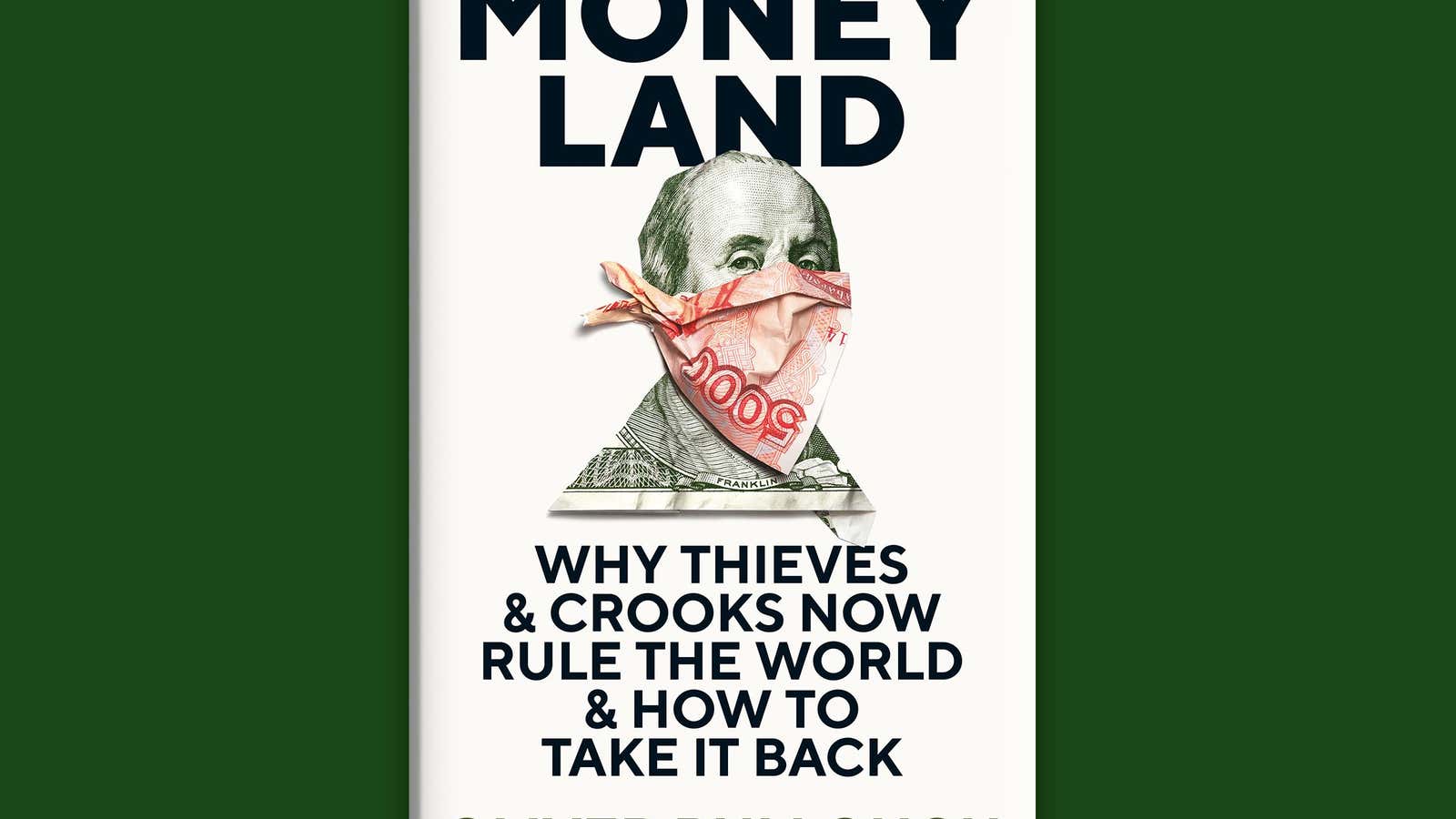

Title: Moneyland: Why Thieves and Crooks Rule the World and How to Take it Back

Number of pages: 278

Year originally published: 2018

Who it’s for: Anyone who wants to understand the structures behind global corruption.

The big idea: Money crosses borders; laws do not. In fact, there’s a magic land out there with no laws at all, replete with penthouses, Rolexes, and super-yachts for everyone. Everyone who’s rich enough to gain access, that is. Oliver Bullough, a former Reuters correspondent and author of two books about Russia, calls that place “Moneyland,” where “Maltese passports, English libel, American privacy, Panamanian shell companies, Jersey trusts, Liechtenstein foundations, all add together to create a virtual space that is far greater than the sum of its parts.” Crucially, “Moneyland” doesn’t care where your money comes from—dictators, sex traffickers, warlords are all welcome in this privileged plane. Bullough dives into that world, combining investigative reporting with smart, deeply-researched analysis, and a twinkling eye for the absurd.

5 things worth learning

- Blame the Brits. “Moneyland” began when a couple of cunning London bankers found a small loophole in the post-war system of capital controls imposed under Bretton Woods, Bullough writes. They figured out a way to bank dollars in the UK and then issue bonds to people hiding those dollars in Switzerland. The Bank of England merrily let them do so, deaf to the cries of US regulators. These “eurobonds” set off the whole world of unrestricted global finance, and enabled criminals and tax evaders not only to hide illicit money, but to spend and gain interest on it.

- Passport shopping. After the money started gushing through this crack in global rules, whole industries began popping up to support the citizens of “Moneyland.” One of those is the world of “citizenship for sale.” If you’ve earned your money with the help of a corrupt regime, “it’s sensible to have a second passport in your safe, so you always have the option of dropping everything, hopping on a plane and getting out,” Bullough writes. If you only have around $100,000 spare, a St Kitts passport gets you visa-free travel to the EU. If you have really big bucks, the US and UK will usher you in.

- Avoiding the law. It’s not strictly true that “Moneyland” has no laws; just the laws its citizens choose at any given time. “If a law is helpful to any aspect of a rich person’s existence, “Moneyland’s” enablers make sure the rich person can enjoy the benefits of that law wherever and whatever it is, to the greater good of the rich person and to the detriment of the rest of us,” Bullough writes. If, when picking your passport, you’re especially nice to a tiny tax haven, they might just make you notional ambassador to something like the International Maritime Organization in London—giving you a nice shield of diplomatic immunity. What if you want to stop a nasty journalist writing about your money’s origins? There are London lawyers aplenty to help you out. He recounts reporting an investigation into an oligarch on sanctions lists, who had money hidden out of sight of Western asset freezes. A British publication and an American one ended up spiking the story, not because of its quality—but because they couldn’t afford fighting a libel suit against someone with endless resources. The oligarch had become “un-write-about-able.”

- Murder Multinational. Threatening “Moneyland” can be bad for your health. Ask Alexander Litvinenko, the former Russian intelligence officer who was poisoned with polonium while having a cup of tea in London. The reason he was killed? He “threatened to expose the money trail,” Bullough argues, noting that Litvinenko had been helping Spanish law enforcement investigate dirty Russian money. “If maintaining Moneyland requires dispatching amateur assassins to London with a phial of the world’s deadliest chemical, then that’s what must be done,” he writes.

- The resistance is weak. Don’t expect things to change any time soon. President Obama in the US and prime minister David Cameron in Britain both made a point of cracking down on global corruption. Both have now gone, and “Moneyland” remains. Switzerland’s tax evasion regime has been opened a tiny crack by information-sharing agreements with the US and other rich countries. However, it has no such agreements with the poor countries from which much of “Moneyland’s” cash emanates. And the US, in turn, doesn’t share data with Switzerland, meaning that much of the landlocked nation’s shady cash has gone straight over to Tax Haven USA.

Quote it: “Moneyland is country that subverts traditional nation states: it is everywhere and nowhere, somewhere ‘in the cloud,’ a new development—a legal construct that is divorced from any place on the map. We cannot see it now, but the stronger it becomes, the more obvious it will be. And it will never be easier to confront than it is today.”

Read, skim, or skip? Read. Moneyland is a skillful unparceling of an extraordinarily complex—and dangerous—global phenomenon, which should appeal both to experts and laypeople. The term “Moneyland” is a useful conceptual tool, and Bullough’s writing is vivid and playful. He explains complex financial systems with references to James Bond and Harry Potter, and takes us through this world with the help of an eccentric cast of morally questionable characters.

The only letdown is the failure to deliver on the second half of the book’s subtitle: “How to take it back.” After diagnosing the causes of “Moneyland” and exposing how pernicious it is, Bullough pulls his punches when it comes to ideas for fixing it. The concluding chapter, “Standing up to Moneyland,” notes that various countries have started publishing open corporate registries, but laments that “those efforts have all been partial, and do not address the root cause of Moneyland, which is that money is international while laws are not.” Earlier on, Bullough writes that “if only everyone had listened to [John Maynard] Keynes and created an international currency at Bretton Woods,” the original gaps in the world’s financial system “would never have happened.” However, aware that there’s zero possibility of such a currency being created now, he doesn’t offer any middle ground. It’s a shame—few people have thought as holistically about the problem as him, and suggestions of workable solutions would be invaluable.

Ultimately, however, the book is a crucial read for anyone who wants to understand how the world really works—and it’s entertaining to boot.