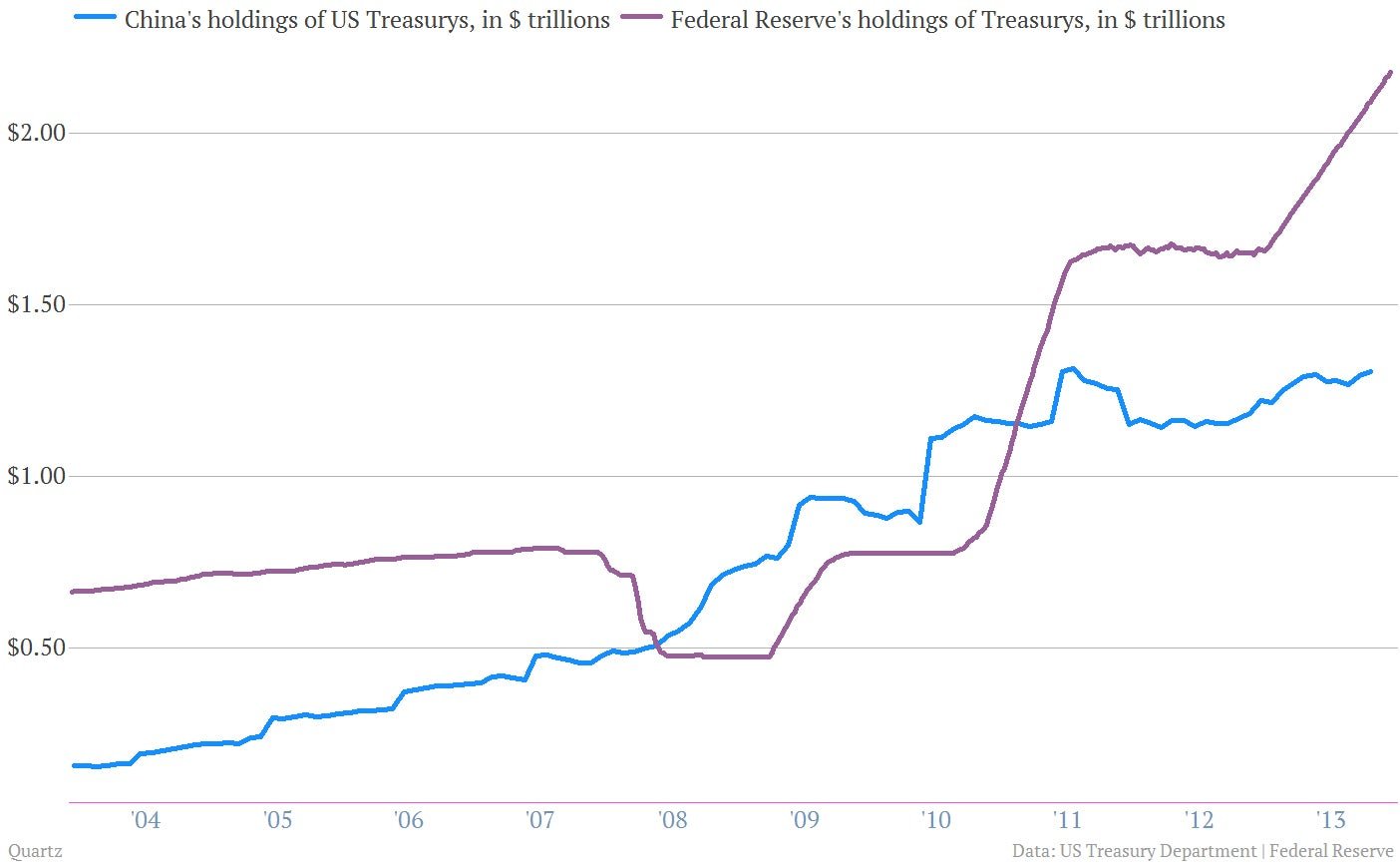

The Federal Reserve’s bond buying now dwarves China’s holdings of US government bonds.

Aflac—the US insurer with that cute spokesduck—dominates the market for cancer insurance in Japan.