Falling business investment and declining long-term interest rates in the US are signs that investors doubt the US’s potential for further economic growth. Many economic analysts are worried the US is headed towards a recession. The continued escalation of the US-China trade is one major reasons a downturn may be on the way, according to analysts from Goldman Sachs. Some worry that the US is simply due for a recession. It has been more than ten years since the US’s last recession, making this the longest economic expansion in its history.

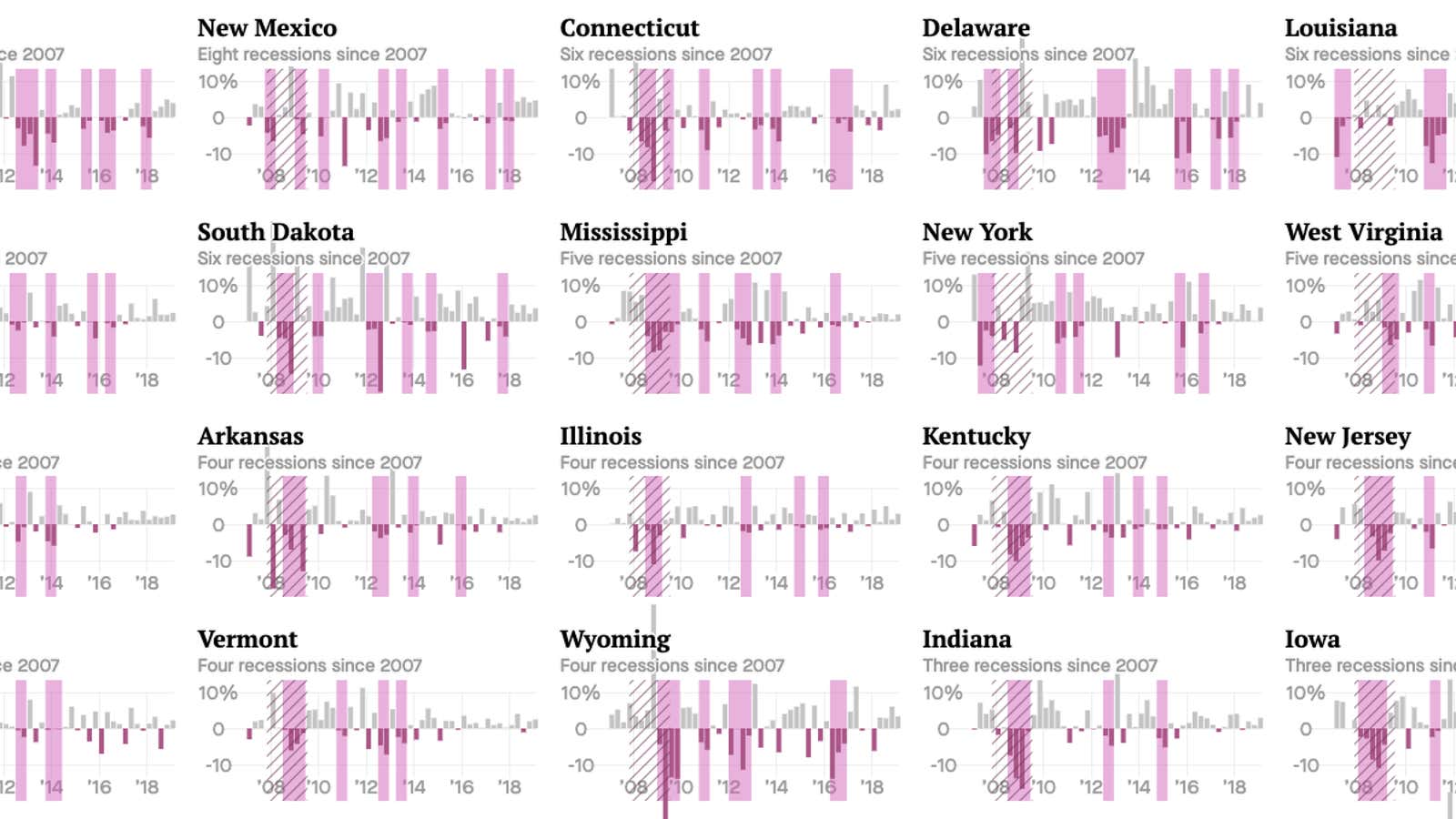

Despite the national trend, regional economies have been varying widely. 38 out of the 50 US states have had at least one recession since the Great Recession of 2007-2009 according to a Quartz analysis of US Bureau of Economic Analysis (BEA) data. Alongside its national figures, the BEA produces quarterly statistics on the GDP of each state. We used that data and the definition of two consecutive quarters of inflation-adjusted negative growth constituting a recession for our analysis. The states of Alaska and New Mexico have each had eight recessions, and about half of the states in the US have experienced two recessions since 2010.

Alaska and New Mexico are particularly recession prone due to their economies’ heavy reliance on the fossil fuel industry. Their economies ebb and flow with the price of oil. A downturn in oil prices, like the one that happened at the end of 2014, will generally lead to a local recession. The economies of oil dependent Louisiana and Wyoming also follow a similar pattern, with job creation dependent on energy prices.

Connecticut and Delaware have also had repeated recessions, the partial result of a low population. States with fewer people tend to have less diverse economies. As a result, low population states tend to have the highest volatility in their GDP growth, according to Quartz’s analysis of the quarterly GDP data since 2010. In California (the US’s most populous state), if the film industry in LA is suffering, the tech industry in San Francisco might make up for it. The same isn’t true for Connecticut, where the insurance and financial services sector has shrunk since the Great Recession, with no other sector growing quick enough to replace it. In Delaware, it is the business services sector that is shrinking.

Considering local recessions is increasingly important, as people have become more rooted in their communities. The share of people moving across state lines for work has been declining for the past several decades. The reasons for the drop in mobility are not entirely clear. One possible explanation is the exorbitant housing costs in the cities with the most productive economies, like New York and California. Another likely contributing factor is the increase in the number of jobs that require a state-specific occupational license. If you are a security guard in Florida, and moving to California requires you to get a new license to work, you may be less willing to move. Regardless of the reason, if you are not able or willing to leave, the state of the local economy becomes more central to your life.

One reason local recessions may receive less attention than they deserve is that they don’t have much of an effect on the stock market. Stock traders and investors are highly influenced by perceptions and performance of the US and global economy, but not much by say, South Dakota’s mining sector.