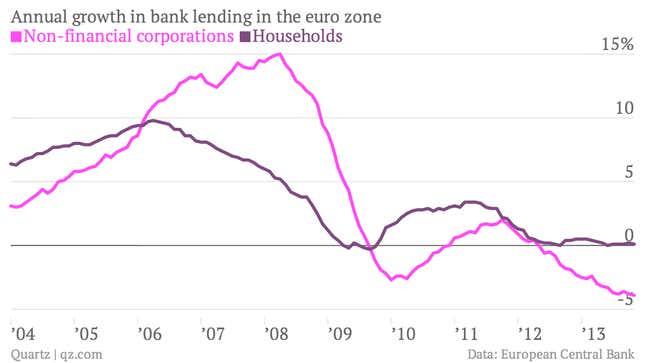

Another month, another grim data point on bank lending in the euro zone. The latest numbers, covering November (pdf), show that loans to companies in the euro zone are falling at a 3.9% annual pace, the fastest rate of decline in more than a decade. Loans to households are holding up better, but growth is still only barely positive.

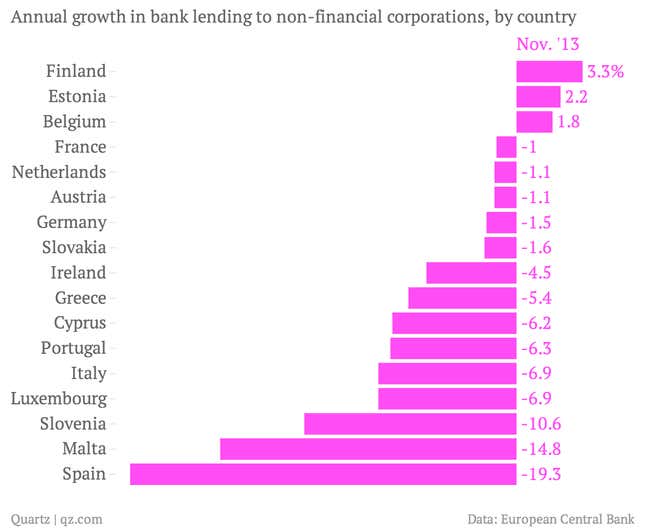

As far as business lending goes, only Finland, Estonia and Belgium managed to eke out growth in November. In Spain, meanwhile, bank loans for businesses are falling by nearly 20% per year.

The lack of bank credit is pushing some companies to seek funds from new sources—witness the small Italian companies recently issuing “minibonds” directly to investors. But many more businesses will simply go without credit, as few expect the lending situation to improve any time soon.

One factor crimping credit is the European Central Bank’s upcoming stress test of the region’s banks. The ECB is pitching this comprehensive “asset quality review” as a definitive exercise that will, once and for all, expose the true health of the region’s banks and force the weakest to bolster their balance sheets. The test will run until October this year. The ECB itself has admitted that lending may suffer as banks cling to capital in hopes of flattering their finances during the assessment.

The message for borrowers, then, is that it will probably get worse before it gets better. The euro zone’s credit crunch will grind on, at least until the autumn.