If you follow market watchers on Twitter or read Barron’s, El Mundo and any number of stock traders’ blogs, you’ve probably seen this chart in recent days:

It comes from a recent post by Tom McClellan, who writes a newsletter that uses technical analysis to identify purportedly predictable patterns in market prices. The similarities between the path of the Dow since last summer and the run-up to the October 1929 crash lead McClellan to believe that there could be a similar plunge in mid-January. He cites two other chartists who use “Fibonacci cycle expansion” and “basic advance” techniques to also identify mid-January as the likely top of the US market.

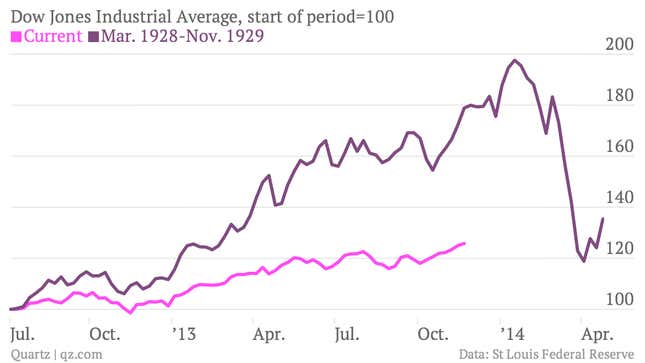

Whatever the merits of their arguments, McClellan’s chart is highly misleading. As is our wont when we see questionably designed charts, we redraw them for greater clarity and accuracy. In McClellan’s chart, the y-axis for the 1928-29 line (on the right) uses a much different scale from the axis that applies to the current line (on the left). This is what makes the two lines look superficially similar. But if you index both series to their starting points—early July 2012 and mid-February 1928, which aligns the October 1929 crash with mid-January 2014—and put them on the same scale, the results tell a different story:

In this version, it becomes clear that the Dow’s rise in 1928-29 dwarfs the increase since last July. At this point in the year during these allegedly similar periods, the Dow in 1928-29 had risen by nearly 80%, while it has only gained around 25% in the current period.

Granted, we may be missing the telltale signs of a Bearish Abandoned Baby, Dragonfly Doji or Three Black Crows patterns used by practitioners of technical analysis. But there’s often more reason to heed Occam’s Razor: The simplest explanation is usually the correct one. By using a common scale to compare similar things—the Dow now versus the Dow then—the current market doesn’t look nearly as frothy as it did just before the Great Depression. There may be reasons to conclude that stocks are overvalued, but it would take a lot more convincing than this.