One of the only straightforward things about Abenomics, prime minister Shinzo Abe’s plan to save Japan from deflation, was that quantitative easing would batter down the value of the yen. That, in turn, would boost Japan’s swooning export sector, which had been suppressed for many years due to the freakishly strong yen.

Batter the yen it did. And inflation is heading up—indeed it’s now above that of the euro zone. But did the weak yen help exports? It sure doesn’t look like it. Here’s how the yen has strengthened against the dollar:

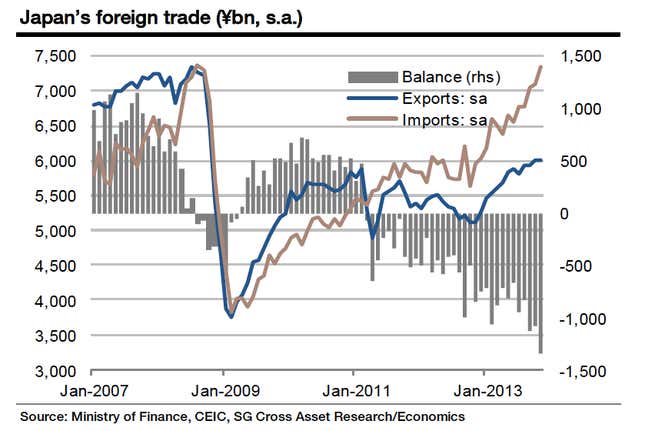

And here’s the trade balance:

November’s ¥1.29 trillion deficit (pdf) was the biggest on record for that month. It also extended Japan’s steadily widening trade deficit to 17 consecutive months. Worse, exports appear to be plateauing as imports surge—which could stall corporate profits and spook the economy. In short, Abenomics’ export revival doesn’t appear to be happening as planned.

But there are a few reasons why things aren’t as bad as they look, as Klaus Baader, economist at Société Générale, points out in a note today. In fact, economic theory says this is to be expected.

Specifically, the cheapening of a currency will cause the cost of imports to rise unusually fast relative to overall prices. That’s because it takes time for people to shift from buying imports to domestically made goods and services. It also takes time for domestic producers to meet that new bump in demand. Meanwhile, exporters need to be confident that the yen won’t start strengthening suddenly before they drop their prices. SocGen expects that these delays are finally going to end and the trade balance will start shriveling up in the second quarter, at the latest—even as it predicts the yen to stay on track to hit ¥110 to the dollar in 2015.

If Baader is right, there’s another nugget of good news in this. SocGen explains that when comparing quarter against quarter, Japanese demand grew 2.7% annualized in the first three quarters of 2013, compared with just 0.6% in 2012. Even when you exclude the effect of the cheaper yen, domestic consumption is strengthening—and that’s exactly what the Japanese economy needs in order to be yanked for good out of deflation’s grip.