Central banks in emerging markets are performing a high-stakes balancing act.

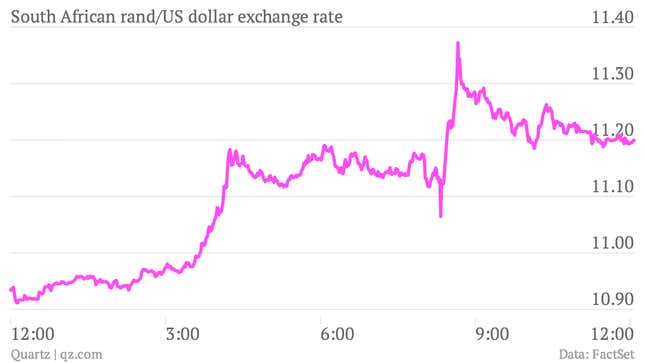

In countries such as Turkey, India and, today, South Africa, central bankers have jacked up interest rates in an effort to prop up their currencies. (Basically, the higher a country’s interest rate relative to other nations, the better the return for investors who put their money into its currency. So raising interest rates is the traditional way to try keep capital from pouring out of the economy.)

As a reminder, the genesis of all this is that interest rates in the developed economies, such as Europe and the US, have been super low since the financial crisis struck. Because fast-growing emerging markets have had much higher rates over the last couple of years, a flood of investor cash has poured into emerging market stocks, corporate bonds and sovereign debt.

But developed-market interest rates are now slowly rising too. (They’re up quite substantially in the US since the Fed in May began talking about “tapering,” or easing up on the bond-buying programs that have helped keep rates low over the last few years. The Fed is expected to continue tapering today.) And that makes the payoff for investing in emerging markets less appetizing. Throw in the fact that those economies are slowing and political problems are burbling, and investors have decided to bring their cash home. The result? Emerging-market currencies are tumbling, and capital is fleeing. Which is why the central banks are now trying to stem the outflows by raising rates.

So will it work? That depends. Rate hikes could help stabilize the currencies. (But not necessarily. Turkey’s lira continued to plummet even after the central bank more than doubled some of its rates yesterday.) However, remember that one reason money is pouring out of these emerging markets is that their future growth prospects don’t look as good as they used to. Higher interest rates might shore up the currency in the short term, but will also act as a headwinds to growth.

Slower growth might be worth it, if stabilizing the currencies—and inflation—set the stage for a long-term economic climb. But that’s a big if. And given the political instability in many of these places, holding back growth, and therefore jobs and prosperity, is a big risk too. On the other hand, just letting the currency collapse would be costly as well, setting off a wave of inflation. In short, there’s no easy answer available.