The art and science of stewarding the S&P 500

Since 1995, David Blitzer has been one of the most influential figures in stock markets around the world. He isn’t a household name, but as longtime chair of the index committee for S&P Global, Blitzer led the team that decides which companies go into the all-important S&P 500 index.

Since 1995, David Blitzer has been one of the most influential figures in stock markets around the world. He isn’t a household name, but as longtime chair of the index committee for S&P Global, Blitzer led the team that decides which companies go into the all-important S&P 500 index.

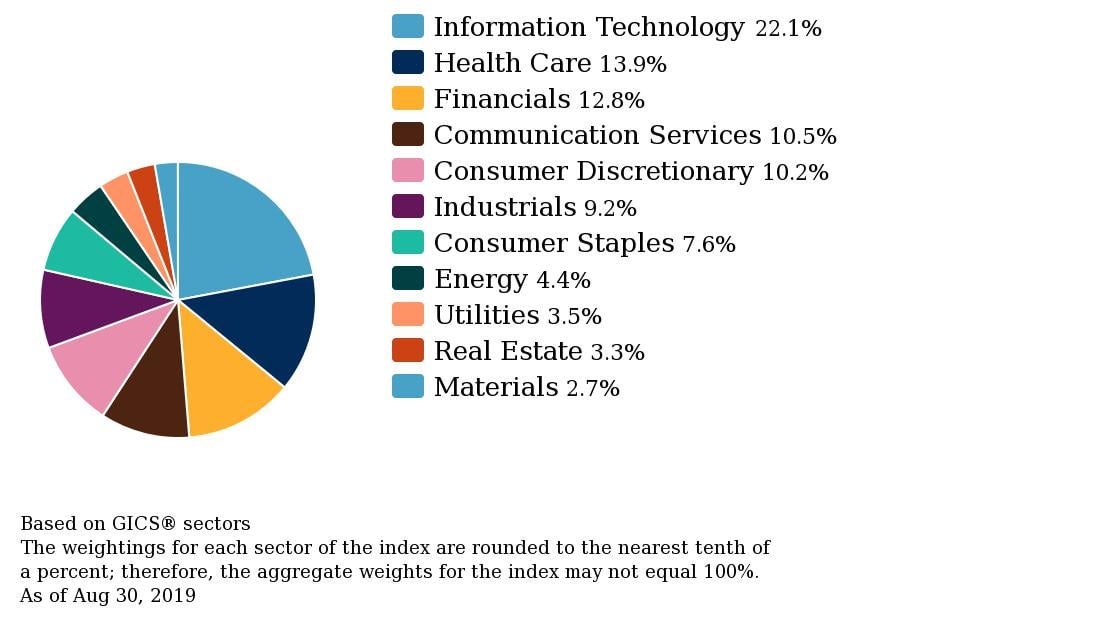

This index of the largest publicly traded American companies encompasses roughly 80% of the entire US stock market, and nearly $10 trillion—with a “T”—in assets is benchmarked or directly linked to it. Even as the rise of index funds and passive investing has cemented the S&P 500’s status as the premier benchmark of “the market” in portfolios and pension funds around the world, few people think very hard about how it is built, or the people who build it.

Blitzer retired last month after 24 years at the helm of S&P’s index committee, and his successor, Philip Murphy, inherited a system that’s a mix of art and science. The curation of the S&P 500 is guided by strict rules, but these are sometimes open to interpretation.

S&P is one of three major index providers—the others are MSCI and FTSE Russell. Each operates slightly differently, but when investors talk about “beating the market,” they’re usually referring to their performance in relation to a benchmark created by one of these groups. More often than not, that benchmark is the S&P 500.

Essentially, the S&P 500 is a list. Once a quarter, stocks are added or deleted as rules change, companies grow (or shrink), and merge. The ins, outs, and adjustments to companies’ weights in the index can be quite subjective and not nearly as mechanical as the funds and trackers that passively invest based on its composition.

In the beginning

Standard Statistics Bureau published an index of 233 companies starting in 1923, which it updated weekly. After merging with Poor’s Publishing Company in 1941, the newly formed Standard & Poor’s index tracked just over 400 companies. The S&P 500, as we know it, was born on March 4, 1957 (pdf), collectively tracking the performance of 425 industrial, 15 rail, and 60 utility stocks. At its outset, the index’s largest component was American Telephone and Telegraph (AT&T), with a market cap of $11.2 billion. Today, AT&T’s market cap is around $275 billion and it doesn’t crack the top 10 of index constituents.

Over the past 60 years or so, the S&P 500’s composition has changed dramatically. In 2007, the index’s 50th anniversary, S&P published a list of the 86 companies that remained from the original lineup. That number has steadily declined, and today, only about 60 original members remain.

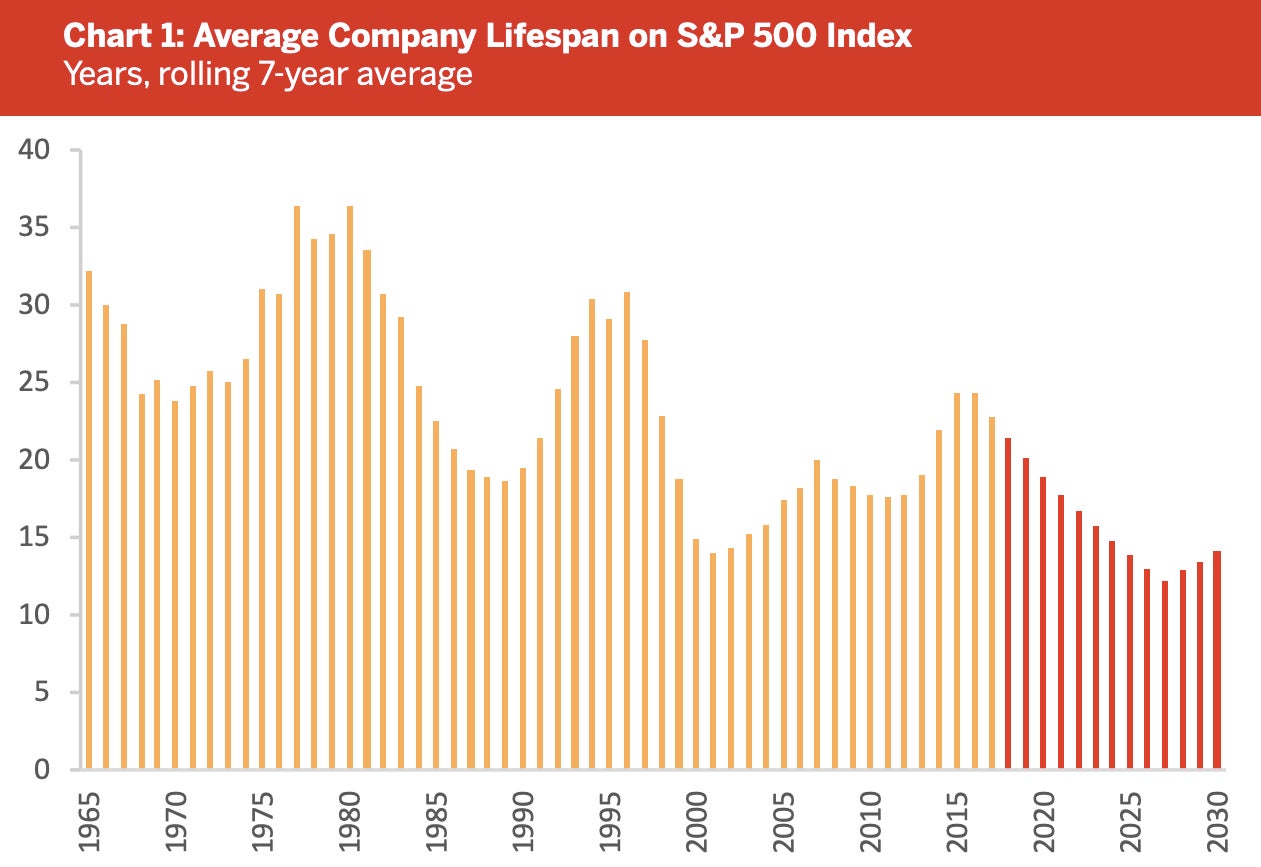

As original members have dwindled, so has the average tenure of companies in the index. In 1964, the average index tenure of an S&P 500 company was 33 years. As of 2016, tenure shrank to 24 years, according to Innosight, a consulting firm. By 2027, Innosight expects S&P 500 tenure to shrink to 12 years.

“Record private equity activity, a robust M&A market, and the growth of startups with billion-dollar valuations are leading indicators of future turbulence,” Innosight explained in a report (pdf). “At the current churn rate, about half of S&P 500 companies will be replaced over the next ten years.”

How does a company qualify for the S&P 500?

The simplest criterion for joining the S&P 500 is being big. As of August, a company must have an unadjusted market cap of at least $8.2 billion (a number that fluctuates based on the stock market’s booms and busts). Per S&P’s eligibility criteria (pdf), only US-domiciled companies whose common stock trades on the NYSE, Nasdaq, Cboe, or IEX are candidates, and at least of 50% of a company’s shares must be available for trading by the public. There’s also a minimum liquidity requirement, measured by the ratio of the annual value of shares traded versus market cap, and companies with multiple share classes are excluded (mostly—more on this below).

Furthermore, S&P requires that a company aiming for inclusion reports positive earnings for its most recent quarter, in addition to an aggregate profit over the previous four quarters. Newly listed companies need to trade for a year before being considered for a spot in the index.

“Turnover in index membership should be avoided when possible,” says S&P. Once a company is in the index, it might not always meet the criteria that got it there. “As a result, an index constituent that appears to violate criteria for addition to that index is not deleted unless ongoing conditions warrant an index change,” notes the index methodology.

The committees that oversee the rebalancing of S&P’s indexes “reserve the right to make exceptions when applying the methodology if the need arises,” the company says.

The index committee

Murphy, the managing director and global head of the index governance group, is supported by nine index committee members who are full-time employees of S&P Global. They meet once a month to discuss the potential revisions to the S&P 500 and other indexes. Unlike Murphy, and Blitzer before him, other committee members’ identities are kept secret (paywall).

Votes by the index committee are decided by a simple majority, S&P told Quartz, and each committee member’s vote counts equally—even the director’s. In the event of a tie, discussion continues until a resolution has been reached.

“The Index Committee structure is intended to foster a collaborative decision-making process,” explained S&P. “All index committee members are encouraged to participate and voice their opinions and positions on all relevant matters. One role of any chairperson is to ensure everyone has their opportunity to opine on all decisions.”

When I asked S&P why Murphy’s title is different from Blitzer’s (chairman), a company spokesperson said the organizational structure had not changed. However, since there are multiple index committees, it now makes “less sense” to say chair of the index committee.

The effects of membership

How many stocks are in the S&P 500? This isn’t such a straightforward question: the index currently has 505 stocks in it. That’s because companies increasingly have multiple share classes—a growing trend among tech companies—and a few were grandfathered into the index by S&P when it changed the rules on this corporate governance quirk in 2017. That’s why Facebook and Berkshire Hathaway are in the index, and five companies (Alphabet, Discovery Inc., Fox, News Corp., and Under Armour) appear in the index twice, with different share classes.

When the committee announces the addition of a new company to the S&P 500, that stock frequently rises—at least temporarily—as the funds tracking the index add the company to their portfolios. For instance, Facebook shares rose 4% after S&P announced the company’s addition in 2013 (paywall). Similarly, Twitter shares jumped after its addition last June (paywall).

Older studies, published in the 1990s, suggested the price boost from getting into the S&P 500 was persistent and measurable (pdf), sometimes as large as 5-7%. However, more recent research indicates the listing bump is short-lived. In 2011, researchers from the New York Fed (pdf) found that, all things equal, a stock’s inclusion in the S&P 500 did not result in a permanent increase in market value. Prior studies, the researchers said, did not control for companies’ strong performance prior to their index listings (as traders bet on likely candidates for inclusion, hoping for a bump when they ultimately make it).

Regardless of whether the index boost is fleeting or not, the selection process is an extremely sensitive matter. Blitzer described S&P’s safeguards in a 2013 interview with Forbes:

Let’s start with a simple fact: trading on inside information is illegal. If you do it, you will get caught, and when you get caught, you’ll go to jail. We remind ourselves of that fairly often.

We also have some procedures and controls in place. Until about 4:30 PM on December 11, the only people who knew about the Facebook announcement were the members of the Index Committee. They draft the announcement and proofread it. All the emails and documents used by the Index Committee are encrypted. The section [of] our NY office where our index managers and committee members work is separate from the rest of the office and only people sitting in that section can get in – the doors are locked. Around 5 PM the announcement is sent to our web-posting team with instructions to publish it at 5:15 PM and send it to various news services at the same time.

What makes S&P different

FTSE Russell’s benchmark indexes are constructed in a more automatic way than the S&P 500. Although eligibility requirements are similar to S&P’s, each May is called “ranking month.” That’s when FTSE Russell arranges index members by market cap and assigns them to different groups based on size—the Russell 1000 for the largest stocks, the Russell 2000 for smaller shares. “As Russell’s method of selection is particularly transparent (unlike for the Dow or the MSCI indices where more judgment is involved), investors can trade ahead of the changes—meaning that on average, stocks that move index trade 45 times their normal volume on the day of reconstitution,” noted the Financial Times (paywall).

MSCI follows a quarterly rebalancing timetable and runs a similar committee arrangement to S&P. Or, as MSCI puts it, “an innovative maintenance methodology that provides superior balance between the need for a stable index that is flexible enough to adjust quickly to a constantly changing opportunity set.” MSCI recently came under fire for alleged foreign political influence (paywall), stemming from its decision to include Chinese domestic stocks in its widely followed emerging markets index. The index company’s annual market classifications—whether a country’s stocks are considered “standalone,” “frontier,” “emerging,” or “developed”—are closely watched among investors.

David Blitzer’s legacy

Blitzer’s steady, long-running oversight over key market indexes have been punctuated by a few critical, and sometimes controversial, choices. Over the past two decades, he helped reshape the S&P 500 to reflect the digital emphasis of corporate America, made tough calls about exceptions to the rules during the 2008 financial crisis, and in his twilight years, assumed responsibility for the 123-year-old Dow Jones Industrial Average, which is constructed in archaic ways.

Since the index committee’s discussions take place behind closed doors, it’s difficult to gauge how much influence Blitzer exerted over the process during his tenure. “If the only requirements for maintaining an index were getting the numbers right each day, a fixed rule book would suffice,” Blitzer wrote in 2014. “But when the market doesn’t play by the rules, a rigid rule book won’t work.” Key occasions when the committee exercised its judgment on the composition of indexes reveal how influential the committee run by Blitzer—and now Murphy—has been.

AOL

On New Year’s Eve 1998, American Online was added to the S&P 500 after market close, unofficially marking the start of the dotcom bubble. In a recent CNBC appearance, Blitzer recalled the index committee being told it “blessed the internet” by adding AOL to the index.

A 1998 CNN article captured the moment: “The addition of AOL to the S&P 500 may be an attempt to update the image of the venerable index by adding a red-hot Internet stock and giving it more of a technology slant.” While AOL has long since disappeared from the index, Blitzer’s willingness to include an internet company in the S&P 500 arguably opened the investment floodgates for web-based business.

AIG

One of the committee’s more dramatic decisions was its choice not to remove AIG from the S&P 500 when the US Treasury Department bailed out the troubled financial firm during the financial crisis. Blitzer explained the committee’s thinking in a 2014 blog post:

Shortly after Lehman filed for bankruptcy [on September 15, 2008], the news broke that the US Treasury was bailing out AIG, one of the world’s largest insurance companies. Suddenly the Treasury owned over 90% of the company. The S&P 500 guidelines require that any company in the index have a public float of at least 50%. Under the rules, the index would have removed AIG. In those scary moments, dropping AIG would have sent the markets tumbling yet again. Given market conditions and investor fears, the Index Committee quietly set the 50% float rule aside. No trading was required. Fast forward a few years, the Treasury sold its shares back to the company and the 50% float rule was okay.

General Electric

Perhaps the most memorable decision of Blitzer’s tenure, though, is one of the committee’s more recent ones—the deletion of General Electric from the Dow. GE was the index’s last remaining original member.

“As economies change, some companies become old. You no longer want the buggy whip factory in the S&P 500 and GE is now seen as a declining conglomerate,” explains John Coffee, director of the Center on Corporate Governance at Columbia Law School. “So it goes and you want to bring in the new people like the Amazons of this world, and that’s been going along at a gradual pace.”

The removal of GE from the Dow also stands out because it was replaced by Walgreens, a retailer, rather than another industrial group. “If you have to delist something because it’s no longer representative… you’re not going to replace it with the nearest identical company,” says Coffee. “You’re going to look to see which sector is underrepresented in terms of its share of overall US market capitalization.”

Indeed, as American business has changed, the S&P and Dow have changed along with it. While Blitzer dealt with plenty of disruption during his time, Murphy may face even thornier challenges as his successor. For example, the money-losing business models and convoluted corporate governance of recently listed and soon-to-IPO tech giants will present difficult decisions on index eligibility. It’s not that much of an exaggeration to say that our financial future depends on what the committee decides.